Starting in 2021, the government offered citizens a certain freedom of choice in terms of forming pension savings. In particular, future pensioners could form the insurance and funded part of the pension. In the first case, we are talking about guaranteed payments that are formed throughout the entire working life and will be assigned upon reaching a specified age. In the second - amounts that a citizen can dispose of at his own discretion and receive additional income if funds are properly allocated.

Please note that a funded pension can be stored not only in the Pension Fund. Citizens can transfer these funds for management to non-governmental organizations - NPFs. Taking into account the recent changes to legislation and the increase in the retirement age, more and more citizens are trying to gain pension independence and get out of the patronage of the state. In particular, in 2021 alone, about 2 million applications to transfer to a non-state pension fund were submitted to the Pension Fund. This is the right of every Russian, however, when making such a choice, you need to know who exactly is best to transfer control of your pension, so as not to regret your decision later. Let's consider what NPF VTB can offer citizens.

What you need to know about pension reform?

In general, all significant changes occurred back in 2014, when a government decree changed the general procedure for pension insurance. In particular, the pension familiar to many was split into insurance and funded, and citizens were given the opportunity to manage their savings.

In the same year, a moratorium on funded pensions was introduced, which is still in effect today. Based on this order, employers cannot transfer money to a funded pension; all mandatory contributions go to the insurance part. In addition, it was decided to form pension savings not in rubles, but in coefficients.

Why transfer money to NPF

At first glance, this makes no sense. Pension savings stored in the Pension Fund are also transferred to trust management and generate investment income. However, this is not quite true.

The fact is that non-governmental organizations manage funds more flexibly, so the profitability from trust management of money is noticeably higher. In addition, the NPF has a more loyal approach to clients; it provides the possibility of receiving all stored funds at once or fixed payments over a certain period of time.

In addition, non-state funds support the testamentary principle, therefore, in the event of a client’s death before reaching retirement age, the accumulated savings are not lost, but are transferred to the beneficiary, whom the NPF client can indicate in the application.

Non-state pension insurance programs

Anyone who contacts the fund can choose one of the proposed service programs:

- Balanced investment portfolio. The return on the program does not have any designated indicator and may differ from year to year. To make a profit, funds raised from clients are invested in bonds, shares and deposits of reliable companies and banks.

- Conservative investment portfolio. Profitability is determined depending on the profit received on deposits, since all funds are placed on deposits of reliable banks.

Among the main opportunities for participation in programs from NPF VTB, it is worth highlighting:

- independent determination of the number of contributions, their amount and frequency;

- accrual of additional income to the account by investing the funds received by the fund;

- obtaining information about the state of a personal savings account, the movement of funds and control over all operations.

NPF operation scheme

Anyone can become a client of the NPF. This means that VTB does not impose any conditions depending on a person’s place of residence or work, the amount of his income and social status. The fund's activities are characterized by its transparency, individual approach to each client and the possibility of remote service through a personal account .

How to become a participant in the program

The algorithm according to which you can become a participant in the program and a client of the VTB Pension Fund is simple. The process does not take much time and consists of several stages:

- Conclusion of an agreement. This can be done during a personal visit to the nearest office of the VTB non-state fund or via the Internet using the special NPO-Online service. To do this, you will need to fill out the proposed questionnaire, after which a specialist from the insurance company will contact the applicant to clarify certain data and subsequent service.

- Selecting the appropriate maintenance program. The client independently determines for himself which product is optimal for him.

- Opening an individual account in which savings will be formed and where income will be received.

Replenishment of an individual pension account

After opening a personal account, you can invest in your future. Citizens are offered several ways to deposit funds, and any of them can be used without any restrictions:

- through your own employer (accounting of an enterprise or organization);

- by resorting to VTB Online, a remote banking system;

- Participants of the Collection program can top up their account with bonuses;

- from a plastic card or in cash through VTB Bank ATMs;

- via the Internet using the NPO-Online service.

- How to get back unpaid pensions

- Lula kebab at home

- 7 phrases that have a destructive effect on your child’s psyche

What kind of profitability does NPF VTB offer to its clients?

Let's start with the fact that the fund itself was established by the international financial group VTB, whose branches operate on 4 continents. This is a credit and financial organization with a state share of more than 60%, which gives the company economic stability and sustainability.

It is noteworthy that VTB NPF is also characterized by a high degree of reliability. According to the Expert RA rating agency, the company received a rating of ruAAA - a stable fund.

The analysis carried out was based on the following factors:

- state of assets;

- the amount of own financial reserves;

- investment income;

- dynamics of fulfillment of undertaken obligations;

- quality of service provision.

As a result of the stability assessment, the growth of investment income over a 3-year period was also determined. The resulting figure was 45.1%. In general, NPF VTB occupies a stable financial position in the Russian economic market. The Fund fully fulfills its obligations under pension insurance and minimizes risks through competent management of assets.

Non-state pension fund VTB

Today there are several dozen large and small non-state foundations operating in Russia. Among them, NPF VTB occupies one of the leading positions in the list of reliable and dynamically developing organizations . It is a member of the international financial group VTB and has more than a thousand representative offices in the Russian Federation. Future pension recipients are offered several areas of work:

- compulsory pension insurance;

- participation in the state pension co-financing program;

- non-state pension provision;

- corporate pension programs.

In accordance with the information posted on the official website, the capital of the non-state VTB Fund, consisting of its own funds, savings and reserves, exceeds the amount of 130 billion rubles and is managed by VTB Capital Asset Management CJSC. The number of citizens who have expressed their trust in the insurer exceeds one and a half million people. The yield at the end of 2021 on open accounts was 8.44% per annum.

- What can cause back pain when breathing?

- What the color of your urine says about your health

- Rassolnik with barley and pickles - step-by-step recipes for cooking with meat, fish or vegetables with photos

Reliability and guarantees for investors

Based on the fact that the fund participates in the deposit insurance program, its clients do not have to worry, because if the PPF is deprived of its license or other force majeure circumstances occur, they will receive the funds due to them through the Deposit Insurance Agency. Another indicator of reliability is that control over the activities of the Pension Fund is exercised by the Federal Agency for State Property Management, in whose portfolio 61% of shares belong.

The Expert RA rating agency assigned the insurer a ruAAA rating with a stable outlook. This became possible due to the high quality of its own funds and assets in which the management company invests. Additionally, the high diversification of assets and the profitability of VTB Non-State Pension Fund from the placement of financial assets were noted.

The agency's experts paid special attention to the stock of equity capital and the positive dynamics in the growth of funds raised. An important role in assigning the rating was played by the quality of services provided, the reliability of the company, transparency of activities and work carried out to minimize risks .

Return on deposits

Since a non-state pension is considered one of the effective means of increasing the cash receipts of citizens on a well-deserved retirement, an important factor, in addition to the frequency and amount of funds contributed, is the profitability offered by the VTB pension fund. Compared to the deposits that can be opened in the country’s banks, the profit of Pension Fund depositors is higher. This is confirmed by official profitability figures for 2021:

- for a balanced portfolio – 8.47%;

- according to conservative – 7.22%;

Total value of assets and number of insured persons

The fund’s assets at the end of 2021 amount to 130.36 billion rubles. This includes own funds, reserves and savings. As for OPS, the numbers look like this:

- return on investment of savings funds for the period from 2010 to 2021 – 74.32%;

- pension savings – 143.63 billion rubles;

- profitability on open accounts – 8.44%;

- the number of persons registered under OPS is more than 1.539 million people.

According to the non-state pension program:

- return on investment of savings funds for the period from 2010 to 2021 – 79.24%;

- return on a balanced investment portfolio – 8.47%;

- yield on a conservative individual entrepreneur – 7.22%;

- pension reserves, which include insurance reserves - 3.26 billion rubles;

- number of NGO participants – 61,689 people;

- the number of people who are already paid the monthly funded part of their pension at VTB is 7,209;

- The average monthly payment is 2,427 rubles.

How to find out the size of your future pension?

It is immediately necessary to clarify that the amount of pension benefits consists of several factors.

The fundamental points are:

- the amount of mandatory contributions;

- number of complete years to date;

- expected retirement age;

- deadline for receiving cash payments.

Based on these data, the total amount of pension savings and the amount of monthly payments are determined.

The most interesting thing is that you don’t need to make any calculations yourself: all calculations are done by online calculators, which are available on the website of any Non-State Pension Fund.

In this direction, VTB offers its current and potential clients a very convenient tool, which is located here: https://www.vtbnpf.ru/privat/calculator/npo/.

The calculator only needs to set the current values, and the system will automatically calculate the amount of pension benefits.

To be fair, we note that such a calculator is also offered by the Pension Fund. It is located at this link: https://www.pfrf.ru/eservices/calc/. In both cases, you do not need to register on the site or enter any personal data.

How to transfer a pension to VTB?

Transfer of the funded part of the pension is carried out only upon application and on a voluntary basis. This means that the citizen makes the decision to transfer a funded pension independently, and no one has the right to force him to take this action.

Let's make a small clarification. Since 2015, many employers have transferred the pensions of their employees to NPFs by default. This was done to obtain certain benefits in terms of compulsory social insurance for employees. Therefore, many citizens do not even know that their savings have “left” the Pension Fund. Let us immediately note that such actions are illegal, and fictitiously concluded contracts can be challenged in supervisory authorities.

Law enforcement agencies do not deal with such issues, so you need to contact the Pension Fund or the National Association of Non-State Pension Funds of Russia. If the fact of unauthorized transfer of a funded pension is confirmed, NPFs may be fined 700,000 rubles and restrictions may be imposed on concluding contracts with private individuals.

To transfer to a non-state pension fund legally, you need to enter into an agreement to transfer the funded pension into trust. To do this, you can go to the official website of the organization: https://www.vtbnpf.ru/privat/anketa/ and fill out the proposed questionnaire.

Please note that a similar procedure can be performed in person by contacting any of the Fund’s regional branches, which usually operate in VTB Bank branches. In addition, NPF agents often make door-to-door visits, concluding agreements with citizens. Here it is necessary to clarify that this is not the best option for concluding an agreement: in order to transfer a pension, you must indicate personal data, which may fall into the hands of fraudsters.

Peculiarities

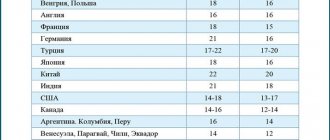

Between 2002 and 2013, employers' contributions of 22% of their employees' salaries could be divided into:

| accumulative part | 6% |

| insurance | 16% |

To transfer part of their pension contributions, a citizen had to enter into an agreement with a non-state pension fund, a management company, or submit an application to the Pension Fund for maintaining the funded part of the pension in the state fund until December 31, 2015.

6% received monthly into your account are funds that a citizen can manage independently. Order options:

- one-time payment of the full amount. Citizens recognized as disabled, those who have lost their breadwinner and other recipients of pensions from the state budget can participate in receiving such a payment;

- receive monthly. The total amount of savings from 2021 is divided into 426 months.;

- receive immediate payments over a ten-year period.

Since 2015, the ability to send part of contributions from a pension account to a savings account for persons served by the state fund has been suspended. In 2021, the freeze will last for another 2 years, and during this time the funded part of the pension will be used only to increase the funds of the insurance type of benefit.

It is likely that the freeze will be extended further, but the Ministry of Finance, for its part, promises not only to return these funds to the holders’ accounts, but also to index them for the entire unused period.

What documents may be required?

When filling out an application on the website, only current data is indicated: scans of documents are not attached to the application form.

The following information is displayed in the provided fields of the form:

- Last name, first name and patronymic: current and data at birth.

- Gender: male/female

- Date and place of birth.

- Registration and actual residence addresses (needed to receive correspondence).

- Passport data.

- Legal successors: who will be able to receive a pension in the event of the client’s death.

- Information about the previous insurer.

- Consent to the processing of personal data.

The information listed above will have to be confirmed with original documents when visiting the branch in person. The NPF employee needs to present a passport and SNILS; additional certificates are usually not required.

How long will it take to transfer funds?

If we talk about the bureaucratic procedure, it takes no more than 3-5 days from the date of submission of the application to make a decision on transferring a funded pension to VTB. The client is informed that the decision is positive by calling the contact number.

However, we are talking only about documenting legal relations. Transferring funds between non-profit financial institutions takes much longer - about a year. For example, if you wrote an application to transfer to VTB Non-State Pension Fund in 2019, the funds will arrive in the client’s account only in 2021. That is why the condition on changing the pension fund no more than once a year applies.

It should be clarified that, according to current rules, investment profits are calculated and credited at 5-year intervals. Therefore, it is recommended to change NPF after this period.

Of course, a non-state fund will not be able to refuse an early transfer, but all accrued profits will be cancelled.

How can you track investment income?

When a client enters into an agreement, a Personal Account is automatically created in the VTB Non-State Pension Fund system.

This is a personal client page that allows you to perform the following actions:

make changes to the previously specified data, for example, if a person’s last name or residential address has changed;- find out the current state of your changes;

- manage correspondence distribution;

- request reports;

- communicate 24/7 with technical support staff via the online chat form.

To access your Personal Account, you will need a login and password. When you first log into the system, the login function is performed by SNILS, and the password function is performed by the passport number. In the future, the password can be changed to a more convenient and easy to remember option.

Information about the status of pension savings is displayed immediately on the start page of your Personal Account. If this information is not available, it means that the money has not yet been credited to the fund balance. More detailed information on this issue can be obtained from technical support by using an online chat with a specialist.

Area of activity

From the very name of the institution, the main type of activity is clear. There are enough players in the financial services market and each, due to competition, must provide its own product to its clients.

The VTB Pension Fund provides the opportunity to accumulate financial resources to receive additional financial resources at retirement age, as additional ones. At the same time, there is no strict rule about accrual amounts, for example, as in loan agreements, when the borrower is obliged to pay at least a certain amount. You can deposit one thousand rubles in the current month, and a hundred thousand in the next month. These funds are real and inherited, unlike the Pension Fund, where the money looks like virtual and is converted into E-points.

How are payments made?

When a VTB client has the right to receive pension benefits, the question arises: how to receive funds? In this direction, NPF offers 3 payment methods, so each person can choose the best option for themselves.

This happens according to the following scheme:

- Urgent payments - you can immediately withdraw all funds stored in the account, or determine the frequency of transfers. Savings are divided into equal parts and paid during the specified period.

- Until the funds run out , the citizen determines the amount of the monthly allowance, and the pension will be paid in the specified amount until the account limit is exhausted.

- Lifetime maintenance - the pension is paid during the client’s life, so the amount of contributions directly depends on the amount of savings.

In all of these cases, a number of identical conditions apply. Firstly, during the payment period, the money continues to remain in the accounts of the NPF, therefore, investment income will be accrued on the balance of funds. Secondly, monetary support is assigned on a declarative basis, unless a different procedure is provided for by the terms of the contract.

Advantages and disadvantages

Any format of legal relations has its strengths and weaknesses. This is especially true for the terms of contracts related to financial payments.

The undoubted advantages include the following:

- High level of reliability of NPF VTB.

- Participation of the fund in the state pension insurance program.

- Developed information service: clients receive timely notifications about all financial transactions on the account.

- Simple registration in the system: A personal account is created by default.

- Relatively high level of investment income.

- Possibility of obtaining consultations at VTB Bank branches and by calling the hotline.

- Possibility of obtaining a tax deduction.

The disadvantages include:

- Unfinished functionality of the Personal Account on the official website: many users contact technical support specifically on this issue.

- Notifications do not always arrive on time, but this problem is not observed in all regions.

- Long wait for payments when granting a pension.

Program conditions

The fund offers programs for individuals and corporate clients with general conditions for the entire group or with individual conditions for each employee.

A person who chooses the VTB fund to save his contributions will have the opportunity to:

- save and increase your money;

- decide on your own when the payment will be made and in what amount;

- participate in VTB group of companies programs designed for retirees;

- make voluntary contributions and return up to 13% back;

- form pension savings in ruble currency, and not in points.

The prospect of receiving additional funds for pension benefits attracts many investors, and each investor keeps their savings in a separate personal account.

Investors should know that the VTB Group fund has an “A++” reliability rating for its organization, which means a high level.

The fund supports the state pension co-financing program. Compliance with the conditions on the part of the client will allow him to receive:

- Double the amount of funds deposited into your personal account. The amount should be from 2 to 12 thousand rubles.

- Possibility of obtaining a tax deduction from the amount of deposited funds in the amount of 13%.

- Transfer of savings by inheritance.

- The date for depositing funds is chosen by the account holder.

- A fourfold increase in additional contributions (no more than 48,000 rubles) if you decide to postpone retirement and continue working.

The user can transfer funds to his personal account in the fund through the VTB online service or by leaving an application in the accounting department of the enterprise.

How to terminate an agreement with NPF VTB?

This procedure is carried out in an application form. To transfer a funded pension to another trust, you need to enter into an agreement with the Pension Fund or another non-state fund.

It should be clarified that the client is not obliged to report to VTB for this transaction and justify his decision in writing. When transferring a pension, the procedure is carried out on a general basis and involves the participation of the following documents:

- statement;

- SNILS;

- passport.

We remind you that it is better to transfer funds after at least 5 years in order to fully preserve investment income.

How to transfer a pension from VTB Non-State Pension Fund back to the Pension Fund?

You can return under the patronage of the state pension fund at any time. At the beginning, we mentioned that free disposal of funds applies to the funded part of the pension. The money transfer can be early or scheduled. In the first case, the application is submitted before December 31, and, starting next year, the money will be transferred to the accounts of the Pension Fund of the Russian Federation, albeit with a loss of investment profit.

With a planned transfer of money, the application is submitted at any time, but the funds are transferred after 5 years, therefore, the applicant retains all the profits due to him.

The procedure itself is performed in 3 stages:

- An application is submitted to the territorial division of the Pension Fund. This can be done on the official website of the fund, by personally contacting a branch of the fund, through the State Services portal or at the MFC. The application form is received at the place of application.

- After making a positive decision to transfer savings, you should re-apply to the Pension Fund to conclude an agreement and present the original documents: passport and SNILS.

- An investment portfolio is selected. At this stage, a decision is made which of the accredited companies will manage pension savings to generate investment income.

Please note that on the VTB NPF website you can find information that when moving to another fund, the client must write a statement to notify the non-governmental organization of his decision. This is done at will: if a citizen ignores this condition, the Pension Fund will send a notification.

How to control your funds?

VTB PF, like other Pension Funds, works with both private and corporate clients. Any VTB PF client gets access to a Personal Account on the VTB Pension Fund website and can see what is happening with his pension savings, as well as order reports by email and ask questions through the contact form.

You can log into your Personal Account at https://web.vtbnpf.ru/index.php?from=main.

- To enter, enter Login - this is your insurance certificate number (SNILS) in the format XXX-XXX-XXX-XX.

- Then enter your password. By default, this is the number of your passport as a citizen of the Russian Federation. Enter it without the series number in the format 123456.

- Enter the verification code - captcha from the picture to confirm that you are not a robot.

If you changed your password and forgot it, use the password recovery form by clicking on the “Forgot your password” button.

If you change your personal data, do not forget to inform the Foundation about it through the personal data clarification form on the official website or personally to an employee of the Foundation.

In the Personal Account, a PF client can:

- Clarify and change your data.

- Set up mailing of correspondence.

- Get acquainted with current information on the state of your funds in the Pension Fund for the period of interest.

- Change password.

- Use the form to message fund employees.

Important!

Since January 2015, Russia has adopted a law establishing a new procedure for calculating your investment income in the event that you move from one non-state pension fund to another or to the Pension Fund of Russia (PFR). In accordance with Article 36.6-1 of the Federal Law of 05/07/1998 No. 75-FZ “On Non-State Pension Funds”, the volume of income and investment income (accruals) are now recorded in your Pension Fund account once every five years.

That is, if you move from one non-state fund to another fund or to the Pension Fund of the Russian Federation more often than once every five years, then all investment income accrued by the Fund to your funded part of the pension will be canceled. In order for the funds to be preserved in full, you must be a PF investor for at least 5 years!

Fund investors can use the 24/7 VTB Pension Fund Hotline at:

8 (free in the Russian Federation).