Differences in payments between the first, second and third child

All basic federal payments for the third child are similar to those for the second child. The amounts and conditions for processing and receiving payments are the same. Federal payments are prescribed by the legislation of the Russian Federation and are paid from the federal budget, regardless of your region of residence. There are also regional payments, individual in each region.

Families with three children, starting from 2013, are entitled to a targeted payment for a child under 3 years of age if they live in a region with a low birth rate. Targeting means that the benefit is not assigned to all families, but only to those that fall under the conditions of payment, for example, the average per capita family income is below the subsistence level. We'll talk more about this below.

Illegal receipt of maternity capital: sanctions

Sanctions for fraud with budget money include imprisonment for up to 10 years, as well as a fine of up to 120,000 rubles in accordance with Article 159 of the Criminal Code of the Russian Federation. But control on the part of regional authorities is less strict than when receiving maternity capital from the state for a second child. Due to the impossibility of checking everything in detail, various concessions are provided. But it is possible to manage the money only after providing the required documents.

Illegal receipt of maternal capital may result in criminal liability

They can be reserved in a special account within the budget or transferred to a bank account, which gives access to the money only with the agreement of the municipality.

Types of payments and benefits

Benefits for 3 children, as well as for the first and second, are divided into monthly and one-time. Part is due only to working people, while other payments are assigned to everyone without exception. Those with many children are also given additional targeted payments, especially if they are low-income.

By the way, in some regions benefits are increased by the regional coefficient, most often these are cities in the north, for example, Salekhard with a coefficient of 1.8 or Nadym with a coefficient of 1.7.

With the help of these coefficients, benefits for registration in the antenatal clinic (LC), benefits for Birth and Labor and a one-time benefit for the birth of a child will be increased.

Example

The BIR allowance in 2020 is the same in all regions of Russia - 17,479 rubles. If the family lives in Nadym, then this benefit will be increased by a factor of 1.7.

17479 * 1.7 = 29714 rubles - this amount will be received by the family at the birth of the baby.

The size of regional maternity capital

The amount is regulated locally, based on the financial capabilities of the constituent entity of the Russian Federation. It is worth considering the amounts in various regions of Russia that are paid at the birth of a third child.

Table 1. Size of regional maternity capital by region

| The subject of the Russian Federation | Amount (rub.) | Special conditions |

| Altai region | 55 375 | — |

| Amur region | 100 000 | Payment for those registered as needing improved housing conditions |

| Arhangelsk region | 50 000 | Residence in the region for 3 years, having the status of a large family |

| Buryatia | 50 000 | Residence in the region for 1 year, income per family member less than 1.5 minimum wage |

| Jewish Autonomous Region | 120 000 | — |

| Irkutsk region | 100 000 | Duration of residence in the region from 1 year |

| Kamchatka Krai | 132 000 | Registration for 3 years or more |

| Komi Republic | 150 000 | — |

| Krasnoyarsk region | 131 000 | — |

| Kemerovo region | 130 000 | — |

| Leningrad region | 117 000 | — |

| Novosibirsk region | 100 000 | Regional resident status from 3 years |

| Primorsky Krai | 163 000 | Contact one year after birth |

Thus, the size of the benefit differs based on budgetary capabilities. The decision is made by the council of deputies of the constituent entity of the Russian Federation. The scope of application of the funds received may also differ; usually they can be spent on:

- improvement of living conditions;

- repayment of the existing mortgage;

- solving current problems when raising a disabled child;

- for children's education.

Maternity capital for a child’s education

Some regions allow you to use the money to purchase new cars. To do this, you need to contact dealers in showrooms, and not buy a vehicle from private individuals.

One-time payments and benefits for the third child

Lump sum payments, as the name implies, are paid to families only once, while some of them are due during the woman’s pregnancy, and some only after the birth of the child.

It is important not to miss deadlines and arrange payments at your place of work or social security, because no one will return benefits retroactively.

One-time payment for those registered in the early stages of pregnancy

The payment for registering a pregnant woman with a housing complex up to 12 weeks is not that big. In 2020 it is equal to 655 rubles. More often, this payment is processed immediately with the BiR allowance, so it is more convenient to submit the entire package of documents once and receive all the money at once.

To process the payment you will need:

- passport;

- statement;

- certificate of incapacity for work issued by the housing complex.

All these papers are submitted to the accounting department at work or to the Social Insurance Fund.

How to get land for a third child

The process of receiving a land plot is usually similar to how you will receive cash payments:

- registration of documents for a newborn child;

- providing a package of documents to employees of the responsible department;

- waiting for a decision.

It is important to understand that the decision is made within 30 days, but the site itself is provided much longer. Some families have been waiting for them for more than 5 years. No one will say in advance exactly where he will be.

A plot of land issued to a family for their third child

The law allows you to change the cash payment by providing a land plot, the estimated value of which will be equivalent. If for some reason the recipient does not agree with the place where the land is allocated, as well as with the decision to replace the cash payment with a plot of land, then you need to go to court.

Before this, you will need to collect evidence. Considering that you will have to sue the municipality, it is recommended to contact a practicing lawyer. He will help resolve the issue and immediately tell you what the probability of a favorable outcome is.

Monthly payments and benefits for the third child

Monthly payments for the third child are paid according to the standard scheme, the same as for the first and second.

Child care allowance up to 1.5 years old

The state undertakes to pay monthly benefits for up to 1.5 years per child, regardless of what kind of child it is and whether its parents are working or unemployed. This is a guaranteed payment.

But the amount of the payment will be different, because the unemployed are entitled to a minimum benefit, but for those working it is calculated based on the average salary for the previous 2 years, from which 40% is taken.

The amount of the minimum benefit for the second, third and subsequent children in 2020 is 6,554 rubles. Full-time students will also receive the same payment if they apply for it.

In addition to the minimum, there is also a maximum value - the amount exceeding which workers will not be paid benefits - 26,152 rubles.

We looked at an example of a detailed calculation of benefits for workers in the article about payments for the first child.

An important point: you need to apply for benefits no later than six months after the child turns 1.5 years old.

Working people register benefits in the accounting department at their jobs, students in their universities, and the unemployed in social security.

The benefit is assigned within 10 days, and you can expect payment only next month, no later than the 26th.

Please note: the right to apply for this benefit is not only for the mother and father of the child, but also for any family member who will actually care for the baby.

Monthly allowance for child care up to 3 years old

The benefit for up to 3 years is a formal payment of 50 rubles, for which few people apply. The benefit amount was established back in 1994 and for some reason has not been indexed since then.

True, soon they plan to finally bring this benefit into line with today's needs of families. At the next government meeting, Dmitry Medvedev proposed to sort out this issue within a year and set the amount of the benefit equal to at least the care allowance for up to 1.5 years per child.

Use of maternity capital funds for 3 children

Legislation allows only targeted spending of public finances. Matkapital cannot be cashed out. Individual families can receive monthly payments from “children’s” money by non-cash transfer, in an amount not exceeding the subsistence level in the region of residence of the parents. The remaining amount of maternity capital can be spent after the third dependent turns 3 years old. It is allowed to spend funds for the following purposes:

- Improving and updating living conditions. Citizens can buy an apartment, a house, build a new home or completely reconstruct their existing place of residence. "Children's" money can be used as mortgage payments or added to your own funds used to purchase or build real estate.

- Replenishment of the personal pension account of the baby’s mother, formation of the funded part of the future benefit.

- Payment for education for the eldest offspring, compensation for the costs of training and raising a dependent in a kindergarten, university, college, and other institutions that have the right to provide this type of service.

- Reimbursement of expenses for the purchase of rehabilitation means for a disabled child in need of adaptation, provision of services to a minor by specialized medical institutions.

It is allowed to use “children’s” products without waiting for the baby to reach the age of three. If, by the time the baby is born, the parents have a mortgage loan agreement, or they took out a housing loan after the birth of their son or daughter, then the funds can be spent on the following purposes:

- execution of repayment of the main body of the loan, or interest on the loan (penalties for late regular payments cannot be paid when using the certificate);

- making the first mortgage payment.

Additional benefits and allowances

The state has a special attitude towards large families; they are supported at both the federal and regional levels. These measures help stimulate the birth rate, which has only been declining in recent years.

Payments and benefits for single mothers

The state does not provide any special individual payments to single mothers, but at the regional level they can receive additional support if the budget allows.

Example

In Moscow, single mothers are paid for any child: first, second, third, etc. monthly allowance. Children under 3 years old are entitled to 15,000 rubles, children from 3 to 18 years old - 6,000 rubles.

Basically, in the regions, single mothers are given some kind of benefits for the purchase of medicines, school supplies, and groceries necessary for the child.

An important point: a woman must present a document confirming her single status to receive benefits. To do this, you need to take a certificate from the registry office, form No. 25.

Benefits and benefits for a disabled child

Disabled children are entitled to additional payments, and the amount of payments does not depend in any way on the order of birth of the child. It's the same with benefits. You can find a complete list of payments and how to receive them in our article on payments for the first child.

Regional and gubernatorial payments

Each subject himself determines, based on his capabilities, what additional benefits to assign to families. The conditions for receiving payments may vary: in some places it is necessary that the family live for a certain number of years in the territory of the subject, in others benefits are assigned only to low-income families or young families under 30 years of age.

Example

In Chelyabinsk, local maternity capital in the amount of 61,455 rubles is provided for the third child. Parents and their children must permanently reside in the Chelyabinsk region to receive this maternity capital.

In Moscow, for 3 children, regional authorities pay an additional 10 subsistence minimums per capita (16,087) - 160,870 rubles.

You can find out about possible benefits for a third child in your region from social security or the MFC.

Benefits for the birth of a third child

There is a list of benefits that are available to families where a 3rd child was born:

- 50% discount on utility bills;

- priority admission of children to kindergarten;

- free entry to exhibitions and museums;

- free education in state art, sports, and music schools;

- free textbooks;

- free meals for schoolchildren;

- free trips to sanatoriums and health camps for children;

- increase in parental leave by 5 days;

- education at a paid university with a 50% discount;

- free medications prescribed by a doctor.

In each region, you need to clarify the list of social security benefits.

Obtaining a land plot

A large family can receive a plot of land measuring 15 acres.

Land is issued once and only if there are three minor children in the family and there are no other land plots in the property.

The state formally leases land for a period of 10 years. During this time, you need to have time to build a house on the site and put it into operation. Every year you will have to pay 0.3% of the cost of the plot for rent. Naturally, the plot cannot be sold until the ownership rights are transferred to the family after the house is put into operation.

Each region itself solves the problem of issuing plots to large families; in fact, they are issuing land far outside the city, where there is no infrastructure, so few people are interested in such a benefit.

Those who decide to receive free land need to follow the following algorithm:

- Select a site from those available for large families (you can look at the list in the local thematic newspaper or find out from the local administration).

- Collect the necessary documents (passports, birth certificates of children, marriage certificates, if necessary, income certificates).

- Submit an application to the local administration.

- Obtain permission from the administration for further actions with the site.

- Conduct topographic survey and land surveying at your own expense.

- Register the plot of land and sign a lease agreement for 10 years.

- Build a house and put it into operation.

Only after all these points will it finally be possible to obtain a certificate of ownership.

How to apply?

A maternity certificate for a third child is issued at the Pension Fund department, the procedure is as follows:

- Submit an application to the district office at your place of residence;

- Submit the required package of documents;

- To get approval;

- Take away a document, funds, land, and so on, that is, take over rights.

Sometimes employees have to be turned away. The reason for this is incorrect completion of the application or an incomplete package of documents, unreliable data, and so on. If this happens, within ten days an official letter is sent to the registered address indicating the reason for the refusal. Disagreement with the decision can be appealed in court.

If a positive decision is made, the final completion of the registration occurs in 1-2 months. It is worth remembering that maternity capital funds at the regional level may differ significantly by region due to the security and financial stability of the republic.

Briefly about the main thing

- For the third child there is an additional targeted monthly payment for up to 3 years in 62 regions.

- The third child is entitled to the same amount of maternity capital, 453,026 rubles.

- Large families can receive a land plot of 0.15 hectares from the state.

- The state is ready to repay mortgage interest in excess of 6% per annum to families where 2 or 3 children were born.

- Regional authorities independently establish the amounts and types of benefits for large families; most often, the third child is entitled to regional maternity capital.

- Working parents who have a third child are entitled to a tax deduction of 3,000 rubles.

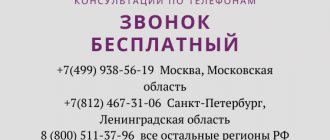

Still have questions? Ask them below in the comments.

Video for dessert: The Most Powerful Blows. Incredibly Strong People

Features of the program for families with 3 children

Meanwhile, such a large amount is not given to every family with a third child - it is subject to certain restrictions.

- First of all, it should be borne in mind that money is not issued in the form of cash banknotes, but is transferred to a bank account created for these purposes .

- to spend funds from maternity capital only non-cash by concluding an agreement .

- The law specifies certain purposes for which funds from maternity capital can be spent.

All of the above conditions were created and regulated by law, primarily so that parents would not spend the certificate on their personal needs, while “bypassing” the needs of their children.

Let's figure out exactly what purposes you can spend funds from maternity capital for. This:

- Shared construction, or purchase of a house, apartment or room on the primary or secondary market.

- The certificate can also be spent on children's education.

- As an additional option, it is proposed to transfer funds to the mother's funded pension.

Starting from 2020, there is another “offer” from the state - now funds can be spent on a child’s preschool education (including hiring a nanny if the child’s mother wants to go to work).

Questions about maternity capital

It is worth considering several typical issues that concern citizens. Here are the main ones:

- How long will the program last for the birth of a third child? It is unlimited in all subjects of the Russian Federation and its functioning depends only on budget revenues. But the council of deputies can suspend it at any time, which will be written about in the local media;

- When can I apply for money? There is no clear time frame in the law, which allows application at any time after the birth of the third baby. But almost 70% of the constituent entities of the Russian Federation offer to dispose of capital only after the child reaches 1.5 years of age and after writing the appropriate application;

Parents will be able to start spending maternity capital when the child turns one and a half years old

- Can they refuse maternity capital? They may if the applicant does not meet the standard requirements. If the refusal is unfounded, then you need to go to court and provide the relevant documents. The case will be considered, and if it is revealed that the employee exceeded his official powers, justice will be restored.

Rules for the use of maternity capital