People of the Far North live and work in difficult weather conditions. Taking this factor into account, Russian legislation, along with Soviet legislation, provided northern benefits for citizens living in regions with a harsh climate. There is a rule for calculating the bonus coefficient, which is regulated by the Labor Code of the Russian Federation, but few people know about it.

Fundamental normative and legislative acts

Northerners and citizens planning to move to areas with extreme climatic conditions must have legal information and know the specifics of regulation and remuneration for persons working in such regions. The legislative framework periodically undergoes changes, but the main part of it has not changed since Soviet times.

The main document protecting the rights of all workers is the Labor Code (LC) of the Russian Federation. When calculating the regional coefficient, officials must be guided by the articles set out in the state act. Chapter No. 50 of the Labor Code, which regulates the norms of social support and protection of the local population, draws a parallel with other legislative provisions and complements them in terms of relations to this category of citizens.

Since the times of the USSR, in 1967, Resolution No. 1029 of the Council of Ministers of November 10 approved a list of subjects of the Far North and areas with a harsh climate, which were decided to be equated with the northern ones. Until today, the state social protection body is guided by this list when calculating and assigning benefits. Although he did several times in 2004 and 2009. edited, but not in terms of changing the regions for calculating the allowance.

Officials are also closely monitored. Order No. 2 of 1990 of the Ministry of Labor of the RSFSR coordinates the actions of enterprise managers, whose responsibilities include compliance with laws, the procedure for calculating and calculating the regional coefficient, and employees working in the northern regions of the country.

After the collapse of the USSR in 1993, the president adopted the first law No. 4520-1, regulating the assignment of benefits. The legal act guarantees state support for persons living and working for the benefit of the country in regions with harsh climatic conditions.

Salary increase taking into account the regional coefficient

One of the benefits inherent to the small peoples of the north is the local indicator. He is mentioned in Art. 315 of the Labor Code of the Russian Federation, which states that wages should be calculated using a coefficient, but its size is not clearly defined anywhere or anything. Thus, Article 316 in Part 1 refers citizens to the government, which establishes the procedure and boundaries of the allowance. Today there are no strict rules for calculating it, despite the fact that funding comes from the federal and local budgets.

Depending on the severity of the work and living conditions, the main limit is set - from 1.2 to 3. The last figure is used to calculate salaries for people working on Antarctic expeditions. The indicator is multiplied by the entire income (salary, bonus payments, long-service bonuses and other incentives, with the exception of financial assistance and other payments not provided for in the employment contract) of the employee. The coefficient is also not used when calculating downtime due to the fault of the employer, regular vacation and other cash payments calculated from the employee’s average earnings.

Benefits for the medal "For Labor Valor"

Unlike budgetary organizations, where funding is of purely federal significance, commercial organizations, guided by Art. 135 of the Labor Code has the right to increase the coefficient. The decision must be recorded in the collective agreement of the enterprise.

Complete deception

Fraudsters profit from the gullibility of older people One of the most frequent requests to our editor is about the amount of payments. Many pensioners carefully monitor all the smallest changes in legislation: perhaps their monthly accruals will also be recalculated? It is very difficult psychologically for those who have worked for several decades not formally, but conscientiously, to accept that, yes, this is exactly the small pension they are entitled to under existing legislation. Such dissatisfaction is fertile ground for fraudulent lawyers.

Northern surcharge percentage

The phrase is often heard in families: “The husband went on a rotational basis to the North.” Such business trips to regions with extreme climates are justified precisely because they are famous for their good bonuses, reaching 100%. The districts are conventionally divided as follows:

| Climate group (CG) | Surcharge | Regions |

| IV | 30 % | · region: Irkutsk, Chita; · rep: Buryatia, Tyva, Komi; · districts: southern Far East. |

| III | 50 % | · region: Arkhangelsk, Tomsk, Amur, Chita, Irkutsk, Sakhalin; · republic: Karelia, Komi, Buryatia; · district: Khanty-Mansi Autonomous Okrug; · region: Krasnoyarsk, Khabarovsk, Primorsky. |

| II | 80 % | · region: Magadan; · rep: Sakha, Komi; · district: Yamalo-Nenets Autonomous Okrug, EAO; · region: Khabarovsk, Kamchatka; · city: Vorkuta. |

| I | 100 % | · district: ChAO, KAO; · districts: North Evenkiy Magadan region, Aleutian Kamchatka region; · on islands other than the White Sea. |

To receive an increased salary, it is necessary to develop a certain amount of experience in the North. The normative situation is regulated by clause 16 of the appendix to order No. 2 of the Ministry of Labor of the RSFSR dated November 22, 1990, which states that there is a relationship between the amount of incentives and the employee’s length of service.

The accrual is made on the entire payment to the employee, except in cases where the calculation is based on the average:

- vacation pay;

- long service payment;

- material support.

If we break down a northerner’s income into its components, it will consist of:

- Basic amount (salary, bonus).

- Regional coefficient.

- Northern.

Moreover, the last criterion has its own differentiation.

Increase up to 30 years

Additional social support for inexperienced specialists with specialized education was a good help until 2005. Since that time she has undergone changes. So, today, they receive it:

- in the amount of 20% of the salary of employees of CG I and II, initially. After this, every six months there is an increase of 20% to the maximum group limit;

- in the amount of 10% of the salary of employees of CG III and IV, initially. After this, every six months there is an increase of 10%, similar to the previous scenario.

There is an exception for indigenous people of the North. So in letter No. 697-13 dated August 17, 2005, the Ministry of Health says the following: those who were born and have lived in the region for more than 5 years as of December 2004 can receive a bonus from the 1st working day in full, and those who began working life after this date, they reach the maximum under the accelerated program.

Increase for those over 30 years old

General rules guide employers when calculating compensation for hard work to subordinates whose age exceeds the 30-year limit. Regardless of which group the region belongs to, all employees of the Far North receive a bonus of 10% for the first six months. Further, as with young specialists, every six months the indicator begins to increase to the maximum limit of the group.

Increase for the military

A significant number of military units are located on the territory of the administrative units of the North. When calculating allowances for military personnel, officials are guided by the same principles applied to the civilian population.

Relocation allowance

The indicator of benefits for residents of the Far North directly depends on the northern work experience. This criterion is used as the basis for the angle. Moreover, the experience adds up. Examples will clearly show:

- The man worked in the second CG, the percentage of the bonus here is 80%. I decided to move to a place where the climate is milder, let’s say in the third CG with 50% northern. According to his overall experience, he already has 80%, therefore, he can legally qualify for a 100% bonus.

- The young man worked for 7 years in the Far North and interrupted his work experience by moving to the south of the country. Having lived there without receiving any incentives, I decided to return to my native land. Since his work experience was 7 years, the calculators, when calculating wages, will take into account the indicator that was before the relocation.

A mishmash of laws

They work in many cities of Russia, invite you to “free consultations” and say exactly what older people want to hear: “How do you get such a small pension?

Yes, this is unfair! Even those who have no work experience at all get paid more than you! Do you know that according to the law, you are still entitled to an additional payment?..” After such words, an elderly person has hope: his small pension of 10-14 thousand rubles, of which he still needs to pay rent and buy medicine, can grow significantly. And these “kind, smart” people will help, you just need to pay them for their work.

“Drawing up an application to the Pension Fund of Russia at the prices of Krasnoyarsk “free lawyers” is 30 thousand rubles,” comments Nina Bondareva, head of the press service of the Pension Fund for the Krasnoyarsk Territory. – Repeated application – 16 thousand rubles. In general, the price of the service can reach 70 thousand rubles. Sometimes the “lawyer” accompanies those who seek advice home so that the pensioner “can find the money”, and prepares all the documents on the spot. Ordinary people cannot evaluate the correctness of filling out papers. And our specialists, to whom they come, are amazed at the references to legislation, which can be cited completely at random. For example, a woman who has lived her entire life in Siberia may be required to recalculate her pension based on an article of the law ... on liquidators of the consequences of the Chernobyl nuclear power plant.

How is a pension calculated in general? It is calculated by a special program that gives many options. Choose the one where the monthly payment will be maximum. Once a year, a person’s pension file is checked for the correctness of accrual by the Pension Fund of Russia controller-auditor. In addition to it, calculations are checked at certain intervals by the Federal Treasury of the Russian Federation, the Accounts Chamber of the Russian Federation and other departments. In other words, the probability of an erroneous calculation is extremely small, although not excluded.

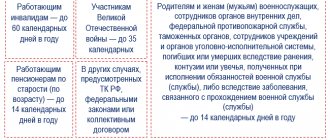

Additional northern days

The preferences for northerners do not end there. In addition to the regular annual paid leave, an employee has the right to take an extra 24 days if he works in the regions of the Far North and 16 days - in the territory of an administrative unit close to harsh conditions. Any citizen working under the following conditions can write an application for days:

- shift method;

- combining activities;

- standard mode.

Persons sent to the Far North lose the right to additional leave, but pregnant women and minor employees can receive compensation for these days by continuing to work at the enterprise.

Who is entitled to an additional payment to their pension for work in the Far North?

If pension recipients who worked in the Far North have disabled dependent family members, or if recipients of the corresponding pension are over 80 years old or if they have a 1st group disability, an increase in the fixed payment on the grounds specified in paragraphs. 1–3 tbsp. 17 of Law No. 385-FZ, is supplemented by additional payments in the amount of 50% of the corresponding increase.

Moreover, even if a person has left certain territories, he cannot be deprived of benefits intended for residents of the corresponding regions, since this individual risked his health for a given period of time.

09 Jun 2021 uristlaw 940

Share this post

- Related Posts

- If I Discharge from the Chernobyd Zone And Then I Disregister Again, Will the Benefits Remain?

- Will the Pension Increase in 2021 for Working Pensioners?

- Transfer Pension From Ukraine To Russia By Citizenship Forum

- Benefits for purchasing housing for a young family in 2021

Compensation of transportation expenses

The laws for northerners are softer than their harsh climate. So, once every couple of years, employees have the right to return the expenses allocated for transportation costs that they incurred while going on vacation (round trip). Both travel and baggage costs are covered. Along with budgetary organizations, private companies are also required to provide benefits. The implementation regulations are set out in the collective agreement and trade union regulations.

Northern pension

Citizens with at least 25 and 20 years , in the northern - 15 , or in equal territories - 20 years , regardless of place of residence, the basic amount increases by one and a half times .

Answer: Hello, Valentin Petrovich. According to current legislation, the status of a pensioner living in special climatic zones must be regularly confirmed . This occurs by submitting a corresponding application to the territorial branch of the Pension Fund of the Russian Federation at the place of residence. The frequency of confirmation is once a year .

Secondary Leave and Parents' Weekends

Mothers and fathers living in the North and having children under 16 years of age have the right to take an additional day off each month at their own expense.

If the employee’s work experience is more than six months, then he has a preference in receiving a paid 14-day leave necessary to accompany an applicant child to another locality. The employee will also have to confirm his intentions by providing a certificate from the educational institution where the entrance exams are planned.

Housing subsidy amount

All citizens of the Russian Federation benefit from compensation for expenses. For residents of the Far North, there is a special federal regulation No. 125 “On housing subsidies”, registered on November 25, 2002, according to which citizens receive financial support:

- who have not previously received subsidies to improve housing conditions;

- if they have worked for at least 15 years in the North, their labor activity began no later than January 1, 1992, and decided to move to entities located outside its borders;

- who do not have real estate in regions outside the Far North and areas included in it, and also recognized by law as in need of improved housing conditions.

Only in the aggregate of the noted criteria can a citizen qualify for social support.

Fixed supplement to pension in 2021: for dependents, disabled people, northerners

Workers in the Far North or areas equivalent to them deserve special attention. It is respectful that a person was able to devote his life to working in such places. Therefore, the state understands how important it is so that such people can afford more.

This is interesting: Certificate of Extract from Place of Residence

5. Citizens who worked in difficult climatic conditions, namely worked for at least 15 years in the Far North. If you have an insurance experience of 25 years or more for men or 20 years or more for women. For them, the size of the fixed payment in 2021 is:

Local retirement benefits

On the territory of the Russian Federation there are a number of categories of citizens who retire earlier than others. Northerners also have the same preference. So, according to Art. 32 Federal Law No. 400 “On Insurance Pensions” dated December 28, 2013, the following have the right to early withdrawal:

- women who have reached the age of 50, with a total of 20 years of insurance experience and 15 years in the Far North or 20 years in regions equivalent to it.

- men who have reached the age of 55, having a similar northern experience with a total of 25.

For non-working northern pensioners receiving state pensions for old age or disability, from January 1, 2005, compensation is provided for travel to the place of rest (in both directions) once every couple of years.

If a person has worked in the North for at least 7.6 years, then when calculating the retirement age, 4 months are subtracted for each working year; in other cases, 12 calendar months are equal to 9 northern months.

Expert: Will Your Pension Increase When You Move to the North?

The fact is that the fixed payment to the insurance pension, according to the Federal Law, actually increases for persons living in the Far North and equivalent areas. There are several such areas in the Irkutsk region. Regional coefficients that increase the amount of a fixed payment are set separately for each district. Without information about where exactly you plan to move, it will not be possible to make an accurate calculation. If the required length of service is not enough, when moving from the northern regions to another region where a lower regional coefficient is established, the fixed payment is subject to change downwards depending on the region of the new place of residence. The amount is awarded to those who have a minimum insurance period, but only in case of permanent residence in the Far North and near it. Features People who have a working or insurance period can begin receiving payments at 55 or 50 years. Therefore, they are entitled to a number of benefits that give an advantage both during retirement and provide financial support in other aspects.

We recommend reading: Standards for living space for placement on the waiting list

Irina met Victor at a mutual friend’s birthday party. She was 22 years old, Vitya was four years older. Very sociable, he easily made acquaintances, so cheerful, even reckless, with a bunch of friends.

Subjects related to the Far North

Low air temperatures, strong winds, and snow are characteristic features of the territories located north of the Arctic Circle. It is difficult and difficult for local people to survive here, but everyone has the ability to adapt. The following is a list of areas as of 2021 with extreme weather conditions.

- Murmansk region;

- Yakutia (Republic of Sakha);

- Magadan region;

- Kamchatka region;

- Chukotka Autonomous Okrug (ChAO);

- Arkhangelsk region;

- Sakhalin region;

- Irkutsk region;

- Tyumen region;

- Republic of Karelia;

- Komi Republic;

- Tyva Republic;

- Krasnoyarsk region;

- Khabarovsk region;

- Perm region;

- Tomsk region;

- Chita region;

- Amur region;

- The Republic of Buryatia;

- Republic of Gorny Altai;

- Primorsky Krai.

Thus, 21 administrative units of the Russian Federation are legally classified as regions of the North, the population of which has the right to receive social assistance.

Northerners have preferences aimed at improving their social and financial situation, which smoothes out the negative impression of areas with harsh weather conditions.

Benefits for FSIN employees in 2021

They will tell you for free

But the most important thing is that you can get an explanation of what your pension consists of, whether you are entitled to pension savings or not, ABSOLUTELY FREE. An appeal to the Pension Fund, written in any form, can be sent either by mail or through the department’s website. You can also come to see specialists at the Pension Fund office at your place of residence.

“All services provided by the Pension Fund specialists are completely free,” says Nina Bondareva. – You can also contact the MFC offices, where documents and applications are processed on established forms and formats completely free of charge. A number of applications can be sent electronically through the “Personal Account” on the Pension Fund website or the Unified Government Services Portal. It is possible to file a complaint with the prosecutor’s office and resolve the problem through the courts.

The Pension Fund notes that more than 1,200 requests from such would-be lawyers were received by specialists in just three months from the beginning of the year.

Not a single positive decision has yet been made based on their work. The regional prosecutor's office opened a case against one of the firms for an administrative offense “for providing low-quality legal services.” Unfortunately, it is very difficult to prove fraud: an elderly person voluntarily gives money, signs all documents, and in some cases even signs a “certificate of completed work” with an open date... Please do not give such amounts to people who have only one goal - make money on your gullibility.

All questions about pensions can be asked by calling the OPFR hotline in the Krasnoyarsk Territory - 8 (391) 229-00-66

№ 29 / 1109

Related links:

16 Nov '2020

Tenants of municipal apartments in the Krasnoyarsk Territory have the right to free installation of metering devices

31 Jul '2021 Social supplement to pension will be assigned automatically

31 Jul '2021 Benefits will be recalculated for working pensioners

21 Jul '2021 Pensioners without a Mir card risk being left without payments

17 Jul '2021 Starting next year, pensions will no longer be below the regional subsistence level