Reasons

Often withholding occurs due to the lack of correctness of the information provided, which affects the payment of the pension and its size.

If there was an overpayment of security, then the funds must be returned in full. The criteria for deduction from security may be:

- a court decision on the recovery of funds paid to provide for pensioners. It may be due to human abuse;

- the decision of the Russian Pension Fund, which provides for and collects a fixed payment, which was transferred in a larger volume than expected;

- executive documentation.

Overpayment most often refers to an overpaid amount of money due to the fault of the recipient or the Russian Pension Fund. Naturally, the amount paid falls on the expenditure operations of the Pension Fund.

Sometimes there may be an overpayment in a larger amount on a monthly or other basis when debt arises from:

- pensioners-students who receive a survivor's pension. Here the natural condition for payments to citizens studying full-time is fulfilled. As soon as deduction or conscription occurs, a person loses the right to receive cash benefits. Accordingly, he must report this;

- all people who provide proper care for a disabled child, incapacitated persons and disabled people of the first group. In this case, only unemployed but able-bodied citizens receive benefits. If a citizen is employed or retired, then a recovery occurs from the caregiver;

- a contingent of people who receive a minimum income below the subsistence level. In this case, a regional social supplement or a federal one may be assigned. Naturally, appointments are made only to unemployed people. After returning to work, this payment is withdrawn, and the rest is collected from the pensioner.

Expired SZV-M? Return the money to the Pension Fund

At the moment, there may be several situations in which the Russian Pension Fund may withhold funds from the security. The main reason here is the reluctance of the citizen to independently return the money.

Reasons

All people must return funds received through illegal means. There are several options here - forced recovery or voluntary recovery. If this is the latter, then the person writes a statement of the established form and returns the funds in cash or by bank transfer.

The latter is done by deducting funds from the pension. If a person refuses to return the money, then the Russian Pension Fund can go to court to recover the funds. Naturally, collection occurs only after a court decision on this issue is made.

In addition to the pension overpayment, the person also undertakes to pay all legal costs of the Russian Pension Fund. If the court deems it necessary, it will bring the citizen to administrative responsibility for fraud.

According to Article 196 of the Civil Code, retention occurs within certain periods:

- the statute of limitations is currently 3 years from the date prescribed by the article of the same legal act;

- The statute of limitations cannot exceed 10 years from the date of violation of the law. The exception here is various situations prescribed in Federal Law No. 35 of March 6, 2006.

Not returned:

- all property transferred in fulfillment of various obligations upon expiration of the statute of limitations;

- all property that is transferred to fulfill obligations before the onset of a specific period of time, unless otherwise provided by current legislation;

- all money and property that is provided in fulfillment of an obligation of a non-existent type, if proven. Used for voluntary affairs;

- wages and other payments received by a citizen as a means of subsistence, if there are no dishonest acts.

Employers who do not report working pensioners to the Pension Fund on time must compensate the Pension Fund for losses. This was decided by two arbitration courts of cassation - the Far Eastern and Northwestern districts (resolutions F03-3587/2018 and A42-9862/2017), supporting the conclusions of previous courts.

The fact is that pensions of non-working pensioners are regularly indexed, but indexation does not apply to working pensioners (Article 26.1 of the Federal Law “On Insurance Pensions”). The companies whose cases were considered by the courts employed pensioners. The company's accountants submitted their SZV-M reports for some months to the Pension Fund late.

The pension fund decided through the court to seek from employers the return of overpaid amounts and won the case. True, the other side can still appeal to the Supreme Court. It’s good that no one demands a refund from pensioners.

A press release has been published on the website of the Commissioner for the Protection of the Rights of Entrepreneurs in Moscow, describing the work of the Ombudsman with appeals since 2014. Among the results of the work is the return to entrepreneurs by tax authorities of about 8.5 million rubles of insurance premiums, excessively collected for periods before January 1, 2021 of the year.

Results such as the return of illegally seized property, the lifting of restrictions on bank accounts, and the prosecution of officials and law enforcement officers are also reported. In addition, at the initiative of the Commissioner, tax rates on office and retail real estate were reduced, the list of types of activities that allow the use of the patent system was expanded, and various tax benefits were provided.

The Pension Fund called on Russians to voluntarily return overpaid pensions

You can write a refusal in free form in the form of an application to the territorial body of the Pension Fund, by mail or through your personal account on the fund’s website, the Pension Fund emphasizes. If the pensioner did not notify the fund on time, the citizen can contact the client service or the Pension Fund of the Russian Federation and write an application for voluntary reimbursement of funds. —>

We recommend reading: One-time payments to young medical professionals

In this case, he has the right to determine the period for which he will reimburse the overpayment to the fund and the amount of the monthly payment. If the pensioner does not want to return the money voluntarily, the matter will be resolved in court, the Pension Fund emphasizes.

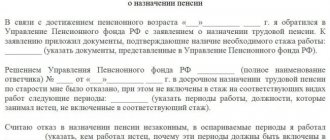

Case of recovery of overpayment of pension

interests are not protected

Lawyer Denis Kozyrev, Yaroslavl

Is the Civil Code of the Russian Federation applicable to pension legal relations...

When a citizen makes demands on the Pension Fund, the courts boldly declare that the rules of civil liability are not applied to pension legal relations.

But as soon as the Pension Fund demands something from a citizen, the courts immediately refer to the norms of the Civil Code of the Russian Federation, as usual, unlawfully and without understanding the validity of the application.

An acquaintance contacted me with fear that she was facing prison for overpaying her pension (she did not report to the PensFund that she worked and received a survivor’s pension).

The pension fund called her out and said threateningly: either return the money or go to prison.

I decided to “wash” these insolent people.

I informed the PensFond via pigeon mail to set him aside or drag him to the prosecutor's office.

The Pension Fund was offended and wrote a “report” to the police to deal with a friend :))

The brave police officer established the presence of signs of a crime, but refused to initiate a criminal case due to the amnesty act.

As a result of an additional check, the same employee no longer discovered any signs of a crime... a split personality straight out :)))

Well, we decided to “have fun” - we demanded that the head of the local branch of the PensFond be prosecuted for false denunciation. Of course they refused, but it was still nice :))

The PensFond did not let up and filed a lawsuit.

The magistrate was convinced that there is a “certain” claim procedure in pension legislation :))) The judge left the Pension Fund’s claim without consideration.

Six months later, the PensFond filed a lawsuit again.

In the decision, of course, I wrote nonsense, since I didn’t even understand on the basis of what provision of law the overpayment was subject to recovery.

The city court rejected my objections about the non-application of the Civil Code of the Russian Federation, about an unauthorized person, about unproven damage - with only one paragraph that “pension legislation does not exclude the possibility of courts considering claims for compensation for damage caused to the state” and referred to Art. 1102 of the Civil Code of the Russian Federation.

They wrote a supervisory complaint, in which they indicated that the pension legislation contains a reference rule for the recovery of damages - therefore, the PensFund had to prove the damage, and the court would refer to the appropriate procedure.

The supervisory regional judge has already written that there was unjust enrichment on the part of the acquaintance, therefore it is necessary to apply Art. 1102 of the Civil Code of the Russian Federation.

Meanwhile, “the casket opens simply.”

Overpayment of pension due to the fault of the pension fund - this issue interests many. After all, a situation often occurs when citizens consciously commit this offense by providing false documents. And even if the mistake was on the part of a government agency, is it necessary to return the money?

Of course it is necessary. Otherwise, the Russian Pension Fund will begin legal proceedings, which will then affect the person’s additional financial expenses.

The Pension Fund makes a decision on the payment of security based on all documents provided. Accordingly, if they were false, then the fact of overpayment is recorded. And this decision can only relate to the executive documentation.

If the Russian Pension Fund determines that it was illegal to receive payments, for example, by providing false papers, then the case is sent to the prosecutor's office to open an appropriate case.

Look,

pension payment schedule in June 2021

.

Who is subject to social pension indexation? Find it at the link.

Legal acts provide for the possibility of receiving monetary compensation only for non-working persons. These include subsidies for the care of incapacitated persons and disabled people. At the same time, the caregiver is also not employed anywhere, as he provides care.

When assigning this type of payment, the applicant signs a corresponding application and fulfills care obligations. If he finds a job, he informs the Pension Fund about this no later than the next working day after this circumstance.

All people believe that no one will see the fact of temporary employment... in fact, the employer transfers contributions to the Russian Pension Fund and reports on all employees without any exception. That is why the Pension Fund of Russia can announce exacting measures against a person.

A situation is allowed if a person is unofficially employed and does not make any payments to the employer. If the carer has not reported employment, then he is sent a notification about the return of the amount within a certain time frame.

For the loss of a breadwinner

All disabled citizens whose breadwinner has died have the right to such a payment. Without fail, they had to be fully supported by him. Also, all close relatives caring for children of the deceased under 14 years of age can count on this payment.

Pension benefits are assigned for the entire time the dependent is considered incapacitated. When any of the represented specialists is hired, the right to receive a pension is lost. Accordingly, they must all report this fact in advance.

The fact of registration with the Employment Center does not play any role in these payments. Overpayments occur only when leaving an educational institution or employment. If the student is on academic leave, the status is maintained and the pension is paid. The exception is conscription into the army.

Pensioners have the right to receive a fixed payment if they have a dependent minor child. This right remains until the child reaches 23 years of age in full-time education.

If a child has joined the army or suspended his educational activities, then this fact must be reported to the Russian Pension Fund in advance.

Overpayment on death

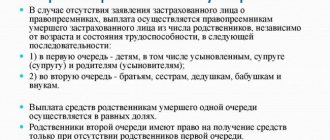

Sometimes there are situations when a person has already died and has lost the right to purchase pension benefits. But the Russian Pension Fund has not yet received information about this fact, but the funds are transferred to the personal account of the deceased and they are withdrawn on a monthly basis.

Read,

who receives an old-age social pension without work experience

.

What is the amount of maternity capital for 2 children in 2019? The answer is here.

Application form for resignation due to retirement. Found in the article.

Excessively paid funds should be returned to the Russian Pension Fund. Otherwise, he has the right to collect this amount and then withhold it from any contingent of persons in the prescribed manner.

Attention!

- Due to frequent changes in legislation, information sometimes becomes outdated faster than we can update it on the website.

- All cases are very individual and depend on many factors. Basic information does not guarantee a solution to your specific problems.

That's why FREE expert consultants work for you around the clock!

- via the form (below), or via online chat

- Call the hotline:

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

The pension fund demands the return of overpaid pensions

After graduating from school in 2021, my daughter enters St. Petersburg State University as a full-time paid student. I submitted a certificate to the Pension Fund stating that she actually entered, but from 01/01/2021. my daughter decided to drop out so as not to pay for the second semester, since it is too expensive, and in the future to prepare for admission to another university on a budget, from 08/08/2021. She entered another university on a budget. I remember exactly that at the end of August 2021. I brought a PF certificate from the academy, but they sent me a letter on March 23, 2021, where they calculated the debt in the amount of 94 thousand, they said that I received an illegal additional payment for my daughter. When I came to find out, no one wanted to explain anything to me, where my certificate could have gone, they said that they had nothing in their computer. When I asked for a recalculation, they said they don’t do anything retroactively, what should I do? Okay, I understand that from 01/01/2914. until August 2021, I had to notify the Pension Fund about the changes, this is my huge mistake and I agree to compensate for the damage, and from 09/01/2021. my daughter started studying at a university and is still in her fourth year, preparing to defend her diploma. Help me figure it out please!

You indicated that in August 2021 you provided a certificate from the Academy, where your daughter entered in 2021. Tell me, did you provide the certificate only once or every year do you provide the Pension Fund with up-to-date information that your daughter is a full-time student and is entitled to a pension? And could you also clarify, after expulsion from the university in January 2021, did you inform the Pension Fund of the Russian Federation about this?

We recommend reading: Vacation compensation for how many years can you receive?

Conditions for withholding an overpaid pension due to the fault of the Pension Fund

A number of pension payments are available to citizens only if certain conditions are met. Violation of these conditions may result in cancellation or reduction of the pension amount. In such cases, moments may arise when the pension is accrued illegally for some time, and it must be returned back to the Pension Fund budget. Let's look at similar cases.

An overpayment of a pension is nothing more than excessively accrued payments within the competence of the Pension Fund, be it pension provision or any other amounts.

It often happens that an overpayment of a pension occurs through no fault of the recipient. For example, there is a calculation error by the Pension Fund.

According to the Civil Code, errors in payments such as wages, alimony and pensions can be regarded as unjust enrichment if there is intent on the part of the recipient or an accounting error by the payer.

As a rule, proving the presence of a counting error is not a difficult task for the Pension Fund, so it will not be easy to avoid returning funds.

Most often, such overpayments arise from the following persons:

- Recipients of pensions due to the loss of a breadwinner. An important condition in such cases is the pensioner’s full-time education at an educational institution. When transferring to other forms of education, as well as when expelling, these citizens often remain silent about these changes, continuing to receive a pension that is no longer rightfully due to them.

- Pensioners caring for disabled citizens (disabled people, elderly people). Such material support is provided to citizens who do not work but are able to work. If pension recipients are employed, they are no longer entitled to receive benefits. Silencing this fact leads to overpayments.

- Those receiving benefits below the subsistence level. For such citizens, a social supplement is provided, provided that they do not work. Otherwise, overpaid funds must be returned.

It is worth noting that all of the listed citizens sign an agreement according to which they must notify the Pension Fund about changes affecting payments within a specified time frame.

There are several options for refunding overpaid amounts:

- Voluntary. In this case, the citizen independently writes a corresponding application and returns the money:

- by bank transfer (withholding from pension benefits);

- in cash.

- Forced. It is used if the pensioner does not want to voluntarily return the overpayment. It is worth noting that forced collection can be carried out after a corresponding court decision has been made. Also, in addition to deductions to the Pension Fund budget, the evader may face penalties.

In some cases, deductions from the pension can be made without the knowledge of the recipient, but only if they do not exceed 20 percent of the security amount.

The terms within which deductions of overpaid amounts can be made are stipulated in the Civil Code of the Russian Federation:

- the general limitation period is 3 years from the moment the limitation period begins to run;

- The limitation period cannot be more than 10 years from the date of violation.

It is also worth noting the cases in which a refund of overpaid amounts is not possible:

- If the property was transferred in fulfillment of obligations, and the statute of limitations has passed.

- If the property was transferred to fulfill obligations and it is proven that:

- property was transferred for charitable purposes;

- the person transferring it was aware that there were no obligations.

- If there is no malicious intent on the part of the payee and there are no accounting errors.

- If the property was transferred to fulfill obligations before the deadline for fulfillment occurred.

Recovery of overpaid amounts is carried out in the following cases:

- provision of false information by a pensioner;

- untimely application to the Pension Fund;

- concealment of changes that may affect pension payments.

After the Pension Fund makes a decision to withhold funds, collection is made from the beginning of the month following the month the decision was made. As already noted, deductions cannot be more than 20% of the pension amount, but in some cases they can deduct up to 50%.

The decision can be appealed by the pensioner in court or at the Pension Fund level:

- If, after an inspection, abuses are discovered on the part of the recipient of payments (intentional provision of incorrect information), the case is transferred to the prosecutor's office.

- After an investigation, the culprit may be prosecuted and ordered to compensate for the damage caused.

It is possible to avoid withholding only in rare cases, provided that the recipient of the payments does not own property and does not have any income. For other citizens, there are several options for reducing withholding:

- Suspension of enforcement proceedings in the case. This option is possible in the following cases:

- loss of legal capacity by the debtor;

- the debtor has served under conscription or under a contract, been on a long business trip or undergoing treatment;

- search for the debtor or his property;

- challenging enforcement documents in the case.

- Termination of enforcement proceedings in the case. In order for such termination to be possible, the following conditions must be satisfied:

- conclusion of a settlement agreement between the parties;

- death or disappearance of the debtor (provided that his obligations are not inherited);

- the statute of limitations has expired;

- cancellation of judicial acts.

- Voluntary payment of debt. In this case, the debtor can avoid reimbursement of legal costs (court fees, lawyer fees, etc.).

Arbitrage practice

As a rule, legal proceedings regarding the withholding of overpayments on pensions end positively for the Pension Fund, and pensioners are required to reimburse the funds. This happens due to the fact that in most cases such situations arise due to pensioners providing incorrect information.

If the pensioner who received the excess funds did not have malicious intent and was in no way involved in the overpayment, he can count on either loyal terms for repayment of the debt, or a complete cancellation of repayment requirements, depending on the characteristics of a particular case.