Accounting for length of service in pension legislation

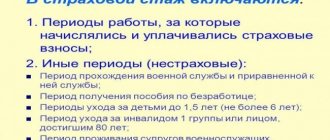

According to the Law of the Russian Federation “On Insurance Pensions” dated December 28, 2013 No. 400-FZ, in force since 2015, the total length of service is unimportant for the issue of assigning a pension.

In terms of the duration of work, the assignment of a pension depends on the insurance period, the calculation of which began in 2002 and is determined not only by the qualitative composition of the periods included in it, but also by reference to the fact of payment of insurance contributions to the Pension Fund during it. The minimum insurance period for retirement in 2021 is 12 years and over the next few years will increase by 1 year annually until it reaches 15 years (in 2024), established by Law No. 400-FZ.

The Law of the Russian Federation “On Labor Pensions in the Russian Federation” dated December 17, 2001 No. 173-FZ, which preceded the latest legal act on pensions, continues to be in force to the extent that does not contradict Law No. 400-FZ, in some of its provisions contains a reference to the total length of service, duration which affects the final calculation of the pension amount. These are the questions of magnification:

- the length of service coefficient, calculated when determining the amount of pension rights that arose before 2002 (clauses 3 and 4 of Article 30 of the Law of the Russian Federation of December 17, 2001 No. 173-FZ);

- a fixed part of the pension if the length of service exceeds a certain length (clause 17, article 14 of law No. 173-FZ).

In none of these points is the length of service tied to 40 years. The amount of the pension depends on the number of points. Bonus points are provided for a long period of work. Thus, when calculating a pension for 40 years of service, the current legislation on pensions does not contain any special reservations regarding the inclusion of increases.

Are non-working days with continued pay, established by Decrees of the President of the Russian Federation in connection with coronavirus, included in the length of service for early retirement if there is a long insurance period of 42 years and 37 years for men and women, respectively? The answer to this question is in ConsultantPlus. If you do not have access to the K+ system, get a trial online access for free.

After 40 years of work experience

Recently, rumors have been circulating on the Internet about the possibility of increasing the number of pension points for long work experience. For example, information is provided that additional payment for work experience of more than 35 years gives 1 pension point, and for work duration of more than 40 years - 5 points.

Representatives of the Pension Fund of the Russian Federation denied such information, but noted that an addition to the pension for 40 years of service is possible if a person is awarded the title of Labor Veteran.

A non-working pensioner can receive honorary status only in accordance with regional legislation. At the federal level, the title Hero of Labor is awarded. Each subject has its own requirements for the duration of continuous work. The amount of additional payment for experience also varies. In Moscow, for example, it is 1 thousand rubles.

- Tax benefits for military pensioners - complete list and procedure for obtaining

- Doctors told how to replace medical masks that have disappeared from sale

- Weekly menu for weight loss

Increase in experience coefficient

When assessing pension rights acquired before 2002 (clauses 3 and 4 of Article 30 of Law No. 173-FZ), the calculation formulas use the length of service coefficient, the value of which directly depends on the length of service. For most calculation situations, its basic value is 0.55 for persons with a work experience of at least 25 years for men and 20 years for women or equal to the required insurance period. For each year of exceeding the established work period, an increase of 0.01 is made to the coefficient. But the total amount of increase cannot exceed 0.2. Thus, the maximum experience coefficient will occur in women with 40 years of experience and in men with 45 years of experience.

Recalculation of a woman’s pension for 40 years of service in 2021: where to apply, what documents are needed

You do not need to work a full forty years to receive the bonus. Thus, for women, one and a half years of maternity leave are included in their work experience. If subsequent births occur, maternity leave is counted for each individual. A woman has the right to serve in the army under a contract; such service will also be included in her seniority.

One of the provisions of the updated pension reform indicates that for forty years of work experience, a pensioner will receive an increase of 5 points. According to the authorities, this should significantly increase payments. Taking into account the constant indexation of pensions, the additional payment will increase over the years along with the weight of points.

09 Jun 2021 uristlaw 369

Share this post

- Related Posts

- Global problems in criminal procedural law

- Payments for Child Custody 2021 in Moscow

- What is the Northern Coefficient in the Krasnodar Territory

- If a Disabled Person of Group 2 Does Not Enjoy the Right to Sanatorium Treatment

Supplement to the fixed part of the pension

The formula for calculating the labor pension established by Art. 14 of Law No. 173-FZ, includes the value of its fixed part. Since 2015, in relation to this fixed amount, there has been a procedure for increasing it by 6% for each full year of service, exceeding for most calculation situations the value of 30 years for men and 25 years for women (clause 17 of Article 14 of the Law of the Russian Federation of December 17, 2001 No. 173-FZ). Thus, upon reaching 40 years of service, the fixed part of the calculation can increase by 60% for men and 90% for women.

Find out how pension payments are recalculated for working citizens in ConsultantPlus. Get free demo access to K+ and go to the material to find out all the details of this procedure.

What benefits does length of service provide for early retirement?

The right to early establishment of a pension provided for by Law No. 173-FZ depends on the required length of service in conditions that give the right to a special approach to its assignment. Moreover, its value is established by law and does not depend on the total length of service. However, when calculating the early pension, the rules for assessing pension rights that arose before 2002, taking into account the overall length of service, and the supplement to the fixed part of the pension will be applied.

Read about the specifics of dismissal upon retirement in the article “Dismissal of an employee due to retirement (nuances)” .

Supplements to pensions for length of service

Some citizens are entitled to certain seniority bonuses for length of continuous work. They are appointed on an application basis. To receive additional payment, you must have a certain work and special experience. The following may apply for bonuses:

- workers who have worked for a certain number of years in the regions of the Far North (RKS) and in equal territories (TKS);

- military personnel;

- persons who have worked in difficult and dangerous conditions according to Lists 1 and 2 for a certain number of years;

- civil servants.

Please note that from 2021, citizens who have worked in the agricultural sector for more than 30 years are entitled to a monthly pension supplement in the amount of 25% of the fixed payment.

Only those applicants who permanently live in rural areas, have stopped working and have reached the generally established age for retirement will be able to receive a bonus.

Working in the Far North

Recalculation and indexation of pensions for citizens with “northern experience” occurs on a general basis. When calculating pensions, some of them are entitled to a bonus in the form of an increase in the fixed payment. To receive an increase in pension, men must have a total work experience of at least 25 years, and women - at least 20. At the same time, they need to work for 15 years in the RKS, and 20 years in the PKS. The amount of the supplement for non-working pensioners is:

- for length of service in the RKS – 50% of the basic EF;

- for length of service in the PKS - 30% of the basic EF.

- 9 surprising reasons for increased gas formation

- 8 Common Causes of High Blood Pressure

- What's the best way to protect your savings?

In difficult and dangerous conditions according to List 1 and 2

Citizens who worked on Lists 1 and 2 are entitled to a preferential pension. Although the professions in them are often repeated, the main differences are that the first includes professions with harmful and especially dangerous working conditions, and the second - with difficult ones. Pension Fund employees, when establishing and calculating the amount of pension payments for a particular person, choose the most profitable option for him, taking into account all the features of his work activity.

Recipients of pensions under List 1, who have work experience under List 2 and have reached the age entitling them to a pension under List 2, have the right to apply to the Pension Fund for re-registration and recalculation on this basis.

Please note that such recalculation is not always profitable. Firstly, this is due to the fact that when calculating pension payments under List 1, additional preferential criteria are used, for example, reduced requirements for total work experience. Compare: to assign security under List 1, men need to work 20 and women 15 years, while under List 2 – 25 and 20 years.

Transfer to a pension on another basis (recalculation) is carried out exclusively at the request of a citizen. The accrual of pension payments in an increased amount begins in the month following the date of application. Customer service employees of the territorial branch of the Pension Fund of Russia will check the feasibility of the recalculation and provide comprehensive advice.

Civil servant

State federal employees can increase the amount of pension payments for each year of work in excess of the required length of service. In 2019 it is 16 and a half years. When calculating the surcharge, the average monthly earnings of a civil servant (AMS) are taken into account.

For each additional year in excess of this standard, 3% of the monthly wage is due, but not more than 75% of the average monthly earnings.

In addition, for residents of the “northern regions” the pension increases by the regional coefficient. When moving to another area, its size is subject to revision or cancellation.

Military personnel under contract

Military personnel are entitled to additional payments for length of service. The size depends on the length of military service. With 20 years of pure military service, a pensioner is entitled to 50% of his salary plus 3% for each additional year. The total amount of the bonus for length of service cannot exceed 75% of the salary.

If a pensioner has a mixed length of service of 25 years, half of which (12 and a half years) were spent in the army, the increase will be 50% of the salary plus 1% for each year on top, but not more than 75% in total.

Results

The calculation procedure under the pension legislation in force since 2015 does not provide special benefits for those with more than 40 years of work experience.

However, according to the previous law, which in a number of situations can still be used to calculate pensions, the total length of service plays a positive role. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

This video is unavailable

Additional payment to pensions for work experience of more than 40 years in 2021 Against the backdrop of reforms carried out in pension legislation this year, the country's leadership decided to pay special attention to Russians who have a wealth of experience behind them and whose work experience exceeds the forty-year mark. After making certain amendments, every pensioner with at least 40 years of work experience has the right to count on some increase in his pension payments. This will be expressed not only in an increased coefficient, but also in a fixed addition to the already assigned pension. This kind of additional payment traditionally occurs automatically, so pensioners applying for it will not have to contact the Pension Fund for its accrual. Reorganizations in the pension system are becoming more and more noticeable for ordinary Russians. But as 2021 begins, many retirees are left with many questions. The majority are completely confused, not understanding what the additional payment is for and how it will be calculated. Everyone knows that from January 1 of this year, citizens who have reached the retirement age barrier and left working practice have had their pension payments increased by one thousand rubles per month. But, in addition to this, an additional bonus is given to those whose work experience is more than 40 years. For this category of the population, an increase of 5 pension points is planned. Let us remind you that 1 such point is equivalent to 78.5 rubles. For those with a total work experience of up to 50 years, fixed payments are provided in the amount of 1063 rubles. Let us repeat that all these additional payments will be accrued to Russian pensioners without contacting the Pension Fund. Only if the pensioner has not received the promised additional payment, but is sure that he can count on it, should he contact the Pension Fund branch at the place of registration. You should take with you your pension certificate and work book, which indicates your total work experience.

This is interesting: Population in Chernobyl for 2020

The main difference between the urban contingent and rural residents is the length of experience. For rural pensioners, it is enough to be 30 years old and they will already receive a bonus. But in addition, the pensioner must systematically live in rural areas. In this case, he will be credited with 25% of the fixed pension payment.