Federal Law of December 28, 2013 No. 424-FZ

RUSSIAN FEDERATION

THE FEDERAL LAW

About funded pension

Adopted by the State Duma on December 23, 2013

Approved by the Federation Council on December 25, 2013

(As amended by federal laws dated May 23, 2016 No. 143-FZ, dated March 7, 2018 No. 56-FZ, dated July 29, 2018 No. 272-FZ, dated October 3, 2018 No. 350-FZ, dated December 8, 2020 No. 429-FZ)

Article 1. Purpose and subject of regulation of this Federal Law

This Federal Law, in accordance with the Constitution of the Russian Federation and the Federal Law of December 15, 2001 No. 167-FZ “On Compulsory Pension Insurance in the Russian Federation,” establishes the grounds for acquiring and the procedure for exercising the right of insured persons to a funded pension.

Article 2. Legislation of the Russian Federation on funded pensions

1. The legislation of the Russian Federation on funded pensions consists of this Federal Law, Federal Law No. 165-FZ of July 16, 1999 “On the Basics of Compulsory Social Insurance”, Federal Law of December 15, 2001 No. 167-FZ “On Compulsory Pension Insurance in Russian Federation", Federal Law of July 24, 2009 No. 212-FZ "On insurance contributions to the Pension Fund of the Russian Federation, Social Insurance Fund of the Russian Federation, Federal Compulsory Medical Insurance Fund", Federal Law of May 7, 1998 No. 75-FZ " On non-state pension funds", Federal Law of November 30, 2011 No. 360-FZ "On the procedure for financing payments from pension savings", Federal Law of April 1, 1996 No. 27-FZ "On individual (personalized) accounting in the mandatory system pension insurance", Federal Law of July 24, 2002 No. 111-FZ "On investing funds to finance funded pensions in the Russian Federation", other federal laws and regulatory legal acts of the Russian Federation adopted in accordance with them.

2. In the cases provided for by this Federal Law, the Government of the Russian Federation determines the procedure for exercising the right of persons insured in accordance with the Federal Law of December 15, 2001 No. 167-FZ “On Compulsory Pension Insurance in the Russian Federation” to a funded pension. For the purpose of uniform application of this Federal Law, if necessary, appropriate clarifications may be issued in the manner determined by the Government of the Russian Federation.

3. In cases where an international treaty of the Russian Federation establishes rules other than the rules provided for by this Federal Law, the rules of the international treaty of the Russian Federation apply.

4. Decisions of interstate bodies adopted on the basis of the provisions of international treaties of the Russian Federation in their interpretation, contrary to the Constitution of the Russian Federation, are not subject to execution in the Russian Federation. Such a contradiction may be established in the manner prescribed by federal constitutional law. (Part introduced - Federal Law No. 429-FZ dated 08.12.2020)

Article 3. Basic concepts used in this Federal Law

1. For the purposes of this Federal Law, the following basic concepts apply:

1) funded pension - a monthly cash payment in order to compensate insured persons for wages and other payments and rewards lost by them due to the onset of incapacity due to old age, calculated based on the amount of pension savings accounted for in a special part of the individual personal account of the insured person or on pension account of the insured person's funded pension, as of the day the funded pension was assigned;

2) establishment of a funded pension - assignment of a funded pension and adjustment of its size;

3) pension savings funds - the totality of funds accounted for in a special part of the individual personal account of the insured person or in the pension account of the insured person’s funded pension, formed from received insurance contributions to finance the funded pension, as well as the result of their investment, additional insurance contributions for the funded pension , employer contributions paid in favor of the insured person, contributions for co-financing the formation of pension savings, as well as the result of their investment and funds (part of the funds) of maternal (family) capital aimed at forming a funded pension, as well as the result of their investment;

4) the expected period of payment of a funded pension - an indicator calculated on the basis of data from the federal executive body that carries out the functions of generating official statistical information on social, economic, demographic, environmental and other social processes in the Russian Federation, and used to determine the size of a funded pension. (As amended by Federal Law No. 272-FZ dated July 29, 2018)

2. Other concepts and terms are used in this Federal Law in the meanings in which they are used to regulate the relevant relations in the Federal Law of April 1, 1996 No. 27-FZ “On individual (personalized) accounting in the compulsory pension insurance system”, Federal Law of May 7, 1998 No. 75-FZ “On Non-State Pension Funds”, Federal Law of July 16, 1999 No. 165-FZ “On the Basics of Compulsory Social Insurance”, Federal Law of December 15, 2001 No. 167-FZ “On Compulsory pension insurance in the Russian Federation", Federal Law of July 24, 2002 No. 111-FZ "On investing funds to finance funded pensions in the Russian Federation", Federal Law of December 29, 2006 No. 256-FZ "On additional measures of state support for families, with children", Federal Law of April 30, 2008 No. 56-FZ "On additional insurance contributions for funded pensions and state support for the formation of pension savings", Federal Law of November 30, 2011 No. 360-FZ "On the procedure for financing payments from funds pension savings" and the Federal Law "On Insurance Pensions".

Article 4. Persons entitled to a funded pension

1. Citizens of the Russian Federation who are insured in accordance with the Federal Law of December 15, 2001 No. 167-FZ “On Compulsory Pension Insurance in the Russian Federation” have the right to a funded pension, if they have pension savings accounted for in a special part of the individual personal account of the insured person or on the pension account of the insured person's funded pension, subject to their compliance with the conditions provided for by this Federal Law.

2. Foreign citizens and stateless persons permanently residing in the Russian Federation, subject to their compliance with the conditions provided for by this Federal Law, have the right to a funded pension on an equal basis with citizens of the Russian Federation, except for cases established by federal law or an international treaty of the Russian Federation.

Article 5. Financial support for payment of funded pension

1. The procedure for financial support for the payment of funded pensions is determined by the Federal Law of December 15, 2001 No. 167-FZ “On Compulsory Pension Insurance in the Russian Federation” and the Federal Law of November 30, 2011 No. 360-FZ “On the Procedure for Financing Payments from Pension Funds” savings."

2. Guarantees of safety of pension savings funds when assigning and making payment of a funded pension are determined by the Federal Law “On guaranteeing the rights of insured persons in the compulsory pension insurance system of the Russian Federation when forming and investing pension savings funds, establishing and making payments from pension savings funds.”

Article 6. Conditions for assigning a funded pension

1. Insured persons have the right to a funded pension: men who have reached the age of 60 years, and women who have reached the age of 55 years, subject to the conditions for the appointment of an old-age insurance pension established by the Federal Law “On Insurance Pensions” (availability of the required insurance period and established the value of the individual pension coefficient).

2. Insured persons specified in Part 1 of Article 30, Article 31, Part 1 of Article 32, Part 2 of Article 33 of the Federal Law “On Insurance Pensions” are assigned a funded pension upon reaching the age or onset of the period determined in accordance with the Federal Law “On Insurance Pensions”. insurance pensions" as of December 31, 2021, and subject to the conditions giving the right to early assignment of an old-age insurance pension (availability of the required insurance period and (or) experience in the relevant types of work and the established value of the individual pension coefficient).

3. A funded pension is assigned to insured persons if there are pension savings accounted for in a special part of the individual personal account of the insured person or in the pension account of the insured person’s funded pension, if the amount of the funded pension is more than 5 percent in relation to the amount of the old-age insurance pension (in including taking into account the fixed payment to the old-age insurance pension and increases in the fixed payment to the insurance pension), calculated in accordance with the Federal Law “On Insurance Pensions”, and the amount of the funded pension calculated on the day the funded pension was assigned. If the amount of the funded pension is 5 percent or less in relation to the amount of the old-age insurance pension (including taking into account the fixed payment to the old-age insurance pension and increases in the fixed payment to the insurance pension), calculated in accordance with the Federal Law “On Insurance Pensions” ”, and the amount of the funded pension calculated on the day the funded pension was assigned, insured persons have the right to receive the specified funds in the form of a lump sum payment.

4. The funded pension is established and paid in accordance with this Federal Law, regardless of the receipt of another pension and monthly lifelong allowance provided for by the legislation of the Russian Federation. Changes in the conditions for assigning a funded pension, the norms for establishing a funded pension and the procedure for paying a funded pension are carried out by amending this Federal Law.

(Article as amended by Federal Law dated October 3, 2018 No. 350-FZ)

Article 7. Amount of funded pension

1. The size of the funded pension is determined based on the amount of pension savings accounted for in a special part of the individual personal account of the insured person or in the pension account of the insured person’s funded pension, as of the day from which he is assigned a funded pension. Additional insurance contributions for a funded pension, employer contributions paid in favor of the insured person, contributions for co-financing the formation of pension savings, as well as the result of their investment and funds (part of the funds) of maternal (family) capital aimed at the formation of a funded pension, as well as the result from their investment are included in pension savings and are taken into account at the choice of the insured person when determining the amount of a funded pension or the amount of a fixed-term pension payment in accordance with Federal Law of November 30, 2011 No. 360-FZ “On the procedure for financing payments from pension savings” .

2. The amount of the funded pension is determined by the formula:

NP = PN / T,

where NP is the amount of the funded pension;

PN - the amount of pension savings of the insured person, accounted for in a special part of the individual personal account or in the pension account of the insured person's funded pension, as of the day from which he is assigned a funded pension. If the insured person is provided with an urgent pension payment, provided for by Federal Law No. 360-FZ of November 30, 2011 “On the procedure for financing payments from pension savings”, the pension savings funds, on the basis of which the amount of this payment is calculated, are not taken into account as part of the funds pension savings, on the basis of which the amount of the funded pension for this insured person is determined;

T - the number of months of the expected period of payment of a funded pension, used to calculate the amount of a funded pension and determined in accordance with Part 1 of Article 17 of this Federal Law.

3. When assigning a funded pension later than acquiring the right to the specified pension, the expected period of payment of the funded pension is reduced by 12 months for each full year (12 months) that has elapsed from the date of acquisition of the right to assign the specified pension. At the same time, the expected period of payment of a funded pension, used to calculate the amount of a funded pension, cannot be less than 168 months from 2015.

4. When adjusting the size of a funded pension in accordance with Part 1 of Article 8 of this Federal Law, the expected period for payment of a funded pension is reduced by 12 months for each full year (12 months) that has elapsed from the date of assignment of a funded pension. In this case, the specified period, including taking into account its reduction in the case provided for in part 3 of this article, cannot be less than 168 months since 2015.

5. Pension savings funds reflected in the special part of the individual personal account of the insured person or in the pension account of the insured person’s funded pension and taken into account when assigning a funded pension are not taken into account when adjusting the amount of the said pension on the basis provided for in Part 1 of Article 8 of this Federal Law.

6. If the death of the insured person occurred before he was assigned a funded pension or before its size was adjusted taking into account additional pension savings in accordance with Part 1 of Article 8 of this Federal Law, the pension savings funds accounted for in a special part of the individual personal account or in the pension accumulative pension account of the insured person, with the exception of funds (part of the funds) of maternal (family) capital aimed at forming a funded pension, as well as the result of their investment, are paid to the legal successors of the deceased insured person in the manner established by the legislation of the Russian Federation. In this case, the insured person has the right at any time, by submitting an application for the distribution of pension savings to the insurer with whom the insured person forms pension savings, to identify specific persons from among the persons specified in part 7 of this article, or from among other persons who can receive such payment, and also establish in what shares the specified funds should be distributed between them. Such an application may be submitted in the form of an electronic document, the procedure for execution of which is determined by the Government of the Russian Federation and which is transmitted to the insurer using public information and telecommunication networks, including the Internet information and telecommunication network, including the federal state information system "Unified Portal of State and municipal services (functions)". In the absence of the specified application, pension savings accounted for in a special part of the individual personal account of the insured person or in the pension account of the insured person's accumulative pension, subject to payment to the relatives of the deceased insured person specified in part 7 of this article, are distributed among them in equal shares. Payment of pension savings to the legal successors of the deceased insured person is carried out subject to an application for the specified payment to the insurer, which formed the pension savings on the date of death of the insured person, within six months from the date of death of the insured person. The deadline for applying for payment to the legal successors of the deceased insured person may be restored in court at the request of the legal successor of the deceased insured person who missed the specified period. The procedure for legal successors to apply for payments of pension savings of deceased insured persons, the procedure, timing and frequency of making these payments and the procedure for calculating the amounts of payments to legal successors of deceased insured persons are established by the Government of the Russian Federation.

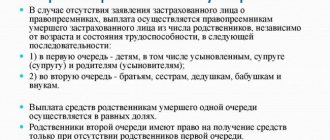

7. In the case provided for in part 6 of this article, the legal successors of the deceased insured person from among the persons specified in the insured person’s application for the distribution of pension savings accounted for in a special part of the individual personal account of the insured person or in the pension account of the insured person’s funded pension or specified in agreement on compulsory pension insurance, payment of these funds is carried out. In the absence of the specified application of the insured person or the definition of legal successors in the contract on compulsory pension insurance, payment is made to the legal successors of the deceased insured person from among the relatives, which include his children, including adopted children, spouse, parents (adoptive parents), brothers, sisters , grandparents and grandchildren, regardless of age and disability, in the following sequence:

1) first of all - to children, including adopted children, spouse and parents (adoptive parents);

2) secondly - to brothers, sisters, grandfathers, grandmothers and grandchildren.

8. Payment of pension savings to relatives of a deceased insured person of the same priority is carried out in equal shares. Relatives of the second stage have the right to receive pension savings accounted for in a special part of the individual personal account of the deceased insured person or in the pension account of the accumulative pension of the deceased insured person, only in the absence of relatives of the first stage. If the insured person does not have relatives specified in part 7 of this article, these funds are taken into account as part of the insurer's reserve for compulsory pension insurance. In this case, a special part of the individual personal account of the insured person or the pension account of the funded pension is closed.

Article 8. Adjustment of the amount of funded pension

1. The size of the funded pension from August 1 of each year is subject to adjustment based on the amount of insurance contributions received to finance the funded pension, additional insurance contributions for the funded pension, employer contributions, contributions for co-financing the formation of pension savings, as well as the result of their investment and funds (parts funds) of maternal (family) capital aimed at forming a funded pension, as well as the result of their investment, accounted for in a special part of the individual personal account of the insured person or in the pension account of the insured person's funded pension, which were not taken into account when determining the amount of pension savings for calculating the amount of a funded pension upon its appointment or previous adjustment provided for in Part 2 of this article.

2. The size of the funded pension is adjusted according to the formula:

NP = NPk + PNk / T,

where NP is the amount of the funded pension;

NPk - the established amount of the funded pension as of July 31 of the year in which the corresponding adjustment is made;

Pnk - the amount of pension savings of the insured person included in the special

Article 2

Introduce into the Federal Law of August 20, 2004 N 117-FZ “On the savings and mortgage system of housing for military personnel” (Collected Legislation of the Russian Federation, 2004, N 34, Art. 3532; 2006, N 6, Art. 636; 2007, N 50, Article 6237; 2008, No. 30, Article 3616; 2009, No. 48, Article 5731) the following changes:

1)

in article 3:

a) paragraph 8 should be stated as follows: “8) targeted housing loan - funds provided to a participant in the savings-mortgage system on a repayable and gratuitous or repayable basis in accordance with this Federal Law;”; b) paragraph 13 after the word “declaration” should be supplemented with the words “manager for the purchase of housing” and deleted;

3)

in article 5:

a) in part 6, replace the word “period” with the word “year”;

b) add part 71 with the following content: “71. On the personal savings account of a participant who was excluded from the register of participants in connection with dismissal from military service for health reasons, or in connection with organizational and staffing events, or for family circumstances, provided for by the legislation of the Russian Federation on military duty and military service, for whom in this case, the right to use savings for housing provision has not arisen on the grounds provided for in paragraph 2 of Article 10 of this Federal Law, and which was included in the register of participants on the basis provided for in paragraph 14 of Part 2 of Article 9 of this Federal Law, funds are taken into account in the amount of savings for housing provision recorded in the participant’s personal savings account on the day the basis for excluding him from the register of participants arose.”;

4)

in article 7:

a) in paragraph 7 of part 1, replace the words “for the purchase of housing” with the words “supplementing savings for housing provision”;

b) part 2 shall be supplemented with paragraph 131 as follows: “131) determines, in accordance with this Federal Law, the requirements for the investment declaration of the management company, including the structure of the investment portfolio;”;

5)

Part 2 of Article 9 shall be supplemented with paragraphs 14 and 15 as follows: “14) for military personnel who voluntarily entered military service from the reserve, if they were excluded from the register of participants and did not receive the payment of funds specified in paragraph 3 of part 1 of Article 4 of this Federal Law, or did not take advantage of the right to become participants in the savings-mortgage system - concluding a new contract for military service; 15) for military personnel who voluntarily entered military service from the reserve, if they were excluded from the register of participants and received payment of funds specified in paragraph 3 of part 1 of Article 4 of this Federal Law - the total duration of their military service is twenty years.” ;

6)

in article 11:

a) in part 1:

paragraphs 1 and 2 shall be stated in the following wording: “1) use the funds specified in paragraphs 1 and 3 of part 1 of article 4 of this Federal Law for the purpose of acquiring residential premises or residential premises in ownership or for other purposes after the right to use these funds; 2) use a targeted housing loan for the purposes provided for in Part 1 of Article 14 of this Federal Law;”; paragraphs 4 - 6 are declared invalid;

b) part 3 should be stated as follows: “3. The receipt by a participant of the funds specified in Part 1 of Article 4 of this Federal Law, or the direction by an authorized federal body to the participant’s creditor of funds from a targeted housing loan for the purposes provided for in paragraph 2 of Part 1 of Article 14 of this Federal Law, is the fulfillment by the state of its obligations to provide housing for a military serviceman. ";

7)

in paragraph one of part 1 of article 12, the words “for the intended use of funds recorded on the participant’s personal savings account and the funds provided for in part 1 of article 4 of this Federal Law” are replaced with the words “to use the funds specified in clauses 1 and 3 of part 1 of the article 4 of this Federal Law, for the purpose of acquiring residential premises or residential premises as a property or for other purposes”;

in article 14:

a) in part 1:

paragraphs 1 and 2 shall be stated as follows: “1) acquisition of residential premises or residential premises, acquisition of a land plot occupied by the acquired residential building or part of a residential building and necessary for their use, secured by the acquired residential premises or residential premises, the specified land plot, as well as the acquisition of residential premises or residential premises under an agreement of participation in shared construction; 2) payment of a down payment when purchasing, using a mortgage loan (loan), a residential premises or residential premises, acquiring a land plot occupied by the acquired residential building or part of a residential building and necessary for their use, paying part of the price of the agreement for participation in shared construction using a mortgage loan (loan) and (or) repayment of obligations under a mortgage loan (loan)."; paragraph 3 is declared invalid;

b) in part 9, the words “purchase of residential premises (residential premises)” shall be replaced with the words “purchase of residential premises or residential premises, acquisition of a land plot occupied by a residential building or part of a residential building being acquired and necessary for their use,” the words “registration of residential premises (residential premises),” replace with the words “registration of residential premises or residential premises, land plot, payment for services”;

9)

Part 1 of Article 16 shall be supplemented with paragraphs 10 and 11 as follows: “10) certificates of deposit; 11) mortgages, the mortgagors of which are participants in the savings-mortgage system.”;

10)

part 14 of article 17 shall be supplemented with paragraph 31 as follows: “31) violation by the management company of the obligation established by paragraph 31 of part 2 of article 20 of this Federal Law;”;

11)

Part 2 of Article 20 shall be supplemented with paragraph 31 as follows: “31) adjust the investment declaration of the management company, including the structure of the investment portfolio, in accordance with the requirements determined by the authorized federal body and within the period established by this body;”;

12)

clause 15 of part 2 of Article 21 shall be supplemented with the words “manager of the trustee” and replaced with the words “manager of the trustee 4) structure of the investment portfolio.”;

c) part 3 is declared invalid;

d) part 4 should be stated as follows: “4. The investment declaration of the management company is approved by the management company and submitted to the authorized federal body within the period established by the trust management agreement, and in the case provided for in paragraph 31 of part 2 of Article 20 of this Federal Law - within the period established by the authorized federal body.”;

15)

in article 27:

a) in part 1: paragraph 2 is declared invalid; paragraph 3 is declared invalid; paragraph 7 is declared invalid;

b) part 2 is declared invalid;

c) add part 13 with the following content: “13. The structure of the investment portfolio is determined by the authorized federal body taking into account the requirements of this article.”;

16)

in article 28:

a) in part 2, the words “remuneration of management companies or the procedure for determining it, amount” should be deleted;

b) add part 21 with the following content: “21. The amount of remuneration for the management company under one trust management agreement is equal to the sum of 0.05 percent of the amount of savings for housing provision (hereinafter referred to as the base part of the remuneration) and 1 percent of the positive financial result from investing savings for housing provision received during the reporting year (hereinafter referred to as the financial result), if the profitability does not exceed the average annual refinancing rate of the Central Bank of the Russian Federation for the reporting year (hereinafter referred to as the average annual refinancing rate). If the profitability exceeds the average annual refinancing rate, the amount of remuneration to the management company under one trust management agreement is an amount equal to the sum of the base part of the remuneration, 1 percent of the base financial result and 10 percent of the amount by which the positive financial result exceeds the base financial result.”;

c) add part 22 with the following content: “22. The amount of savings for housing provision for the purpose of calculating the amount of remuneration for the management company in accordance with Part 21 of this article is calculated based on: 1) the value of the net assets of the investment portfolio, calculated at the beginning of the reporting year or, if the trust management agreement was concluded in the current year, on the date conclusion of the said agreement; 2) the amount of savings for housing transferred by the authorized federal body to the investment portfolio in the current year, minus the amount of savings for housing transferred in the current year from the investment portfolio to the authorized federal body or the person specified by it.”;

d) add part 23 with the following content: “23. The procedure for calculating the financial result for the purpose of calculating the amount of remuneration for the management company in accordance with Part 21 of this article is established by the federal executive body in the field of financial markets in agreement with the authorized federal body.”;

e) part 3 should be stated as follows: “3. The basic financial result for the purpose of calculating the amount of remuneration for the management company in accordance with Part 21 of this article is calculated based on the average annual refinancing rate and the amount of savings for housing.”;

f) in part 31, delete the words “from investing savings for housing”;

g) part 7 is declared invalid;

17)

Part 2 of Article 29 after the word “declarations” is supplemented with the words “managers a” of paragraph 8, paragraphs three - five of subparagraph “a” and subparagraph “b” of paragraph 15, subparagraph “e” of paragraph 16 of Article 1 of the Federal Law of December 4, 2007 N 324-FZ “On Amendments to Certain Legislative Acts of the Russian Federation” (Collection of Legislation of the Russian Federation, 2007, No. 50, Art. 6237) shall be declared invalid.