Minimum pension in the Perm region

Non-working pensioners whose total amount of material support is less than the regional subsistence level of a pensioner are entitled to a federal social supplement (from the federal budget):

- all types of pensions;

- immediate pension payment;

- additional material (social) support;

- monthly cash payment (including the cost of a set of social services);

- other measures of social support (assistance) established by regional legislation in monetary terms (with the exception of measures of social support provided at a time);

- cash equivalents of the social support measures provided to pay for the use of telephones, residential premises and utilities, travel on all types of passenger transport, as well as monetary compensation for the costs of paying for these services.

Social supplement to pension

According to Article 1 of Federal Law N 178-FZ “On State Social Assistance” (06/11/2021)

, a social supplement to a pension is a sum of money provided to a citizen (pensioner) towards an insurance pension and (or) towards pension provision, taking into account cash payments and individual measures of social support provided in kind up to the pensioner’s subsistence level established in the constituent entities of the Russian Federation according to his place of residence or place of stay (in this case, in the Perm region).

The surcharge is set in such an amount that the total amount of material support for the pensioner, taking into account this surcharge, reaches the cost of living for a pensioner established in the Perm Territory (9 613 ₽

).

What does the total amount of material support consist of?

When calculating the total amount of financial support for a pensioner, the amounts of the following monetary payments established in accordance with the legislation of the Russian Federation and the legislation of the constituent entities of the Russian Federation are taken into account:

- pensions, including the amount of the due old-age insurance pension, taking into account the fixed payment to the insurance pension, increases in the fixed payment to the insurance pension established in accordance with Federal Law N 400-FZ “On Insurance Pensions” (04/30/2021), and funded pension established in accordance with Federal Law N 424-FZ “On funded pensions” (12/08/2020), in the event of a pensioner’s refusal to receive these pensions;

- urgent pension payment;

- additional material (social) support;

- monthly cash payment (including the cost of a set of social services);

- other measures of social support (assistance) established by the legislation of the constituent entities of the Russian Federation in monetary terms (with the exception of measures of social support provided at a time).

The calculation does not take into account social support measures provided in kind, with the exception of cash equivalents of social support measures for paying for telephone use, for paying for residential premises and utilities, for paying for travel on all types of passenger transport (urban, suburban and intercity), and as well as monetary compensation for the costs of paying for these services.

The minimum old-age pension in 2021 has been announced: it will be increased by only 120 rubles

What will be the minimum old-age pension in 2021? What amount can a non-working pensioner receive less than? The minimum value is already known, it was announced by officials. However, the increase was only 120 rubles. Let's tell you where this figure came from.

It turns out that non-working old-age pensioners in Russia from January 1, 2021 should not receive less than 8,846 rubles. If the size of the insurance pension after indexation from January 1 is smaller, then the pensioner will be able to receive a federal supplement of up to 8,846 rubles. See “Where to apply for additional payment: to social security or the Pension Fund?” If the cost of living in the region is higher, then a regional surcharge is issued.

Minimum pension in Russia in 2021 - table by region

From January 1, 2021, in Russia as a whole and in its individual regions, new values of the living wage for a pensioner will begin to apply.

This indicator, albeit indirectly, determines the amount of the minimum old-age insurance pension for residents of specific regions, republics and territories of our country.

Let's find out what the minimum old-age pension will be in Russia from January 1, 2021 - a table of specific amounts for all regions of the country.

What kind of living wage are we talking about?

The expression “living wage” in relation to pensioners can have two meanings in Russia. And older Russians sometimes confuse them, so it’s worth recalling some nuances.

There is a statistical living wage. It is calculated every quarter of the calendar year. Rosstat monitors the cost of goods included in the consumer basket.

Then, using a certain methodology, the cost of living is determined in a specific region and in the country as a whole.

Moreover, four different figures are obtained: the cost of living for people of working age, pensioners, children, as well as the average value “per capita”.

At the same time, for pensioners, another value is determined - the pensioner’s subsistence level (PMP) for calculating the amount of social supplement.

The amount of PMP is no longer determined by Rosstat, but by the authorities of each Russian region and the government of the country (it sets a certain average figure for Russia). PMP is installed once a year - in the fall or even at the beginning of winter.

This value is calculated in advance and is valid from January 1 of the next calendar year.

Until recently, PMP may not have been correlated with the statistical subsistence level at all. There was simply no single method for calculating such a value. Now this technique has appeared, and the PMP more adequately reflects reality.

The meaning of the PMP is that a pensioner in any Russian region cannot have an income less than this value. If his pension accrued to the Pension Fund is lower than the PMP, and there is no other income, the person is paid a social supplement. It equalizes the pension to the pensioner’s living wage.

At least that's how it worked until 2021. Now the scheme for calculating minimum pensions has become a little more complex, but more profitable for older Russians.

Minimum pension and PMP are no longer synonymous

There are not so few people in Russia who receive a minimum pension. And in most cases, people are not at all to blame for what happened to them in old age. They worked honestly for decades and received good salaries. But the Pension Fund awarded them a pension less than the subsistence level.

In many cases, this happened due to the fact that at one time the archives, which contained the information necessary for calculating pensions, disappeared. Often the destruction of archives was beneficial to certain people. And the interests of hundreds and thousands of honest workers, of course, were of no interest to anyone.

In addition to the fact that people now receive pensions that are much less than the level they deserve, they have been haunted by another injustice for many years.

The point is the methodology by which minimum pensions were indexed at the beginning of each year. The amount that was calculated by the Pension Fund and which was less than the subsistence level was subject to recalculation.

The accrued pension increased, but this did not guarantee that a person would receive more in the new year. If the PMP in the region did not increase or increased slightly (and there are areas in Russia where the PMP did not grow for years or increased by mocking amounts of 2-3 rubles), the pension remained the same.

It’s just that the social supplement decreased as much as the accrued pension increased.

In the spring of 2021, the law was changed, and now it has become fairer. The Pension Fund first determines the new amount of social supplement relative to the old amount of the accrued pension. The amount of the surcharge is fixed. Then the pension is indexed to a common percentage for everyone, and to this the results are added to the previously fixed amount of social security payment.

As a result, a particular person’s pension, although not by much, exceeds the amount of the PMP. The final result is different for different pensioners. So it is no longer possible to say that the minimum pension and PMP are always synonymous.

Only those who have just retired will receive a monthly payment at the subsistence level of pensioners in 2021. Provided that they receive a pension less than this level. And that they will officially leave work - working pensioners are not entitled to social security payments.

Living wage for a pensioner in 2021 - table by region

At the moment, the authorities of all Russian regions have decided on the size of the PMP on their territory.

For this, a new methodology is now used, which is also a little fairer - regional officials can no longer come up with the amount of PMP arbitrarily.

They are required to take the cost of living statistics and multiply them by a certain coefficient, which takes into account the inflation forecast for the new year.

The following table contains the cost of living for a pensioner in the regions of Russia from January 1, 2021, as well as a comparison with 2021 - this way you can find out how much the minimum pension will increase in a particular region.

Why in some regions the PMP will not change, but in others it will grow very much

It's all about the new method of calculating it, which has become the same for everyone. If the PMP has increased very much (in some cases - by more than two thousand rubles at once), this indicates that local authorities have been installing too small a PMP for many years. In fact, pensioners in such regions lived on benefits below the real subsistence level.

And vice versa - where PMP did not increase at all, it was slightly overestimated. After calculation using a unified methodology, it turned out that in such regions of Russia it should be less than what has already been established. It is clear that no one will reduce the amount of pensions for elderly residents of such regions or republics. But there will be no growth in PMP until the real cost of living catches up with the one that has already been formally established.

Original article on our website:

https://newsment.ru/context/minimalnaya-pensiya-v-rossii-v-2020-godu-tablitsa-po-regionam/

Source: https://zen.yandex.ru/media/ id/5bed62e6c792cb00ac0b9ae7/5df74a51c49f2900b1eb6a82

Minimum pension in Perm and the Perm region in 2021

Hello! I received a living space under a social tenancy agreement in the Arzamas district of the village of Krasnoye in 2021 under the orphans program. The social tenancy agreement expires in 2021. Can I somehow get permission for the early privatization of this living space from the purpose of selling it and buying housing in the Krasnoyarsk Territory, where there is work and good earnings, but there is no housing and the possibility of registration?

In legislation, everything is decided in accordance with the calculation formula. It usually divides the benefit upon reaching the age specified by law or upon receiving a disability group into several main parts. They can be:

What will change in the procedure for determining PM

Federal Law-473 dated December 29, 2020 makes amendments to the legislation on the cost of living and the federal minimum wage. The minimum wage in the Russian Federation was introduced in the amount of 12,792 rubles.

The cost of living in the Voronezh region in 2021, from January 1, cannot be less than the minimum monthly wage for the 2nd quarter of 2021. This is established in the new law.

What else has changed:

- periodicity. There will be no more indicators for the 1st quarter of 2021, for the 2nd or 3rd quarter. The subsistence minimum will be approved in the regions before September 15 of the current year next year;

- basis for calculation. The consumer basket is no longer considered in this capacity; this indicator has generally lost all meaning. In fact, instead of it, the average income of a citizen in the Russian Federation has been introduced; the per capita monthly income in the Russian Federation is calculated from it, to which all other indicators are linked (they form part of it, a percentage);

- the minimum pension in the Voronezh region in 2021 will also be determined by PM for pensioners, but the latter indicator will not be approved separately either at the level of the Russian Federation or at the level of a constituent entity of the Russian Federation.

The division of the indicator by socio-demographic groups is backward, but the PM itself is now determined by the level of income, not expenses. This had little effect on the amounts.

Benefits for labor veterans in the Voronezh region in 2020-2021 - what is important to know?

Minimum Pension in 2021 in the Perm Territory

In order to eliminate unjustified underestimation or overestimation of the pensioner’s subsistence level in order to establish a social supplement to pensions and ensure an appropriate level of social support for low-income pensioners, it is proposed to clarify the procedure for determining this amount.

The federal social supplement (FSD) is paid by Pension Fund institutions and is established if the total amount of cash payments to a non-working pensioner does not reach the pensioner’s subsistence level established in the region of residence, which, in turn, does not reach the pensioner’s subsistence level in the whole of the Russian Federation.

Minimum pension in Russia by region in 2021: table

According to Article 2. 134-FZ, the subsistence minimum for the Russian Federation as a whole at the federal level is intended for:

- assessing the standard of living of the population of the Russian Federation in the development and implementation of social policy and federal social programs;

- justification for the minimum wage established at the federal level;

- determining the amounts of scholarships, benefits and other social benefits established at the federal level;

- formation of the federal budget.

How much does a person need to spend on life in order to be healthy, socially active and not be in poverty? This figure is reported to us every quarter by the Statistical authorities, and approved by the Government of the Russian Federation (and at the regional level - by the Regional Government). It is called the subsistence minimum (LS).

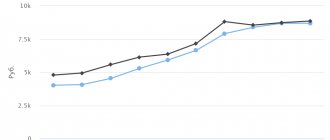

As follows from the project of the Russian Ministry of Finance, next year the living wage for a pensioner should be 9,311 rubles. This amount will be valid for the Russian Federation as a whole to determine the amount of social supplement to pensions at the federal level. This year, the average cost of living for a pensioner in the Russian Federation as a whole is 8,846 rubles. This data is provided by the Russian Pension Fund. Thus, PMP, and therefore the minimum pensions of Russian pensioners, will increase by 465 rubles. This increase will be equal to the inflation rate recorded this year.

This year it was finalized, and it was sent to the regions as a guideline, and the regions themselves additionally calculate their subsistence levels. This serves as the basis for later budgeting to take place according to the model for those whose pensions and subsistence level do not correspond, then an additional payment occurs. This is social mathematics.

Earlier, Deputy Prime Minister of the Russian government for social issues Tatyana Golikova announced that in 2021, insurance pensions of non-working pensioners will be indexed above the forecast inflation value by 6.6%, and their average size will be 16,400 rubles. At the same time, insurance pensioners will still receive minimum pensions at the level of the established PMP. Experts emphasize that it is very important to recalculate the cost of living of pensioners annually, as is being done now, in order to take into account inflation and other factors.

A group of employees collects all the data necessary for the calculation. After which a calculation is performed using a special formula. It is important to note that all kinds of services and goods are taken at a minimum cost.

Minimum old-age pension in the Perm region for 2021

Strictly speaking, Russian legislation does not contain such a concept as a minimum guaranteed pension. However, in practice, a minimum old-age pension still exists, and it is determined indirectly through other provisions of the law.

This additional payment is called social; it can be financed both by the all-Russian budget and by the budget of the region itself. It all depends on the level at which the regional authorities set the cost of living for a pensioner. If it is lower or equal to the all-Russian one, funding comes only from the federal treasury. If the regional indicator exceeds the national average, funding comes from the local budget.

Minimum pension amount from January 1, 2021

The minimum pension and PMP have been one and the same thing for years. Pensioners for whom the Pension Fund calculated a pension amount below the PMP received an additional payment exactly up to the level of this value.

The minimum fixed payment for recipients of an insurance pension in the event of the loss of a breadwinner is 3,022 rubles. 24 kopecks per month.

This is dictated by changes in the calculation of the minimum wage (the corresponding federal law has already been adopted in the State Duma).

The Russian government and parliament have no objections to the indexation of pensions for working pensioners, and funding is being sought.

You are wrong. Tatarstan is in first place in terms of the cost of living for a pensioner from the end, and not the Saratov region.

In those regions where the cost of living for a pensioner in 2021 is less than 10,022 rubles, low-income pensioners will be assigned a federal social benefit.

Living wage for a pensioner in the Perm region in 2021

If the amount is less, then a social supplement is assigned from the regional or federal budget. The surcharge is set in such an amount that the total amount of material support for the pensioner, taking into account this surcharge, reaches the cost of living for a pensioner established in the Perm Territory ( 8 539 ₽

).

Interesting read: How to get on the waiting list for kindergarten

According to Article 12_1 of Federal Law No. 178-FZ “On State Social Assistance” (04/01/2021)

, the total amount of material support for a non-working pensioner cannot be less than the cost of living of a pensioner in a constituent entity of the Russian Federation (in this case, in the Perm Territory).

Minimum old-age pension in Voronezh and the region from January 1, 2021

The regional authorities of Voronezh have set the cost of living for a pensioner in the region for 2021 at 8,750 rubles . This figure was fixed by the regional law of October 29, 2018. This value will be the amount of the minimum old-age pension in the region in 2021.

In 2021, the minimum pension level in the Voronezh region is 8,620 rubles. The increase in pensions for recipients of the minimum benefit is therefore 130 rubles.

The specified amount - 8,750 rubles - will be the minimum pension only for non-working pensioners. The law is based on the fact that if a pensioner works or receives some other income in addition to a pension, then he is not entitled to a social supplement. Even if the pension is below the subsistence level, the person generally receives an income above this amount and without additional payment.

Pension benefits for residents of Perm and the Perm region in 2021

For example, if maintenance has been accrued in the amount of 6.7 thousand rubles, then the applicant has the right to declare a desire to bring it to 8.279 thousand rubles. or 8.54 thousand rubles. It is clear that any person will choose a large number. Information: participants of the Great Patriotic War and home front workers receive an allowance from the local budget. It is equal to 300.0 rubles. In addition, pensioners are entitled to a social package for transport services and utility bills.

The law provides a formula for calculation. It divides old age or disability benefits into several components. They are:

General information for residents of the Perm region

The right to a pension is enshrined in federal legislation.

Moreover, it is drawn up in such a way that citizens are not left without income if they become unable to work. Thus, the following persons will be able to apply for pensions in the Perm Territory in 2021:

- who have reached the retirement age specified in regulations;

- those who have lost their ability to work partially or completely due to health problems;

- those who have lost their breadwinner.

Therefore, there are several types of benefits. The conditions for obtaining them vary:

1. By old age:

a. insurance is assigned if the criteria for length of service and points are met:

- after 60 years for women;

- after 65 years for men;

- at a different age in the presence of preferential grounds;

- work experience of at least 15 years (this indicator will be relevant by 2024, in 2021 the minimum experience is 11 years, within 4 years it will increase by 1 year annually);

- 30 individual pension coefficients (in 2021, the minimum amount of pension points is 18.6, the required number will increase annually and will reach 30 by 2024)

b. social :

- women who have celebrated their 65th birthday;

- men over 70 years of age;

- foreign citizens and stateless persons permanently residing in the territory of the Russian Federation for at least 15 years and who have reached the specified age;

- state : assigned to citizens affected by radiation or man-made disasters;

- The state pension for long service is assigned to federal civil servants, military personnel, astronauts and flight test personnel.

2. For disability:

- insurance in the presence of disability and at least one day of insurance experience;

- social in the presence of disability and lack of insurance coverage;

- state is assigned to military personnel, citizens who suffered as a result of radiation or man-made disasters, participants in the Great Patriotic War, citizens awarded the “Resident of Siege Leningrad” badge, and cosmonauts;

3. In the event of the loss of a breadwinner, a pension is entitled to:

- insurance is assigned upon the death of the breadwinner, who was dependent on the applicant for pension provision. The main condition is that the deceased breadwinner has an insurance period (at least one day);

- social is assigned to children under the age of 18, as well as over this age, studying full-time in educational organizations, until they complete such training, but no longer than until they reach the age of 23, who have lost one or both parents, and children of a deceased single person mothers;

4. State pension is assigned to disabled family members of fallen (deceased) military personnel; citizens injured as a result of radiation or man-made disasters, astronauts.

5. Only workers born after 1966 can apply for the funded part. It is formalized by contract on an individual basis at the initiative of the future recipient.

Hint: all issues of assignment and payments are dealt with by the regional branches of the Pension Fund (PFR).

Composition of pension accrual

The law provides a formula for calculation. It divides old age or disability benefits into several components. They are:

- The basic part is the same for all recipients. This indicator will be subject to annual indexing. In 2021 it was RUB 5,334.19.

- The insurance component is formed individually. Its value is strictly related to the quantity by the formula:

- years officially worked;

- accumulated points (they are a multiple of the contributions transferred for the worker).

- Additional payments of various kinds (more on them below).

Statistical data for the Perm region

To understand the principle of forming charges, you need to look at what the Government is starting from. It forms rules taking into account the following indicators:

| Index | Size, rub. | Explanations |

| Average pension content of pensioners in Perm and the Territory | 12 300,0 | Calculated taking into account all recipients |

| Minimum pension for a non-working pensioner | 8 703,0 | Monitored to prevent a decline in people's living standards |

| Minimum wage (minimum wage) | 11 280,0 | Affects the filling of the Pension Fund budget |

| Subsistence subsistence per capita in the region | 10 556,0 | Affects the accrual of surcharges |

| Northern odds | 1,15 1,2 | Increase the amount to be paid |

| Number of recipients | 786,998 people | Find out for planning budget expenses |

Attention: the law strictly regulates the amount of income of pensioners. They are limited to a minimum level equal to the subsistence minimum (LM). The last indicator is set quarterly at the end of the period:

- at the country level by the Government of the Russian Federation;

- in the region - by local authorities.

What additional payments can recipients of the Perm Territory qualify for?

The legislation establishes certain federal-level bonuses for pensioners.

In addition, local authorities can pay extra to certain groups from their own budget. Due to the fact that the pensions of elderly citizens are very small, the following strict rule has been adopted:

- a non-working pensioner cannot receive an income below the monthly minimum: by country;

- on the edge;

- chosen by the recipient.

Thus, the incomes of elderly people and disabled citizens are brought to the subsistence level. Moreover, the recipient is required to submit an application for additional payment and formally select the PM indicator. Naturally, everyone chooses the one that is larger.

Information: participants of the Great Patriotic War and home front workers receive an allowance from the local budget. It is equal to 300.0 rubles. Home front workers receive a monthly payment of 390 rubles, rehabilitated persons - 480 rubles. In addition, pensioners are entitled to a social package for transport services and utility bills.

Minimum pension in 2021: size

- increase by the amount of inflation from February 1, according to the law. Inflation is expected to be around 3%;

- an increase from April 1 by an amount depending on cash receipts to the Pension Fund in the current period - about 4% are planned in 2021.

The Ministry of Labor has found that the calculation of the cost of living in many regions is done incorrectly. The difference with the actual PM indicator was found in more than half of the constituent entities of the Russian Federation and in some it was more than 15%. In 70 regions, the PMP is set higher than the actual one - in favor of older people, but in 14 regions this figure is lower than the actual one. In connection with these data, the Ministry of Labor initiated the development of legal norms that will regulate the new procedure for determining PM.

Minimum pension from January 1, 2021

If the amount is less, then a social supplement is assigned from the regional or federal budget. The surcharge is set in such an amount that the total amount of material support for the pensioner, taking into account this surcharge, reaches the cost of living for a pensioner established in the Perm Territory ( 8 539 ₽

).

- increase by the amount of inflation from February 1, according to the law. Inflation is expected to be around 3%;

- an increase from April 1 by an amount depending on cash receipts to the Pension Fund in the current period - about 4% are planned in 2021.

The Ministry of Labor has found that the calculation of the cost of living in many regions is done incorrectly. The difference with the actual PM indicator was found in more than half of the constituent entities of the Russian Federation and in some it was more than 15%. In 70 regions, the PMP is set higher than the actual one - in favor of older people, but in 14 regions this figure is lower than the actual one. In connection with these data, the Ministry of Labor initiated the development of legal norms that will regulate the new procedure for determining PM.

In addition, pensioners are exempt from property tax on one property from each category of property. Also, starting this year, they are provided with a tax deduction for six acres of owned land.

- Labor veterans. These are citizens who have worked for a long time for the benefit of the country and have merit to it and incentive awards for their work.

- Veterans of war and combat. These include military personnel who participated in military conflicts, military battles, operations behind enemy lines, and served in the army during the Second World War.

The President made announcements that indexation is provided above the inflation index, that is, the minimum pension in Russia in 2021 by region will increase. The latter figure is expected to be around 4%, but pensions will increase to a level that is 2% higher than the above figure.

The President pledged to do everything to ensure these conditions. He also said that normal indexation of pension payments for working citizens will be resumed, but this requires budgetary security. So far the last factor is missing, but the authorities are doing everything to correct this omission.

Calculations by the Ministry of Labor indicate that the average annual pension after indexation will be 17,443 rubles. The state budget will spend almost eight trillion rubles to finance these payments. Accordingly, the minimum old-age pension in 2021 in the Krasnodar Territory will increase in terms of indicators.

According to calculations by the Ministry of Labor, the average annual pension after indexation will be 17,443 rubles; financing pension payments will require 7.8 trillion rubles in 2021. This will provide pensions to 43 million people.

The pension fund budget for 2021 has already been formed. His project contains information that indexation will nevertheless be increased, that is, it is worth counting on an indexation coefficient of around 6.3%.

However, social pensions, which are currently minimal, will increase by only 2.6 percent. The minimum social pension is currently 6,044 rubles. And for comparison, the average old-age pension payments reach 17,000 rubles.

State assistance to pensioners in the Perm region in 2021

In addition, pensioners are exempt from property tax on one property from each category of property. Also, starting this year, they are provided with a tax deduction for six acres of owned land.

- Labor veterans. These are citizens who have worked for a long time for the benefit of the country and have merit to it and incentive awards for their work.

- Veterans of war and combat. These include military personnel who participated in military conflicts, military battles, operations behind enemy lines, and served in the army during the Second World War.

What will be the cost of living for a pensioner in 2021?

another scam and scam by our servants of genetic garbage. And what? they are no longer ashamed to call us that. We are cattle and bullies for them. my pension was 7900. + federal handout up to 8400. I received 8400. With NG they added a pension and I received 8450, that is, I no longer have the right to apply for federal handouts for the nouveau riche because my pension has become more than the norm and I have become rich. conclusion? They added 60 rubles to me. simple math. and all this nonsense of bloggers who are mouthpieces for the thief Putin is pure noodles on our slave ears

The President issued a decree from January 1, 2021 to equalize the cost of living and minimum wage throughout Russia... This is 11,280 rubles. But why do Governors set their own cost of living and minimum wage? This means that Putin’s decree is FAKE, it is simply ignored... We live in the same country, and the regions have different minimum wages and living wages...

Interesting to read: Sample of a fixed amount of alimony

Who gets paid

In addition, when calculating the total amount of material support for a pensioner, the cash equivalents of the social support measures provided to him for paying for the use of a telephone, residential premises and utilities, travel on all types of passenger transport, as well as monetary compensation for the costs of paying for these services are taken into account.

You may be interested ==> Mortgage subsidies for low-income families

Indexing

The federal social supplement is paid by the territorial bodies of the Pension Fund of the Russian Federation and is established if the total amount of cash payments to a non-working pensioner does not reach the pensioner’s subsistence level established in the region of residence, which, in turn, does not reach the pensioner’s subsistence level in the whole of the Russian Federation.

Therefore, the cost of living established in a particular subject of the Russian Federation for pensioners is essentially the value of the minimum pension in a given region. PMP values are approved annually, and it is already known what the minimum pension will be from January 1, 2021 . A table by region indicating the size of the minimum pension is presented later in the article.

Living wage in the Perm region

Note to table: Quarterly values are shown for 2021, 2021, 2021, 2021, 2021. These living wage values are used in the cities of: Perm, Berezniki, Solikamsk, Chaikovsky, Kungur, Lysva, Krasnokamsk, Chusovoy, Dobryanka, Chernushka, Kudymkar, Vereshchagino, Osa, Gubakha and other settlements of the Perm Territory.

PM is the cost of the consumer basket (PC) and mandatory payments. Let's start with mandatory payments. They mean only personal income tax - a tax on personal income, which is included in the minimum wage of the working population. The minimum is also calculated for children and pensioners.

Increasing the minimum wage and living wage

In 2021, excise tax rates on tobacco products will be raised significantly by 20% - to 2,359 rubles per thousand pieces, on vapes and electronic cigarettes - to 60 rubles per piece. An increase in excise taxes will lead to an increase in the price of a pack of cigarettes by an average of 20 rubles - to approximately 140 rubles. The measure is aimed at combating smoking. Excise taxes on alcohol have been increased by 4%, but when setting prices for alcohol, it is not only the excise tax that will affect the price. From January, all alcohol sold in the country will be sold with federal special Goznak brands, which will affect the price tags.

Rising prices for alcohol and cigarettes

In addition, from January 1, a tax on deposits of more than 1 million rubles appeared. The rate will be 13%, and interest will be taxed, not the deposit amount itself. The measure will not apply to interest income received in 2021.

According to preliminary data from the Department of Labor and Employment of the Voronezh Region, the cost of living for a pensioner to determine the size of the social supplement to the pension for 2021 will not exceed the cost of living established in the Voronezh Region for 2020. Thus, in the region this figure is determined by law in the amount of 8,750 rubles for 2021. The cost of living for a pensioner in the Voronezh region will not exceed the projected cost of living for a pensioner in the Russian Federation as a whole. This means that social supplements to citizens will be provided from the federal budget by the Pension Fund of the Russian Federation.

The calculated value is established in accordance with the laws “On the subsistence level in the Voronezh region” and “On the consumer basket in the Voronezh region”, as well as the decree of the Government of the Russian Federation, which approved a unified calculation procedure in the regions of Russia. In addition, experts take into account data from Voronezhstat, the cost of the consumer basket in the region, which includes a minimum set of products, non-food goods and services.

Chairman of the Voronezh Regional Duma Vladimir Netesov recalled that the approval of the subsistence minimum is necessary to determine the amount of social supplement to the pension of non-working pensioners with low incomes. Its value is established annually at the regional level and is brought to the attention of the Pension Fund of the Russian Federation no later than September 15 of the year preceding the onset of the financial year for which it is established. A social supplement to pension is assigned to non-working pensioners whose total amount of material support does not reach the subsistence level of a pensioner in the region.

- periodicity. There will be no more indicators for the 1st quarter of 2021, for the 2nd or 3rd quarter. The subsistence minimum will be approved in the regions before September 15 of the current year next year;

- basis for calculation. The consumer basket is no longer considered in this capacity; this indicator has generally lost all meaning. In fact, instead of it, the average income of a citizen in the Russian Federation has been introduced; the per capita monthly income in the Russian Federation is calculated from it, to which all other indicators are linked (they form part of it, a percentage);

- the minimum pension in the Voronezh region in 2021 will also be determined by PM for pensioners, but the latter indicator will not be approved separately either at the level of the Russian Federation or at the level of a constituent entity of the Russian Federation.

You might be interested ==> Is pension paid for group 3 disabled people in Kazakhstan?

The minimum pension in the Voronezh region from January 1, 2021 is 8,750 rubles. This is the minimum living wage for a pensioner approved for 2021. According to Federal Law-178, it is the minimum pension. The indicator was approved by Law 84-OZ of September 15, 2020 and has not been changed, although the cost of living of a pensioner in the Voronezh region in 2021 is significantly less than the federal indicator according to Decree of the Government of the Russian Federation No. 2409 of December 31, 2020. (10,022 rubles).

What will change in the procedure for determining PM

In the regions of Russia and at the federal level, until January 1, 2021, the subsistence minimum (LM) was established quarterly for pensioners, children, working citizens and on average per person. PM along with the minimum wage (SMW) are the most important indicators of socio-economic development. In 2021, the legislation on PM and minimum wages has changed. Both values will be set once a year; the formula for their calculation has changed. At the federal level, the changes have already come into force, and the regions have been given time to switch to new calculations.

In the Voronezh region in 2021, for the first time, the cost of living will be established for the whole year, and not quarterly. The draft document was published on the regional government portal on Friday, January 22. Compared to the last quarter of 2021, this amount will be higher.

Supplement to pension up to the subsistence level in 2021 - payment calculation

Such payments cease for the duration of the employment of the citizen receiving the pension, when changing residence and leaving Russia. In addition, payments cease to be received if the pensioner's income exceeds the amount below which such government funding is due. Recalculation is also carried out when changing the region of residence, on which the pensioner’s minimum monthly allowance established there depends.

An additional payment to a pension at the federal level is established so that the income of an elderly person reaches the pensioner’s minimum wage, determined on average for Russia. For its appointment, the criteria are taken into account when the total amount of material support for a person on pension is simultaneously less than the subsistence level:

What does the minimum pension in Voronezh depend on?

Old age pension and other types of payments have a minimum expression. This indicator depends on the cost of living established in a particular territory.

Therefore, the pension amount is fixed at several levels. Including:

- at the federal level;

- at the regional level.

In a situation where a citizen receives payments below the established value, he is entitled to an additional payment to his pension. From what budget the bonus is paid is determined depending on the level of PM in the region.

When a subject uses PM lower than in the country as a whole, the premiums are financed by the state treasury. If the cost of living is higher than the general one, then the responsibility for paying additional payments falls on the treasury of a particular region.

The authorities implement constant monitoring of the indicator under consideration. This is necessary in order to protect segments of the population such as pensioners.

In particular, as of 2021, the following values are used in the Voronezh region:

- the average insurance pension is 14,000 rubles;

- minimum payments for those who do not work – 8750;

- Since in Russia the minimum pension is set at 9,311 rubles, regional authorities will have to make additional payments to pensioners up to this amount.

Currently, there are 753 thousand pensioners in Voronezh. To bring the indicators into a unified system, the authorities set the level of monthly wages and minimum wages.

The first is used to assign pensions to citizens. The second is used when calculating the required contributions to the Pension Fund.

What is the minimum pension in 2021 after indexation?

Instead of reforming the judicial system, they decided to make life more difficult for people, rather than make it easier. Not only has the retirement age been increased, but it’s also unclear what’s happening with pension savings. First they suggest putting aside the savings part, then counting pension points, then gaining experience, and here is the last joy in quotes, length of service doesn’t matter, just work until you die.

The goal seems to be good, changes in the calculation of pensions are necessary for a fair distribution of material benefits for all pensioners, the pension should be equal for everyone. Those who have not worked will receive almost the same pension as citizens who have worked all their lives. It’s good for some, but there doesn’t seem to be justice either.

The cost of living for a Voronezh pensioner in 2021 has been announced

According to information from the Minister of Social Labor, some entities are artificially reducing the size of the minimum pension in order to save money. According to the official, he has information on 30 regions where regional and social supplements are provided in the range from 100 to 1,500 rubles.

It is planned that additional norms to the bill “On the calculation of social supplements to pensions in excess of the subsistence level”, adopted by the State Duma on March 19, 2020, will introduce a unified metric for calculating the subsistence level for citizens of retirement age. Thus, the problem was solved after the correlation in the May statements.

This process will affect the increase in basic payments, and the pension point will also increase in value.

- For April 2021, the Government of the Russian Federation plans to index social payments. They are due to residents of the Russian Federation who do not have the right to receive a labor pension.

- The calculation of the minimum pension in the Voronezh region is regulated by Russian legislation. Its increase also occurs in accordance with basic laws. Officials promise that in 2021 the cost of living for a pensioner will definitely increase. It is on this basis that the payment for an elderly person will be calculated. This is how local authorities take care of the welfare of older people.

It is necessary to differentiate the issue of the minimum pension in 2021 according to the accrual categories for citizens: Insurance pension (by age) assumes retirement for women after 55 years and for men after 60 years, with a work experience of at least 7 years (until 2024 this standard will increase to 15 years). 8,703 rubles – this is the minimum that beneficiaries of an insurance pension can count on in 2021. From January 1 of the new year, pensioners in Moscow are promised to be paid twice as much - 17,500 rubles. Social pension is benefits paid regularly to those citizens who do not receive monthly insurance payments, but need government support for certain reasons (in case of disability, loss of a breadwinner, old age in the absence of insurance coverage). In 2021, the government promises to index this type of benefits by 3.7%.

To assign them you will need:

- official information about the presence of dependents;

- birth certificates of all children, including adults;

- preferential certificate (relevant, for example, for Chernobyl victims);

- medical certificate stating that the applicant needs additional care.

Addresses of PFR branches in Voronezh Service area Address Telephone for information Working hours with the population Voronezh st. Pushkinskaya, 5A +7 8:00 - 18:00 Zheleznodorozhny Ave. Leninsky, 174/21 Kominternovsky st. Druzhinnikov, 5B +7 473 269-81-78 Leninsky st. Pushkinskaya, 5A Levoberezhny Ave. Leninsky, 21 Sovetsky st.

Krasnozvezdnaya, 10 Central st. Studencheskaya, 36B Tip: on Fridays and pre-holiday days, citizens are received until 16:45.

Minimum pension in 2021 - latest news and table by region

- Federal – national average;

- Regional – separately for each region, taking into account the following regional features:

- the cost of a food basket for a certain group of the population;

- transport and utility costs;

- prices for medical and other services.

Every citizen of Russia who has reached retirement age must receive no less than the minimum required for survival (SMP). If his pension in total with other income is less than the established limit, then this difference must be compensated by the state or local governments. If old age has already arrived, and the citizen is still working and receiving a salary, then this income raises his benefit above the established PMP. In fact, social supplements are paid only to non-working pensioners.

In the Voronezh region they told how much pensions will increase in 2021

A large number of changes occurred in 2021, some of which affected pension provision, including the minimum pension. As before, the size of the pension benefit is determined by the subsistence level, which is established by the authorities of the constituent entity of the Russian Federation in which the pensioner lives. If there is a lack of funds received from the state, an additional payment is made up to the established value.

Social pensions are paid in a fixed amount assigned to a specific category of citizens. How much will payments increase? According to the latest news, the amounts will change as follows:

- for disability group III - from 4765.27 rubles. up to 4889.17 rub.

- for old age, for disability group II, for loss of a breadwinner - from 5606.17 rubles. up to 5751.93 rub.

- for disability group I and group II from childhood, for children without both parents - from 11,212.36 rubles. up to 11503.88 rub.

- for disability since childhood and disabled children - from 13,454.64 rubles. up to 13804.46 rub.

A citizen will receive benefits only after he has applied for it, so there is no need to delay this. First, you need to send a completed application to the territorial body of the Pension Fund. To do this, you can collect a list of documents and send them by mail or contact the MFC. Note that the second option does not always apply, but only in cases where organizations have a data exchange agreement. You can find out more details at the Pension Fund branch or at the MFC.

For the most part, the application is submitted personally by the person who wants to apply for a social pension. But if the payment is made for a child, then adults can write and submit an application for him.

The following documents must be provided:

- statement;

- SNILS;

- passport or birth certificate;

- for disabled people, a certificate indicating the group;

- document confirming the right to receive social benefits.

The establishment of a social supplement to a pension occurs if the financial support of the pensioner is below the regional subsistence level.

Social supplement can be:

- federal;

- regional.

The following income is taken into account as financial support:

- all types of pensions, including fixed-term pension payments;

- additional material (social) support;

- monthly cash payments, including a set of social services;

- other types of monetary social support from the state.

When calculating the financial support of a pensioner, social support in kind is not taken into account.

Social supplement to pension is not paid during the period of work that involves the transfer of contributions for compulsory pension insurance

To receive additional payment, you must prepare the following documents:

- statement;

- applicant's passport;

- notarized power of attorney (when applying through a representative).

statements

Additionally, a work book may be required.

To establish a social supplement to the pension, children under 18 years of age receiving a survivor's pension and disabled children do not need to submit an application. The additional payment is made automatically.

You can apply for a federal social supplement to your pension through the official website of the Pension Fund.

Pension in Perm and Perm region

The pension consists of an insurance, funded and basic part. The basic portion does not depend on the pensioner’s length of service. The insurance part is the amount of insurance premiums that are transferred monthly by the employer to the Pension Fund. But at the same time, employment must be of an official nature. The funded part is for people born in 1967 and later.

If a citizen does not have a disability, then his work experience must be at least one day in order to become a pensioner in the future. Pension contributions can be made in the department of the Pension Fund of Perm. Necessary documents for registration of pension payments:

13 Aug 2021 uristland 439

Share this post

- Related Posts

- Judicial practice termination of a real estate purchase and sale agreement

- Alimony is withheld from the disability pension

- How is it calculated for beneficiaries in the Saratov region in 2021?

- How much is the Pension Supplement after 80 years?

PMP and minimum age pension

The Russian Pension Fund has finally published complete data on the cost of living of a pensioner (PMP) for all 85 Russian regions. PMP is actually a minimum old-age pension - those elderly Russians for whom the Pension Fund has calculated a lower pension receive an additional payment up to this level. Although the procedure for calculating minimum pensions has changed slightly in 2021, in general this rule continues to work. What is the minimum pension in Russia from January 1, 2021, depending on the region - a complete table of the cost of living for a pensioner in the country from the Pension Fund of Russia.

You might be interested ==> How to draw up a deed of gift for a share in an apartment without a notary 2021

Minimum pension in Russian regions from January 1, 2021

Now everything is a little more complicated, but in favor of pensioners. The amount of their additional payment is fixed, and during annual indexations the main part of the pension is increased by a percentage common to all. As a result, recipients of social supplements from the same region today receive slightly different pension amounts.

per capita 11,653 rubles for the working population - 12,702 rubles for pensioners - 10,022 rubles for children - 11,303 rubles According to the Federal Law of December 29, 2021 No. 473-FZ, the cost of living per capita in the Russian Federation as a whole is the next year is established by the Government of the Russian Federation taking into account the opinion of the Russian Tripartite Commission for the Regulation of Social and Labor Relations and is calculated based on the median per capita income for the previous year.