Home / Alimony / Alimony for wife, disabled husband of groups 2, 3 in case of divorce

Everyone knows that parents must support their children; many have heard about children’s child support obligations to their parents. But not everyone is aware that spouses must also financially support each other, including after a divorce. The process of collecting and paying alimony to an ex-wife or ex-husband is determined by regulatory documents, in particular, the Family Code of the Russian Federation. This article covers in detail the issue of spousal maintenance after divorce.

When a disabled ex-husband or wife can count on alimony

Ex-husband and wife, being in a difficult situation or having serious health problems, have the right to file a lawsuit demanding to recover money from their partner for their maintenance under certain conditions.

The legislation of the Russian Federation recognizes disabled people as disabled, that is, citizens who have persistent health problems resulting from illnesses, injuries, congenital defects, as a result of which they cannot live a full life and need social protection.

To recognize a person as incapable of work, a medical and social examination is required, after which a special conclusion is issued, and then a corresponding certificate is issued. The issued document becomes an official confirmation of disability, but the mere fact of disability of the former spouse is not enough to collect alimony from the partner.

The court determines alimony payments, and in order for it to make a positive decision, the following circumstances must exist:

- need is an evaluative concept that assesses the level of material security of a citizen;

- disability – was acquired during marriage or occurred no later than 12 months after the divorce.

The judge always establishes and verifies facts that should confirm the poor financial situation of the plaintiff. These include:

- Sources of funds and their size.

- Stability of earnings and circumstances influencing fluctuations in the amount.

- The ratio of incoming funds and expenses of a person in need to provide for his basic needs.

- Common children under 18 years of age (with whom they live and who supports them).

- Financial assistance from other family members.

- Other circumstances affecting the financial situation, for example, the need for expensive treatment.

Payment procedure

The procedure for paying alimony is determined in two ways:

- by concluding an agreement;

- by going to court.

By agreement

The most preferable option for both parties is an agreement, because people express their will in it, which means there is more reason to believe that the agreements will be paid. The contract must indicate:

- The amount of assistance prescribed in the form of a certain amount of money or as a part or percentage of earnings.

- The procedure for payments is both in the form of monthly, quarterly payments, and one-time payments, if the amount is large enough. Help can also be the transfer of expensive property that is subject to sale or rental.

The agreement must be certified by a notary office. Depending on the specific situation, you need to attach to it:

- Passports of both parties.

- Certificate of incapacity for work of the spouse.

- Confirmation of reaching retirement age.

- Documents about the husband’s income for at least three months.

By the tribunal's decision

To collect alimony after a divorce, the wife needs to write a statement of claim. It is filed with the court of first instance at the place determined at the request of the plaintiff. In accordance with Art. 29 of the Code of Civil Procedure of the Russian Federation, this may be the place where the ex-wife or ex-husband lives.

If the plaintiff is a disabled person of group I or II, then on the basis of the provisions of Art. 333.36 of the Tax Code of the Russian Federation, she should not pay a fee. If there is a disability of group III, the amount of the fee will be determined based on the price of the claim (Article 333.19 of the Tax Code of the Russian Federation). When the judge makes a decision in favor of the ex-wife, the responsibility for paying the fee shifts to the shoulders of the ex-husband.

For such cases, the Civil Code of the Russian Federation provides for a limitation period of three years.

The requirements for the claim do not have any distinctive features from claims in other categories of cases and are regulated by Art. 131 Code of Civil Procedure. As for drawing up a claim for the award of alimony to a disabled former spouse, it must contain information about the dates of official registration of marriage and divorce, about maintaining a joint or separate budget, about the presence or absence of joint children. It is also necessary to indicate the amount of the claim, indicating how much alimony the plaintiff wants to receive during the year.

The following documents must be attached to the claim:

- Confirmation of payment of the duty - for group III.

- Power of attorney for a representative (if any), certified by a notary.

- A copy of the application intended for the defendant.

- Certificate of disability.

- A copy of the plaintiff's passport.

- A copy of the certificate of divorce.

- Documents indicating the amount necessary to provide for the ex-wife;

- Documents containing information about the defendant’s income. If the plaintiff cannot provide these, it is necessary to state in the application a request for their requisition by the court.

Disability 1, 2, 3 groups and alimony

Separately, it is worth considering the situation when the disabled person is not the recipient of alimony, but the payer. In general, disability of any group does not relieve parents of the obligation to financially support a joint minor child. Alimony is still withheld from wages if the citizen continues to work, or from benefits.

Some adjustments may occur if disability benefits are the parent’s only source of income, or if a working disabled person receives temporary disability benefits, then the court may review the form of alimony and order its payment in a fixed amount.

Grounds for refusal to satisfy claims

The law provides for circumstances in which a court may refuse to satisfy a disabled spouse’s demands for alimony.

Such circumstances include:

- The plaintiff’s abuse of drugs or alcoholic beverages, resulting in serious health problems and loss of ability to work;

- The plaintiff committed an intentional crime, as a result of which he himself became disabled.

You can also get a refusal if the marriage with the defendant did not last long, or if the plaintiff behaved in an unworthy manner in the family. The court will refuse to collect alimony from a disabled spouse who does not have additional income, as well as from an able-bodied spouse who has a low income and a large number of dependents.

Is it possible to reduce the amount of alimony based on disability?

A child support worker with a disability can rarely boast of a high income; as a rule, he lives on a small allowance, sometimes working part-time at a simple job that pays little. At the same time, he spends a lot of money on treatment and maintaining health.

Therefore, a disabled parent can submit an application to the court with a request to reduce the amount of alimony. Please note that the court will not completely remove alimony obligations; we are only talking about reducing them, and then only when the citizen provides convincing arguments in favor of this decision.

In what cases can a disabled spouse demand alimony?

In accordance with established judicial practice, the following categories of disabled citizens can file a claim for the recovery of alimony:

- men over 60 years of age;

- women after reaching 55 years of age;

- spouses with disabilities of groups 1, 2, as well as with group 3, established by the Medical and Social Expertise.

Group 3 disabled people can work and provide for their needs independently. In order to qualify for alimony payments, a citizen with disability group 3 will need to pass the VTEK. The commission must issue a recommendation to prohibit work activity. At the same time, a parent with a disability is not released from child support obligations in favor of minor children.

If certain circumstances occur, the alimony payer may be released from obligations. These circumstances are determined by Art. 92 family law:

- If the spouse received a disability due to addiction to alcohol or drugs. The payer will need to present medical certificates to the court.

- If the disability group was the result of an unlawful act committed by the claimant. The alimony payer must provide a valid court decision on the imposition of a sentence due to a crime committed by the alimony collector.

- The official marriage lasted less than 5 years. For example, after 3 years of cohabitation, the judge may reject the claim.

- Commitment of unworthy acts by the spouse receiving alimony payments: prolonged absence from home, regular infidelity, wild life, causing bodily harm to the spouse, etc.

- If a divorced disabled spouse enters into a new marriage.

- The alimony payer will be released from the obligation to support the disabled spouse if he signs an agreement on lifelong maintenance on account of his real estate. In this case, other citizens bear the responsibility for maintaining the disabled person.

When assigning alimony maintenance in favor of a spouse with a disability, the court does not take into account the date of its occurrence (before or after the registration of the marriage relationship). Also, the cause of disability is not taken into account if it is not indicated in the RF IC.

Only spouses who have officially registered their family relationship are entitled to receive alimony payments. Citizens living together without registering their relationship with the registry office cannot claim alimony from their partner.

When alimony is not collected from the former spouse of a disabled person

Article 92 of the RF IC stipulates cases when a judge may refuse to satisfy a claim for alimony to a disabled former spouse. A potential payer is exempt from maintaining a disabled husband or wife if he:

- deliberately contributed to the onset of disability, for example, by drinking heavily or taking drugs and generally leading an unhealthy lifestyle;

- committed criminal or violent acts against the defendant;

- was in a marital union for less than 5 years.

Important! Alimony cannot be awarded to a former spouse if he became unable to work before marriage or a year after the divorce, and also if the plaintiff is able to provide for himself.

Registration of alimony on a voluntary basis

If the couple who decided to file for divorce still have friendly relations, they can agree on alimony and enter into an agreement.

The legal basis for contractual relations is laid down in Chapter. 16 IC RF. According to Art. 99 of the RF IC, the agreement is concluded between the person who undertakes to pay alimony and the recipient himself.

The document is an agreement that states the obligations of one party to provide for the other, indicates the amount of payments, and stipulates the frequency of their receipt. One of the mandatory items is sanctions for failure to fulfill obligations.

As part of the agreement, it is possible not only to establish the order of cash receipts, but also to transfer material assets for alimony.

The document is drawn up in writing and certified by a notary.

How not to pay child support to a disabled person

In addition to the cases described above, when the court refuses to collect alimony (the citizen himself caused himself to be disabled or received it outside the marriage union), payments are not made if the able-bodied spouse has other dependents, for example, small children from a new marriage or elderly parents, or he repays the loan.

Financial assistance to the ex-wife is assigned only when the husband has enough financial resources to pay it. If his income is below the subsistence level, then the application for recovery will be rejected, since the payer will not be able to provide himself with the bare minimum.

What determines the size of payments?

When determining the amount of alimony, the judge, guided by Art. 91 of the RF IC, takes into account:

- the financial condition of each party to the dispute;

- living wage in the place of residence of the ex-wife in accordance with her socio-demographic status.

According to the provisions of Art. 117 of the RF IC, the court assigns alimony in a specific monetary amount. This amount is a share of the minimum subsistence level in force in the place of residence of the disabled spouse. If it is not established in the region, the federal indicator is taken as the starting point. In the future, the assigned amount is indexed, since the cost of living is a floating value and, following its change, the amount of alimony also changes. There is no indication in the legislation about the maximum amount of payments.

How is the need for alimony determined?

In order for the court to decide to award alimony to a disabled spouse after a divorce, he must prove his need for financial assistance from his former partner. First of all, you will need certificates and documents confirming your unsatisfactory state of health, and as a result, the inability to work fully.

In addition, statements of income received and checks for medicines and treatment can be used as arguments; if the judge sees that the money available to a disabled person is not enough to maintain his condition, then most likely the claim will be satisfied.

Methods for collecting alimony

According to clause 1 of Article 89 of the RF IC, there are two possible ways to collect alimony: voluntary (by oral or written agreement) or judicial.

Voluntary order

If a husband and wife have maintained a respectful relationship after a divorce, asking for and receiving financial support when being assigned a disability will not be difficult.

A couple can agree orally or in writing and enter into an alimony agreement (Article 99 of the RF IC).

The advantages of a written document are obvious. An agreement drawn up in writing and certified by a notary is equivalent to a writ of execution and may be the basis for the forced collection of funds through the Bailiff Service if the voluntary fulfillment of obligations ceases.

Another advantage of the written form of the document is the ability to provide for all the conditions for the payment of funds: amount, regularity, method of transferring funds, and even sanctions for failure to fulfill the obligation.

Judicial order

If a husband or wife does not want to financially support each other, and even if there are legal grounds, they cannot reach an agreement and enter into an alimony agreement, they have the right to go to court and ask for forced collection of alimony.

Consideration of the issue of collecting alimony for a disabled and needy ex-spouse occurs only in the manner of claim proceedings - by filing a claim in court. Read more about the legal process for collecting alimony for an ex-husband or wife below.

Who is entitled to alimony after divorce?

After the divorce of a marriage, alimony for the maintenance of an ex-wife can be assigned not only to disabled people; women also fall into the category of those in need:

- in a situation or having children under 3 years old in common with the child support provider;

- caring for a joint child who has been disabled since childhood (and payments are made until the child reaches adulthood);

- who became disabled during marriage or a year after its dissolution;

- after a long marriage and subsequent divorce, retired and no longer able to support themselves.

Registration of alimony agreement

To avoid litigation, spouses can write an agreement on alimony. The main principle of its preparation is voluntariness. Coercion to sign a document is not allowed.

The agreement should include the following information:

- The amount of alimony payments and the procedure for transferring funds (indicated by the share method of collection or withholding in a fixed amount).

- Frequency of payment of alimony (monthly, once a quarter, six months, a one-time payment is also allowed).

- Principles for indexing alimony payments.

- Other subtleties of alimony legal relations (calculation of penalties for late payment, the possibility of postponing the date of transfer of money, etc.).

The alimony agreement must be signed in the presence of a notary. Next, after the notary is convinced of the legal capacity of the parties and the voluntariness of their intentions, the document is registered.

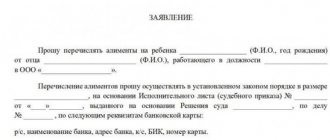

Download a sample alimony agreement

Collection for the previous period

The ex-wife has the right to go to court after an unlimited amount of time, from the moment she becomes eligible to receive alimony. The legislation only limits the period for collecting funds, that is, the alimony payer (if the claim is satisfied) will have to pay the alimony arrears for no more than 3 years.

Such a development of the situation is only possible if the woman did everything possible to receive financial assistance, but the husband shirked his responsibilities. It is worth noting that, as sanctions against the evader, the court may make a decision according to which the spouse will be left without his share of the inheritance, and it will go to his ex-wife.

If your spouse is working or retired

When considering the case, the court must take into account whether the disabled wife has the opportunity to work. This is done on the basis of a medical opinion and is due to the fact that the presence of group II or III implies the likelihood of working ability, albeit limited.

The law does not clearly indicate what degree of disability is required to pay alimony. The very fact that a spouse works does not mean that she is not entitled to alimony.

When deciding such issues, the judge evaluates the specific situation. The following are taken into account:

- size of pension and salary, availability of other types of income;

- their relationship with the immediate needs of the plaintiff;

- the income of the ex-husband for the possibility of providing financial assistance to the former “other half”.

If the court comes to the conclusion that despite receiving a salary, the applicant’s financial situation leaves much to be desired, alimony will have to be paid.

When a person has work experience, has reached retirement age (55 years for women) and is disabled, he is entitled to only one type of pension - either old age or disability. Naturally, he will receive the one that is larger.

The list of categories of citizens who are entitled to two pensions is strictly limited by law. In particular, these are disabled people who became disabled due to war injuries, WWII participants who later became disabled.

These and all other categories of disabled people also have the right to receive alimony. And if they have not reached an amicable agreement with their ex-spouse, they can file an application with the court - it will make a decision in accordance with the law and taking into account the specific circumstances of the case.

Basic Concepts

Alimony relations between spouses, including former ones, are regulated in Chapter 14 of the Family Code of the Russian Federation. Article 89 of this regulatory act lists an exhaustive list of people who have the right to seek from a spouse who has the necessary financial capabilities the payment of alimony benefits.

These individuals include:

- A spouse who, due to physical or psychological factors, is unable to work and at the same time needs financial support.

- A pregnant wife or a woman caring for a child under 3 years of age.

- A needy parent caring for a child who is disabled until he reaches adulthood or disabled in group 1 from birth.

- The needy spouse is a pensioner;

- Disabled parents - from their adult and able-bodied children.

The main criterion for requesting financial assistance in this case is need. This term is not specified or exhaustively defined in any regulations, therefore it is determined independently in each individual case, by comparing a person’s income and expenses necessary for his normal existence.

A special class of needy spouses includes a husband or wife who is classified as a disabled person. Alimony relationships between these persons and their former spouses are distinguished by the fact that there is no interest in them for the children.

Also, a spouse who becomes disabled both during marriage and within 1 year after divorce has the right to demand maintenance for himself.

Example: Marina P. filed a lawsuit against her ex-husband, indicating that as a result of an accident that occurred during the marriage, she was assigned disability group II and could not fully support herself. In this regard, she asked to collect alimony in the amount of 15,000 rubles monthly from her ex-husband.

The court found no grounds for satisfying the claim because:

- The plaintiff is employed in a private company, her income is twice the subsistence level in the region;

- The plaintiff also receives additional income from renting out apartments and non-residential premises;

- Interest from the bank deposit is transferred to her account monthly;

- Her total income is twice the income of her ex-husband, while the husband’s dependent child is from his first marriage;

- The costs of treatment and rehabilitation procedures presented to the court and confirmed do not exceed even 1/6 of the plaintiff’s total income.

Thus, the court did not see the need for help and rejected the ex-wife’s claim against her ex-husband.

Termination

The writ of execution for alimony becomes invalid in the following cases:

- restoration of the claimant's ability to work. In this case, the payer applies to the court to terminate payments;

- change in the financial situation of the parties: the emergence of an additional source of income for a disabled person or a deterioration in the financial situation of the payer.

In the first case, payments stop regardless of whether the ex-spouse continues to need money. In the second, the judge's decision will depend on the circumstances of the particular case.

Responsibility for non-payment of alimony

For late payment or evasion of transfer of alimony to support a citizen with a disability, the law provides for certain liability:

- civil law - the debtor is charged a penalty in the amount of 0.5% of the amount of debt for the day of delay if it arose for an unjustifiable reason (Article 115 of the RF IC);

- administrative - provides several options for punishing an evader from paying alimony for the maintenance of a disabled person: a fine, seizure of bank accounts or property, deprivation of a driver's license, a ban on traveling abroad, as well as involvement in correctional labor lasting up to 150 hours or arrest for 10-15 days (Article 5.35.1 of the Code of Administrative Offenses of the Russian Federation);

- criminal - possible only in case of malicious evasion of alimony payments for a long period: arrest for up to 3 months, imprisonment for a year (Article 157 of the Criminal Code of the Russian Federation).

According to Russian legislation, before criminal punishment is applied to a debtor for alimony to provide for the needs of an incapacitated person, administrative measures are used - a fine of 20,000 rubles is imposed. If the person obligated for alimony continues to evade payments in every possible way, then after 2 months a criminal case is opened against him.

How an agreement is drawn up

It is best to resolve this issue peacefully. To do this, spouses can sign the appropriate document, which will contain all the information regarding alimony payments, without involving third parties in resolving their issue. The bilateral agreement includes the following points:

- It must indicate the amount determined as alimony payment.

- The possibility of indexing payments is prescribed.

- Frequency of depositing funds and deadlines. Most often, alimony is paid every month. There are also quarterly payments. Under special circumstances, biannual payments may be possible.

- Payment Methods. Nowadays, bank transfer is most often used for this. But funds can also be transferred in person or by mail. For a disabled person, the option of receiving it from hand to hand may be advantageous, due to the limitation of his physical activity.

- Other nuances that the parties consider necessary to include in the agreement.

To confirm the legality of a document, it must be notarized. This will allow the alimony agreement to operate on a par with the writ of execution. This step will insure the recipient in case the payer refuses to voluntarily deposit funds. Then you can begin enforcement proceedings by contacting the bailiff service.