Home / Family law / Inheritance

Back

Published: 03/06/2020

Reading time: 3 min

0

528

In my legal practice, the majority of legal disputes have involved challenges to wills. Any clue could cause a dispute. And even where there was nothing to cling to, relatives often claimed that the will was drawn up under duress.

- Is it possible to invalidate a will made under duress?

- Who can demand that a will be declared invalid?

- Recognition procedure Where to apply

- How to write an application

- Evidence of Coercion

What does a will provide?

Compared to transferring an inheritance by law, receiving it in accordance with a will has a number of advantages:

- The testator himself decides to whom to transfer the inheritance. He can completely change the circle of heirs and their shares, or maybe partially. There is only one restriction - you cannot deprive the recipients of the compulsory share of their inheritance.

- The inheritance can be divided so that each heir receives a specific piece of property. In the case of inheritance by law, everything will be divided into proportional shares. As a result, the heirs themselves will have to divide the received property, which often leads to litigation.

- The testator can exclude heirs by law if he considers them unworthy to receive his property. He may also oblige the recipient of the inheritance to fulfill certain conditions in relation to the excluded person.

- During his life, the testator can rewrite the will as many times as he likes (this right is defined in Article of the Civil Code No. 1130).

- When entering into an inheritance under a will, the heir does not need documents that prove his relationship with the testator (when entering into inheritance, they are required by law).

- The testator can indicate in the document the conditions that the heirs must comply with if they receive the property. Within 3 years, the beneficiary has the right to testamentary refusal. If he does not use it, then after this period the heir is free not to fulfill the specified conditions.

In general, a will allows you to think through in detail the division and transfer of property by inheritance. Thanks to this, the will of the testator will be fully taken into account.

Contents of the will and sample

As the samples of wills for all property show, such documents, regardless of the form they are drawn up, must contain mandatory details and elements.

Use the Sample Will for All Property to draw up such an administrative act yourself.

Among them:

- place, date of compilation;

- Full name, address of the testator, where he is registered and lives;

- Full name, address of the heirs who are appointed (except for those cases when the heir has not yet been born);

- information about witnesses and the attacker;

- special orders of the property owner.

When considering the contents and how a will for property is drawn up, it should be taken into account that the composition and individual parameters of the property that is bequeathed do not have to be indicated.

Determination of inheritance shares in a will

The size and content of shares of the inheritance, when there are several heirs at once, are also not considered mandatory information when drawing up a document. The will of the testator may manifest itself in other ways. In particular, in an effort to disinherit a specific successor, assign responsibilities for receiving the inheritance, or indicate the recipients of the inheritance.

As the example of a will for property shows, if the size of the shares of the estate is not indicated, then it is distributed among certain legal successors in equal amounts.

Is it possible to specify conditions in a will?

Yes, according to Russian law, the testator has the right to set the conditions. They can be in the form:

- Testamentary refusal. It involves the fulfillment of property-related obligations.

- A testamentary assignment may concern not only property, but also non-property obligations aimed at generally beneficial purposes.

For example, indicating in the will the right of the testator's mother to live in the apartment bequeathed to the heir will be considered a testamentary refusal, and the condition to take in the testator's pets will be considered a testamentary assignment.

It is important that the terms of the will do not violate the law.

It is also worth considering that they may be associated with objective events (transferring an inheritance to a son if he turns 18, or to his mother if the testator dies earlier). But the conditions may be suspensive. For example, if the inheritance should go to the son after he receives higher education. If the testator dies earlier, his executor must be appointed who will preserve the property until the condition is fulfilled.

What property can be bequeathed?

The future testator has the right to bequeath all his own property, including what will be acquired in the future, or only a certain share of it. He has the right to divide the inheritance in any shares and in any order between legal successors, taking into account only personal considerations.

The following may be included in a sample will for all property in the form of an inheritance estate:

- real estate as well as movable property;

- plot of land;

- securities;

- bank deposits;

- things of specific monetary value;

- sums of money that were not paid to the testator while he was alive;

- company or agricultural firm, rights of participation in them.

Please note: as any sample will for movable and immovable property shows, in order to draw up an administrative document, for example, for an apartment, you need to accurately indicate its address. That is, it is necessary to determine and identify the inherited thing.

Any property can be included in the estate of the inheritance, including that which at the time of drawing up the testamentary document was not included in the personal assets of the testator. To dispose of it in advance, the testator can determine the transfer of all property, wherever it is and whatever its contents.

What conditions can be included in a will?

Responsibilities assigned to heirs may be as follows:

- Transfer of property or rights to the legatee.

- Perform work for the beneficiary.

- Pay him certain amounts of money within a specified time.

- Provide him with housing for a certain period of time or for life.

- Keep animals.

- Get an education or get married.

A separate condition for receiving an inheritance may be reaching the age of majority.

Entry into inheritance according to the new rules

The innovations in the law on wills are reduced to a simplified registration procedure, which came into force in September 2020. A new concept “Inherited Fund” (NF) has appeared.

The changes affected parts 1-3 of the Civil Code of the Russian Federation. Creating a fund eliminates the six-month waiting period.

Unfortunately, today not all legal sources of information adequately explain its purpose and main functions. The result is confusion and substitution of legally significant concepts.

According to the new law on wills, any citizen can create his own NF, with the help of which the deceased’s business, his property, and various types of savings will be managed.

- It is created by the testator at the time of drawing up the expression of will, in which he describes in detail who will be at the head of the organization and manage its activities after death.

- The creator himself approves the Charter.

- Managers are appointed, the role of each person in the organization is outlined, with a detailed description of how to dispose of the property.

- Methods of replenishment and volumes of assets are indicated.

- The validity period of the Fund is established. The execution of the will of the deceased is controlled by the administrators.

Important! All instructions are mandatory. Correction is possible only through the courts, and in very rare cases.

Expert opinion

Romanov Igor Severinovich

Lawyer with 7 years of experience. Specialization: civil law. Extensive experience in developing legal documentation.

The Foundation, having the status of an organization, also becomes a co-heir with management rights. The rights to the received material assets are claimed:

- creditors of the deceased;

- relatives specified in the will and members of the obligatory share.

This approach preserves assets and the ability to continue the family business if close relatives are unable or refuse.

Will with the condition of lifelong residence

One of the most common conditions is the provision of living quarters. The requirements for indicating such a condition are described in Article 1137 of the Civil Code of the Russian Federation:

- This right must be exercised within 3 years.

- The recipient of the right of residence may require its state registration.

- Responsibilities for maintaining housing are equally divided between the tenant and the owner.

- If the order specifies a period of use of the housing, then after its expiration the tenant must move.

If the legatee is not a member of the heir's family, then:

- The heir can provide him with housing, and live in another place.

- The beneficiary can write a refusal to use this housing.

Such a refusal must be certified by a notary so that the heir does not lose the right to the bequeathed property due to failure to fulfill the terms of the will.

Form

The refusal must include the following information:

- Place and date of registration.

- Testator's details.

- Document's name.

- The essence of the conditions.

- List of property transferred to beneficiaries.

- List of applicants and their data.

- Size of shares of beneficiaries.

- A condition that the heirs must fulfill.

- Form number.

- Fee payment information.

- Signature of the testator with a transcript of his last name.

You can draw up an order using the sample provided by the notary or at your own discretion. But in this case, the notary must check the document for its compliance with the law.

The testator must sign the will in the presence of a notary. One copy remains with the testator, the second - with the notary.

Content

A key part of a will includes basic details about the property and its beneficiaries. Namely:

- Personal information of the testator.

- List of heirs.

- List of property objects.

- A specific definition of the conditions imposed on applicants.

Without complying with these requirements, the will will be considered invalid.

Sample

I, Full Name, bequeath the apartment to my daughter (Full Name). If she sells it, she must pay half the price to my son (full name).

My daughter should give my car to her cousin (full name).

I bequeath my bank account to my grandson (full name). He must receive it after reaching adulthood.

At the end of the will it is indicated that the notary explained the content of Article of the Civil Code of the Russian Federation No. 1149, and also that one copy was handed over to the notary. Next is the date and signature.

Non-acceptance of inheritance and receipt

Heirs may not pay inheritance debts if they do not accept the inheritance. And since the heirs either accept the entire inheritance or refuse it, it is impossible to accept only debts (or only property). In addition, there is no way to force the heir to accept the inheritance, no matter how interested the lender is in this.

Vera U., whose son had died, turned to a lawyer for help. The son had no property except a motorcycle. However, there were many debts. The neighbor, who also lent money to the deceased against a receipt, demanded that Vera accept the inheritance and give the motorcycle to pay off the debt, otherwise he threatened to force the woman to accept the inheritance through the court. The lawyer explained that no one has the right to force the heir to accept the inheritance. And if the inheritance is not accepted, then the potential heir is not obliged to pay debts. As for the motorcycle as a debt, the lender can file a claim against the state to collect the motorcycle as a debt.

But the heirs must understand that in addition to the notarial acceptance of the inheritance, there is also the actual acceptance of the inheritance. And lenders, in principle, have the right to award the debt if they prove through the court that they accepted the inheritance. But it turns out to be possible to prove this if the heirs:

- officially renounced the inheritance;

- do not use the property of the deceased.

For example, it will not be possible to justify the actual acceptance of an inheritance if the relatives of the deceased continued to use household items, but the ownership of the housing itself did not belong to the testator. It is impossible to prove that the remaining items were the property of the deceased.

It will also be impossible to collect the debt after the statute of limitations has expired, even if the inheritance is accepted.

Procedure for executing a will

The heirs are responsible for fulfilling the testamentary disposition. If the terms of the will are not fulfilled, the legatee has the right to file a lawsuit to force the heirs to fulfill them.

The testator can prevent such problems by appointing an executor during his lifetime (according to Article 1134 of the Civil Code of the Russian Federation). His functions will include the implementation of the testamentary disposition. He will have a certificate that confirms his credentials.

The responsibilities of the will executor include:

- Preserve the testator's property.

- Receive the testator's money to pass it on to the heirs.

- Carry out the will of the testator, ensuring the transfer of his property rights to the heirs.

- Conducting cases related to the fulfillment of the terms of a will in court and various government agencies.

In this case, the executor can require the beneficiaries to fulfill the terms of the will. If they don't, he can sue.

Timing and cost

When drawing up a will, only the notary fee is paid, for which the tariffs of the selected notary office are taken into account. There is no need to pay any taxes or incur additional expenses. Usually a fee of 500 rubles is charged. up to 2 thousand rubles .

If a document is drawn up in an emergency with the participation of a doctor from a medical organization or other officials, since there is no possibility of involving a notary, then you do not have to pay any fee .

A will is drawn up literally within a few minutes, so you just need to decide in advance how all the assets will be distributed among the heirs. The testator can make changes if necessary or completely cancel the act of expression of will. It is allowed to correct both the entire document and some of its points. Amendments are allowed to be made any number of times without compelling reasons, and for this you do not need to obtain permission from a notary.

Reference! If a citizen decides to cancel a will, then it is enough to contact a notary with the appropriate request, after which the documentation is officially destroyed.

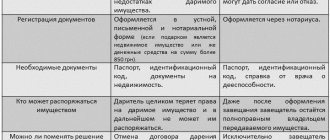

Similarities and differences between refusal and assignment

It is necessary to understand that the term “testamentary refusal” does not mean disinheritance. This meaning conceals a condition requiring the successor, by law or will, to bear property obligations to third parties. An assignment is a separate condition when the beneficiary receives, along with the inheritance, some obligation that he must fulfill. The executor can be either an heir or an outsider (an executor appointed by the testator).

But both the first and second options are types of conditions into which most orders of testators are divided. A common feature is disinheritance if the successor refuses to carry out the will of the deceased. Sub-assignment is allowed when property is transferred to a specific person mentioned in the text of the will in the event of refusal to accept the inheritance or death of the main applicant. The duties of the designated citizen are also determined by the will of the testator.

Instructions: how to write a document naming an heir?

Before drawing up a will naming an heir, it is worth deciding on all the property to be left as an inheritance and all the persons to whom it is planned to be transferred.

Additional information about wills can be found in other articles:

- Types of wills.

- Nuances of drawing up an inheritance agreement.

- What is a testamentary disposition?

- What is an emergency will and how is it executed?

- In what cases is a closed will written?

- How to make a will for a bank deposit and who can become an heir?

Where to go and with what papers?

It is best to contact a notary office to register a will. The following documents may be required for this:

- testator's passport. Based on this document, the notary establishes the identity when certifying the will.

- Documents identifying the citizens to whom the inherited property will be transferred will also be required.

- Important papers are certificates confirming ownership of all inherited property.

What should be in the content?

The document on the transfer of inherited property must be in writing. It must indicate the place and date of compilation.

You can draw up a will yourself, or you can use the services of a specialist. In the latter case, the document will not contain legal errors and it is almost impossible to challenge it in court. A will is a one-sided legal document. It can only be issued by one person.

Drawing up the text of the will itself. It must be clear and unambiguously defined. In addition to the date and place of its preparation, the document must include:

- Full name and basic information about the testator. Moreover, no reductions are allowed.

- Information about the notary: full name and location of his office.

- Information about heirs.

- An important section is the description of the subject of inheritance, which can be indicated with the delimitation of certain shares between the heirs.

- When writing a will with conditions, they must be clearly defined. At the same time, the notary can give recommendations to the client about slippery points that can subsequently be challenged in court.

The will must be signed in front of a notary in the testator's own handwriting. The notary studies the text presented to him in detail and certifies it with his signature and personal seal.

The drawn up and certified document must be entered into a special register.

The photo shows an example of a document:

State duty and other financial expenses

When contacting a notary office, the client pays the cost of drawing up a will.

The prices for this operation are set by each notary independently.

The average price varies from 1000 rubles per sheet of text.

For certification of a document, the notary charges a state fee, which is established by the Tax Code of the Russian Federation in the amount of 100 rubles.

Legal and illegal conditions

The possibility of including conditions in the text of a will is provided for in the Civil Code of the Russian Federation. It is only necessary that the conditions set out in the document do not contradict other laws. Otherwise, it can be challenged in court.

Most often, the document on the transfer of inheritance includes the following requirements:

- payment of maintenance to third parties;

- a ban on marriage or, conversely, marriage with a certain person;

- receiving an inheritance only upon reaching a certain age;

- graduation from an educational institution;

- living in inherited real estate by a third party.

Unlawful conditions include the following restrictions:

- mandatory residence, which is contrary to constitutional rights and freedom of movement.

- Participation in religious organizations or a ban on the adoption of a particular religion.

- Imposing the choice of a specific professional activity.

- A ban on the sale of certain things, as this is considered a violation of the citizen’s legal capacity.

For example, if the will states that inheritance will occur upon receipt of higher education, this will be a completely legitimate condition. But when specifying a specific educational institution, the condition becomes illegal , since it contradicts the freedom to choose a profession.

Inheritance by law

Such inheritance is regulated by Ch. 63 and other norms of Section V of the Civil Code of the Russian Federation, and it is possible in the absence of a will. The right to inherit property by law belongs to the relatives of the testator listed in Art. 1142 – 1145 and 1148 of the Civil Code of the Russian Federation in the following order:

- Children, spouse and parents. This includes adopted children. They usually lose their ancestral connection with their biological parents unless their family relationship with such parents is preserved by a court decision.

- Full and half-siblings, grandparents.

- Uncles, aunts.

- Great-grandfathers, great-grandmothers.

- Children of nephews, nieces (cousins and granddaughters), brothers, sisters of grandfathers and grandmothers.

- Children of cousins' grandchildren and granddaughters (great-great-great-grandsons, great-granddaughters), children of cousins (great-nephews, nieces) and children of great-uncles and grandmothers (great uncles, aunts).

- Stepsons, stepdaughters, stepfather, stepmother.

Each subsequent line inherits in equal shares in the absence of the previous one or when the heirs are unworthy of it (Article 1117 of the Civil Code of the Russian Federation), are deprived of the inheritance (clause 1 of Article 1119 of the Civil Code of the Russian Federation), did not accept it, or refused it. Inheritance by law is subject to the provision on compulsory heirs.