Benefits for labor veterans in 2021

According to the law, citizens living in apartment buildings are required to make monthly contributions for the repair of common property and the building as a whole.

However, upon reaching 80 years of age, this obligation is removed. In this case, the benefits for major repairs are in the form of 100% compensation. In fact, 80-year-old pensioners are exempt from paying such payments.

However, the citizen must meet the following conditions:

- sole ownership of residential premises;

- living alone or with a spouse of retirement age;

- no debts on utility bills.

The procedure for providing benefits should be clarified separately with the administration authorities. For example, the privilege may be of a reverse nature.

This means that first the elderly resident will need to repay the amount in full and only then will the money spent be returned to him.

80-year-old pensioners have the right to submit a request for support from social protection authorities. Such assistance is provided free of charge.

Social security assistance may include the following:

- visits by a specially trained social worker - care, cooking, cleaning, etc.;

- providing a set of food, clothing or other in-kind assistance;

- placement of needy pensioners in nursing homes and special boarding houses.

The full list of social support measures should be obtained separately from regional social protection departments.

What additional benefits are available to a pensioner after 80 years of age in 2021?

The first and most important thing that the applicants complain about is a limited list of departmental awards that give the right to receive the status of a labor veteran

(federal). So, now this list is quite specific and exhaustive, but until July 1, 2021, in this sense, the regions had relative freedom to establish their own lists of requirements.

Because of this, difficult situations arise. Thus, one of the media describes the story of how a woman received a departmental “Gratitude” award from the Russian Ministry of Agriculture on September 26, 2021. When awarding her, she was told that the award also entitles her to “Veteran of Labor.” Literally on the same day, the woman went to the district department of social protection to apply for status, additional payment and benefits - but they refused her.

As it turned out, it is the “Gratitude” from the Ministry of Agriculture that has not given the right to veteran status for almost 2 months

– and those who awarded her simply didn’t know about it yet. Other awards did not help the woman either - for example, from the Ministry of Agriculture of the Moscow Region and the head of the district for many years of fruitful work.

Interestingly, if the woman had been awarded only 2 months earlier, she would have received the status of a labor veteran - all the grounds that were in force until July 1, 2021 remained in force - but only if the corresponding awards were presented before this date.

Other problems are directly related to the benefits themselves. For example, in the Moscow region, the monthly allowance for labor veterans of retirement age is 446 rubles - not the lowest amount. But if the beneficiary wants to retain his right to free travel, the amount of EDV will be only 160 rubles per month

. There is no violation here, since regional authorities have the right to assign payment amounts and benefits at their own discretion.

Some labor veterans complain about the sharply decreased amounts of utility compensation - some, after 1500-2000 rubles a month, began to receive 300-500 rubles. And there is no violation here, since the amounts of compensation are calculated based on the actual payment for housing and communal services

. For example, if a region switched to charging for heating using a 1/8 system instead of 1/12, then in the summer months there is no need to pay for heating - accordingly, there will be no compensation.

In general, after amendments to the laws of 2021, assigning the status of a labor veteran has become a more understandable and transparent procedure. Unfortunately, because of this, many now do not fall under this status.

The largest package of amendments regarding labor veterans began to take effect in 2021, when it was clearly defined which awards should be considered departmental. Since then, all innovations either concern only certain regions, or remain initiatives.

For example, back in the summer, a bill was introduced to the State Duma that would grant labor veteran status to those who have worked at least 30 (women) or 35 (men) years in the Far North

– and without the mandatory requirement for departmental awards. Moreover, we are talking about the federal status of a labor veteran - when moving to another region (even to the south), labor veterans with this status, according to the idea of the authors of the bill, should not lose their status.

The bill was approved by the relevant committee (albeit with comments from the legal department); it was supposed to be prepared for consideration in the first reading in September 2021. However, at the moment it is listed as postponed - therefore, despite the support of parliament, there is no point in expecting such a project to be adopted soon. However, after its adoption, many will become eligible for the title of veteran

labor – in Russia there are more than 200 regions of the Far North and equivalent regions, which are located in 23 regions of the country.

Other innovations concern mainly regions, for example:

- labor veterans of the Irkutsk region will now receive payments even after moving to another subject of the Russian Federation;

- the same thing was adopted in the Saratov region - when moving, labor veterans retain the right to a payment in the amount of 167 rubles per month;

- in the Primorsky Territory they plan to issue land plots to those who have the status of a labor veteran. So far this is only a bill, but it has already been supported by the relevant committee of the regional Legislative Assembly;

- in the Astrakhan region they propose to create a unified federal register of labor veterans. Now, in order to assign payments or benefits to a person, the region is forced to contact all other 84 constituent entities of the Russian Federation with a request to see if this applicant is receiving funds from another region. But this will already concern the federal level and the non-declaration of status, so the issue will not be resolved quickly.

No other “high-profile” events regarding labor veterans are expected in 2021. In Moscow, the authorities continue to deal with a related category – “children of war”, strengthening their social protection; in other regions they may revise the amounts of the monthly allowance. There are no radical changes planned yet

.

Russian citizens can count on some benefits on utility bills. These include:

- Partial compensation for utilities is provided for those pensioners for whom the cost of paying for them takes away a significant part of their total monthly income.

- Benefits for paying for water, gas and electricity services.

- Benefits for paying for services related to the maintenance of the local area.

Not everyone knows what benefits pensioners from different parts of the country are entitled to and how to get them. In addition to federal programs, additional benefits will apply in different regions of Russia:

- Discount on utility bills. In each city it is different, for example, in St. Petersburg - 100%, in the Yaroslavl, Nizhny Novgorod, Sverdlovsk regions - 50%.

- Free medical care is available everywhere.

- Labor veterans of Moscow, St. Petersburg and other cities will receive an additional payment, its amount is set at the regional level.

What benefits are available to pensioners after 80 years of age in 2021?

After reaching the age of 80, citizens move into a special category protected by the state, which is allowed to receive:

- additional payments to the basic pension;

- transport benefits;

- free medical care;

- discounts on utility bills and major home repairs;

- social assistance from a health visitor.

Additional financial support is provided for relatives or caregivers of the elderly. Every month the state allocates 1,200 rubles in social care benefits. It can be issued starting from the age of 14. The main thing is to comply with the conditions - to be unemployed at the time of registration, but an able-bodied citizen.

Elderly people apply for support from the local administration or regional authorities. For example, monthly cash benefits, discounts on housing and communal services (garbage collection or gasification), compensation for landline telephone subscription fees.

To use such benefits, a person must not only reach the appropriate age, but also additionally have some kind of status - be a labor veteran, a disabled person or a participant in the Great Patriotic War, a rehabilitated person, a home front worker, or have another status.

As a general rule, social supplementation is assigned after the pensioner writes an application. You must apply with the appropriate package of documents to the following authorities:

- territorial PRF;

- Social Security Administration;

- MFC.

After submitting the application, the additional payment will be calculated the following month.

A period of 5 to 14 working days is allotted for review of documentation. The pensioner will receive all due accruals from the beginning of the next month after submitting the application.

Such payments include:

- care allowance;

- cash benefits instead of receiving preferential medications;

- registration of discounts on housing and communal services, subscription fees.

From the age of 80, a person is entitled to a number of benefits, as he enters the category of a specially protected segment of the population. In case of loss of ability to work, a citizen has the right to count on receiving an additional pension, compensation payments for care, social assistance, transportation and other benefits. Also, these benefits are reviewed annually by the authorities and indexed, which only leads to their increase.

Receiving the title “veteran of labor” is not only honorable, but also beneficial, since it gives the right to additional social benefits. At the moment, there are two ways to become a labor veteran:

- according to the rules of the federal law, which requires, first of all, a state or departmental award (Article 7 of Law No. 5-FZ),

-or according to the rules of your region, where there may be other conditions for conferring a title (however, benefits for such a title are provided only if you live in the same region).

Last year’s sensational bill (No. 1015322-7), which proposed conferring the federal title of “labor veteran” without awards, only for long service (45 years for men and 40 years for women), was never adopted by the State Duma (they cited that it was not a source of financing the budget expenses that will be additionally required for this is provided).

Therefore, for now there are no plans for changes in the rules for assigning the veteran title. But in terms of benefits and cash payments to labor veterans, there are still certain innovations. Let's look at them in more detail.

50% compensation for monthly utility bills is, of course, the most important social support measure for labor veterans. This includes fees for all utilities, including garbage collection, which is now also a type of housing and communal services.

As for contributions for major repairs, not all regions yet provide this benefit to labor veterans.

For example, in Moscow and the Moscow region, 50% compensation is provided, and in St. Petersburg, labor veterans receive this benefit only on an equal basis with other pensioners who are over 70 years old.

In this case, compensation is calculated not from the amount of payments accrued to the labor veteran, but according to regional consumption standards. Therefore, in fact, the amount of compensation may be noticeably less than 50% of the utility bill issued to the beneficiary.

Please note that starting this year, the conditions for rent compensation for labor veterans have changed significantly. Now they are deprived of this benefit only if there is a court decision to collect from them the debt for utility bills for the last 3 years.

Social protection authorities themselves must check whether labor veterans have such debts - they are prohibited from demanding certificates from citizens (Article 160 of the RF Housing Code as amended).

If the social security authority unreasonably refuses to compensate a labor veteran for payment of housing and communal services, it can recover from him in court compensation for moral damage (this was confirmed at the level of the Supreme Court of the Russian Federation - case No. 56-KG 18-38).

In most regions, the amount of cash payments to labor veterans is being increased. On average, the indexation percentage ranged from 3.5% to 4%.

For example, from 2021, federal labor veterans in Moscow will be paid an additional 1,096 rubles per month (40 rubles more compared to 2021).

In St. Petersburg - 979 rubles. In the Sverdlovsk region - 932 rubles. In the Nizhny Novgorod region, payment to labor veterans will be 627 rubles.

The Chelyabinsk region has one of the highest additional payments for labor veterans; in 2021 it will increase by another 4% and will become 1,450 rubles.

In the Moscow region, nothing has yet been mentioned about increasing additional payments to labor veterans, as long as their amount remains at 164 rubles.

For now, it remains in most regions of the country as a necessary condition for veterans to receive payments and benefits. The veteran’s income level does not matter in St. Petersburg, Moscow, and Chelyabinsk regions.

In Moscow there is this criterion, but it is so high that for many it is practically not felt: income should not exceed 1.8 million rubles per year. But in other regions, the criterion of need is increasingly becoming an obstacle to using benefits.

The problem is that the indexation of the income limit at which benefits are granted in the regions noticeably lags behind the growth of pensions (and for most labor veterans this is the main income).

As a result, it turns out that every year more and more beneficiaries are eliminated based on their income level.

For example, in 2021, insurance pensions for non-working citizens were indexed by 6.3%. And in the Nizhny Novgorod region, the income limit for benefits was increased by only 3.9% (now it is 24,662 rubles per month).

Last year, a project to abolish the income limit for beneficiaries was discussed in the Leningrad Region. However, the law has not yet been adopted.

What benefits are there at 80 and how to get them?

- Pension increase

- Benefits for utilities

- Benefits for major repairs

- Benefits for purchasing housing

- Benefits for medical services

- Transport benefits

- Tax benefits

- Caregiver's compensation

- Social benefits of regional importance

- Increasing pension after 80 years

- Elderly care supplement

- Regulatory framework

- Procedure for applying for benefits

Pensioners who have reached 80 years of age can find out about benefits in their region on the administration website. Typically, regional authorities assign additional monthly cash payments, give benefits for garbage collection and gasification, and pay compensation for the monthly fee for a landline telephone.

As a rule, in order to take advantage of such benefits, a pensioner must not only reach the appropriate age, but also additionally have some kind of status - be a labor veteran, a disabled person or a participant in the Great Patriotic War, a rehabilitated person, a home front worker, or have another status.

When a pensioner turns 80, his pension becomes larger, since the fixed payment to the insurance part of the pension doubles. This payment does not depend on insurance premiums, length of service and points. It is only affected by age, area of residence, disability and dependents.

But the pension is increased only for those pensioners who receive an old-age insurance pension. If the pension is social or for the loss of a survivor, it will not increase when the pensioner turns 80 years old. And the pension of disabled people of group 1 does not increase - they already receive double the amount of a fixed payment.

A labor veteran sounds proud. People who have been on the Honor Board for a long time, who have been true professionals in their field and role models, should be properly appreciated. Legislators did everything to ensure that their children, grandchildren, and great-grandchildren remember the labor exploits of pensioners.

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem , contact a consultant:

+7 (Saint Petersburg)

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FREE !

What can the state do for honored workers? Firstly, to compensate for the costs of expensive medications. Secondly, provide free travel on public transport. Third, offer a 50 percent discount on utility bills. Fourthly, (for working categories of the population) guarantee vacation at a convenient time. This is not a complete list.

Basic benefits and compensation are provided as a pension supplement.

Not every employee with a solid work history can be called a labor veteran.

5-FZ strictly regulates the list of candidates:

- Those who once received the “veteran of labor” certificate.

- Holders of honorary titles of the USSR or the Russian Federation.

- Awarded persons whose work has been appreciated at the level of the President of the Russian Federation (certificate or gratitude).

- Those who began their career during the Great Patriotic War of 1941-1945 and generally worked for 40 years (men) or 35 years (women).

- Holders of insignia from various departments with more than 15 years of experience in this field.

Benefits for pensioners of the Moscow region: what is required by law

The indicated benefits are available only to single citizens. If other family members also live in the apartment, they are not entitled to certain benefits, additional rights, full or partial exemption from fulfilling established rules, duties, or facilitating the conditions for their fulfillment.

- free travel on public transport within the city and in the suburbs: metro, train, ground transport, with the exception of taxis;

- free medical care in public hospitals;

- free annual flu vaccination and medical examination every 3 years;

- discounts of 50-100% on medications prescribed by a doctor;

- free dentures or their repair for non-working pensioners;

- if the income of a citizen is a person belonging to the permanent population of a given state, enjoying its protection and endowed with a set of political and other rights and obligations. Also, the form of oral and written appeal to a person in Soviet and post-Soviet society is less than 2 subsistence minimums, he is entitled to a free voucher to a sanatorium for treatment every 2 years;

- reimbursement of payment for mobile communications if it is not possible to connect a citizen to a landline telephone.

- for garbage removal . This compensation is due to non-working pensioners of a certain age. People under 70 years old can return 30% of the amount, aged 70-80 years - 50%, over 80 years old - 100%.

- for major repairs. Pensioners aged 70-80 years can count on a 50% discount on the amount; those over 80 years old are completely exempt from paying.

- Personal income tax . Applies only to pension payments. Other income (salaries, rental income) is subject to personal income tax. When purchasing an apartment, one of the types of residential premises, consisting of one or more adjacent rooms with a separate external exit, constituting a separate part of the house, a pensioner can issue a material deduction immediately for the current year (when he purchased the apartment) and for the 3 previous years.

- for transport . Pensioners in the Capital Region do not have any payment benefits, but can receive benefits if they belong to another category, for example, they are disabled, combat veterans, have the title of Hero of the USSR or the Russian Federation, etc. Those falling into these categories may not have to pay tax on one vehicle.

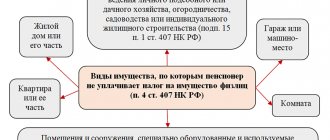

- on property. Pensioners are exempt from paying tax on one property of each type. If a Russian owns an apartment, garage or dacha, he may not pay anything. If he owns an apartment and 2 garages, then he is exempt from tax on the apartment and 1 garage.

- to the ground . It covers a plot of land of 6 acres. If a pensioner owns a plot of 5 acres, he is completely exempt from tax. If the plot occupies 8 acres, you will have to pay for 2 acres.

- state duties. When going to court on issues related to the calculation of pensions, citizens are exempt from paying state fees if the size of the claims is less than a million. When calling on other issues, pensioners pay the same as others.

In addition, large stores provide a discount on a voluntary, unilateral reduction in the cost of a product (service) by the seller (service provider) from the original cost of the product (service). To activate it you need a social card. The discount is valid on certain days and times.

We recommend reading: Place of Registration and Place of Residence: What's the Difference?

In addition, if necessary, an elderly person can be provided with a place in a nursing home or a specialized medical facility if he needs constant care and supervision from doctors. Also, an 80-year-old elderly person must be visited by a visiting nurse who can carry out the necessary medical procedures at home.

The increase depends on incapacitated citizens under the care of a pensioner, as well as on length of service in disadvantaged areas. Also, pensioners can receive a 50% discount on payment for housing and communal services and a discount on payment for major repairs or a complete exemption from it.

The question arises: what is this fixed part of the pension? This is a guaranteed payment towards the insurance pension, which does not depend on the amount of insurance premiums previously paid for the citizen. Its size is established by the state, taking into account the pensioner’s social factors such as:

- does not receive money as an unemployed person (state support);

- did not retire;

- no official income;

- not registered as an individual entrepreneur;

- no criminal history;

- no disability;

- over 14 years old.

In order for an elderly citizen to be able to receive information, necessary care, and home delivery of necessities, the Government of the Russian Federation has provided for the possibility of receiving a compensation payment for care in the amount of 1,200 rubles. The role of an assistant, to pay for whose activities this amount is accrued, can be a relative or a stranger who has no other sources of income (not working, not receiving pensions or unemployment benefits).

Benefits for labor veterans after 80 years of age

In order to secure your status as a “veteran of labor” you need to go to the territorial department of the social protection authorities.

The following documents are brought with you:

- Papers confirming the conferment of honorary statuses and titles.

- A pensioner’s work record book or an extract from the Pension Fund of the Russian Federation on the status of the personal account.

- Passport, military ID for those who were once liable for military service.

- Labor veteran certificate, if you already have one.

- An extract from the last place of employment with reference to the applicant’s total work experience.

After registration, you can receive bonuses and benefits thanks to the Pension Fund. If something is not clear about the charges, you should come in person for a consultation.

The federal budget makes it possible to establish a set of social services for veterans everywhere. At the same time, the monetization of benefits under 122-FZ gives the right to refuse one or another social program and demand its replacement with monetary compensation. To do this, it is recommended to draw up a corresponding application at the territorial department of the Pension Fund.

[1]

Another federal law “On Taxes of Property Persons” gives the right not to spend veterans’ funds on paying property taxes. These categories of the population are exempt from charges and penalties.

Like other citizens of the Russian Federation, a pensioner has the opportunity to return the excess personal income tax paid to the budget if he purchased housing or land worth 2-3 million. Payments are made in any case, even if a loan or targeted loan was issued. Receipt is organized through the Tax Inspectorate.

Will there be an increase in pensions for military retirees in 2021? It's in this article.

The legal topic is very complex, but in this article we will try to answer the question “Benefits for labor veterans in 2021 in Moscow upon reaching 80 years of age.” Of course, if you still have questions, you can consult with lawyers online for free directly on the website.

To receive an increase to the main part of your pension, you do not need to write an application to government agencies. After 80 years of age, benefits for pensioners are accrued automatically. A person will receive an increased pension the very next month after his birthday.

- orders, medals, honorary titles of the Russian Federation and the USSR;

- certificates and gratitude from the President;

- departmental insignia for labor or service merit (including for work of at least 15 years in a certain industry), provided that the length of service is at least 25 years (men) and 20 years (women). However, in some regions the requirements for experience are different.

Benefits for federal labor veterans

For example, labor veterans of the city of Moscow, labor veterans of the city of Moscow who are subscribers of telephone networks, are provided with a monthly cash payment in the amount of 190 rubles to pay for local telephone services provided in the city of Moscow.

p, blockquote 4,0,0,0,0 —>

- in the Yamal-Nenets Autonomous Okrug the coefficient is 1.5, so the pension supplement will be equal to 8 thousand rubles;

- on the territory of the Chukotka Autonomous Okrug, the amount of security will increase by 10 thousand 668 rubles, taking into account the coefficient of 2.0.

Exemption of a pensioner from paying tax on one of the property

However, there have been some changes in the rules for calculating taxes; now they are related to the cadastral value. Today it significantly exceeds the inventory value of objects, which was previously taken as a basis.

Therefore, if a pensioner has received a notice of the need to pay tax, he does not need to panic; this is most likely a technical error. This issue can be resolved very simply - with a standard visit to the nearest branch of the Federal Tax Service to show your pension.

We recommend reading: Pension supplements for WWII participants in 2021

How much do federal labor veterans get paid?

An additional payment for housing and communal services is assigned to pensioners whose monthly income is less than the established minimum in the region of residence. To apply for a benefit, you must contact the social security authority and submit a corresponding application. You can also use (MFC) or the government services portal.

The amount of compensation is calculated individually and is determined depending on the total family income, as well as the amount of payment for the use of services. This benefit is issued only if the following conditions are met:

- the residential premises (house or apartment) are owned by the pensioner or rented by him in accordance with the rental agreement;

- the amount of rent exceeds 22% of the total income of all family members registered in this living space, or from the pension benefit;

- absence of debts on utility bills and their timely payment.

According to the legislation of the Russian Federation, any able-bodied citizen who does not have an official place of work can care for an elderly person. The type of payment in question is not subject to indexation, so its size remains the same - 1,200 rubles.

The amount of the additional payment is included in the pension benefit and can only be disposed of by the pensioner himself, according to an agreement between the parties. Compensation is assigned based on an application, which must be submitted through the territorial department of the Pension Fund. In regions where there is an increasing coefficient, the amount of compensation may be greater.

In accordance with the law, all residents of apartment buildings are required to make monthly payments to a special account, the funds of which will subsequently be used for major repairs.

Elderly citizens who have reached the age of 80 are completely exempt from this obligation. But in addition to age criteria, an applicant for benefits must meet the following conditions:

- be the sole owner of the property;

- live alone or together with non-working spouses (other relatives) of retirement age;

- have no arrears in paying for housing and communal services.

This type of benefit is established automatically and is accrued from the month following the date of birth. When a pensioner reaches the age of 80, the size of the fixed payment to the insurance pension doubles and in 2021 will amount to 12,088.96 rubles (6,044.48 × 2). If there are dependents, the amount of the supplement increases. Only recipients of insurance payments can count on an increase in pension after 80 years of age.

80-year-old pensioners are entitled to a pension increase

The payment is made at the location of the elderly person’s pension file. The corresponding statements must be written by both the pensioner* and the carer**. Also, the client service of the Pension Fund of the Russian Federation must provide both passports, the work book of the caregiver (if available), and if he is studying full-time at an educational institution, a certificate from this institution. If a pensioner cannot come to the Pension Fund Office, his notarized application is accepted. For residents of Blagoveshchensk, a mobile customer service can even come to your home to pick up documents; you can order a visit by calling 239-333.

We recommend reading: Property object, fence or house

There is no need to submit any applications; the increase in the month of turning 80 is assigned automatically. The exception is for disabled people of group 1, for whom a fixed basic amount of the insurance part of their labor pension has already been assigned from the moment the disability of group 1 is established, regardless of age.

Benefits for labor veterans in Russia in 2021

Senior citizens are exempt from paying taxes on the following types of property owned by them:

- room, apartment or residential building;

- land plot;

- parking space or garage;

- premises used as an atelier, creative workshop, studio, etc.;

- one car whose power does not exceed 100 horsepower.

Territorial authorities also provide assistance to elderly residents of the regions, in accordance with the legislation of the subject of the Federation. It can be:

- additional monthly payments;

- compensation for landline telephone payments;

- discounts on housing and communal services (garbage removal, for example);

- other privileges established on the basis of regulations of a particular region.

To receive benefits, a citizen must not only reach the specified age, but also be the owner of a certain status - a rehabilitated person, a participant or disabled person of the Second World War, a home front worker, a labor veteran.

The regulatory legal act regulates at the legislative level the grounds for securing the status of “labor veteran”, as well as the procedure for issuing monthly benefits.

According to the document, the following persons belong to the above category:

- Having work experience of more than 25 years;

- Possessing awards, orders (of the Russian Federation or the Soviet Union);

- Received insignia;

- Those who have issued a certificate of “labor veteran”;

- Those who were engaged in labor activity during the Great Patriotic War as a minor and have accumulated a minimum experience of 35 years for women and 40 years for men.

Depending on the source of funding, some categories of citizens will receive monthly benefits in the following amount in 2021.

- Labor veterans – 712 rubles;

- Veterans who participated in the Second World War and subsequently became disabled - 5,215.84 rubles.

- Workers who have a badge of honor - 61,081.74 rubles;

- Heroes of Labor – 45,038.77 rubles.

Benefits of federal significance will be assigned if certain papers are available and provided:

- Identification;

- document confirming the title;

- work book (or contract that confirms the length of service);

- pensioner's certificate;

- insurance certificate;

- other documents that indicate existing merits;

- 2 photos, like for a passport.

Benefits for federal labor veterans in 2021

The authorities are taking all kinds of support measures aimed at both workers and veterans who participated in the Second World War. To receive benefits for this category of people, you need to collect a certain package of documents and go through the registration procedure. The size of the monthly payment depends on the source of financing.

If you find an error

Please select a piece of text and press Ctrl + Enter

CTRL + ENTER

This is an average of 1 thousand rubles above a veteran’s pension. The recalculation will be made on January 1, and not on February 1, as an indexation for other payments. Not everyone accepts a pension increase, only those who do not work. Working people are not entitled to additional money, but if they retire, they will receive a pension within 3 months. Includes all missing indexes.

The Federal Law “On Veterans” dated January 12, 1995 No. 5-FZ (with subsequent additions and amendments) provides for two statuses:

- federal;

- regional

In 2021, payments to labor veterans will depend on this status. The difference between them is that federal status provides social benefits on the territory of the Russian Federation. Regional - only within the boundaries of certain administrative districts. When changing their place of residence and moving to another area or region, its owners lose all benefits.

To restore them, you need to collect another package of documents, contact the social protection authorities at your place of residence and receive honorary status.

The conflict of laws causes serious inconvenience for veterans. State Duma deputies Sergei Vostretsov and Yuri Volkov have already raised this issue and proposed changes to Art. Article 10 of the Federal Law “On Veterans”. The changes, in particular, concern exclusion from the list of requirements for residence in a particular area. Simply put, with the adoption of the relevant law, benefits will remain when veterans change their place of residence and place of registration.

When will this happen? The bill has already been prepared and submitted to the State Duma. If deputies support it, then the changes will come into force in 2021.

Do pensioners need to pay apartment tax?

recognized as pensioners can receive benefits for paying apartment taxes and some other taxes - they have a pensioner’s certificate and are recipients of the corresponding type of benefit.

- Part 2 of the Tax Code of the Russian Federation Federal Law No. 117 of August 5, 2021;

- Federal Law “On Insurance Pensions” No. 400-FZ dated 12/28/2021;

- Government Decree No. 761 of December 14, 2005;

- NLA (laws, Government resolutions) of the constituent entities of the Russian Federation.

We recommend reading: How to distribute water drainage one in 1s

Benefits for labor veterans in 2020-2021

The legislation provides for a number of tax benefits for this category of citizens:

- They are exempt from paying property taxes on an apartment, room or other property they own. If a veteran owns several properties, only one of them is exempt from property taxes.

- Personal income tax (NDFL) is not levied on payments of social benefits, financial assistance, and sanatorium-resort treatment. The amount of personal income tax should not exceed 4 thousand rubles. In year.

- As for the rates of land and transport taxes, they are set by the provincial government. They also determine preferential categories, the procedure and amount of subsidies.

Benefits are regulated by the Veterans Act and are available at the federal and state levels. Provides payment for certain services. About it:

- directions to sanatoriums;

- medicines and medical supplies;

- free pass.

The law allows you to refuse the entire social package or some of its points and receive monetary compensation in return. To do this, you need to write an application and submit it to the social security authorities at the place of official registration.

Veterans of labor registered in Moscow can count on state benefits when receiving an old-age pension or pension for other reasons. They are not provided for those who do not receive a pension. This procedure will come into force in the capital in 2021 and will continue in 2021.

A one-time payment is made to the copyright holder who has moved to another region for permanent residence in the Murmansk region.

The list of transport benefits in St. Petersburg includes free year-round travel on electric trains and free production of prosthetics in the Krasnodar Territory.

Latest developments for labor veterans: video

Note! There is no general list of benefits for labor veterans at the federal level. Each subject of the Russian Federation independently determines the list of preferences for the specified category of citizens. Therefore, such lists in different regions may differ significantly. Moreover, some constituent entities of the Russian Federation do not establish separate benefits for labor veterans at all.

All preferences provided by BT can be formally divided into:

- additional payments;

- discounts and compensations;

- the right to use services out of turn.

The list of benefits presented below is approximate based on a generalized analysis of legal acts of several regions.

In the Russian Federation, labor veterans differ: some are federal in status, others are regional.

Benefits for federal labor veterans are valid throughout Russia. Regional beneficiaries receive privileges within the place of registration. Having changed their place of residence, they lose the status of a labor veteran; it must be proven again and the corresponding package of documents must be collected.

The procedure for calculating and the deadline for transferring income tax from wages in 2021

Income in the form of wages is accrued once a month, on the last day of the month (clause 2 of article 223 of the Tax Code of the Russian Federation). Accordingly, salary income tax must be calculated and withheld once a month. This provision is confirmed by letters of the Ministry of Finance of the Russian Federation dated September 12, 2017 No. 03-04-06/58501, dated April 10, 2015 No. 03-04-06/20406. An exception is the situation of dismissal of an employee, in which the calculation of his salary for the current month is made on the day of dismissal (last working day).

The situation is special with an advance payment, the payment date of which coincides with the last day of the month (i.e., the day of accrual of income for this month). The tax authorities believe that personal income tax must be paid on such an advance. The courts can also support them (see the decision of the Supreme Court dated May 11, 2016 No. 309-KG16-1804).

Do I need to pay personal income tax when paying an advance? If it is paid before the end of the month with which it is contacted, then it is not necessary. An advance is not yet a salary, but a payment towards the amount that will be calculated only on the last day of the month. The point of view that there is no need to transfer personal income tax on an advance payment is confirmed by letters from the Ministry of Finance of the Russian Federation dated December 15, 2017 No. 03-04-06/84250, Federal Tax Service dated April 29, 2016 No. BS-4-11/7893, dated May 26, 2014 No. BS -4-11/ [email protected]

Currently, there is a single deadline for paying personal income tax on all forms of wage payment. The organization is obliged to transfer personal income tax to the budget no later than the day following the day of actual payment of wages, taking into account the postponement due to weekends and holidays (clause 2 of Article 223, clause 6 of Article 226 of the Tax Code of the Russian Federation).

- in the form of income that is not taxed at all;

- which are not taxed in the prescribed amount and are deducted from the income received (deductions). That is, the income received is reduced by the amount of the deduction and income tax is withheld from the balance.

For reference: Pensioners are exempt from property tax on all residential and non-residential properties. But, if a pensioner owns several garages, then only one of them is exempt from paying tax at his discretion. You will have to pay for the land under the garage in any case.

The levy rate on the property of individuals in 2021 will be 0.1%, calculated from the value according to the cadastre. All residential premises, as well as utility buildings larger than 50 square meters, will be subject to taxation. meters, if located on a plot of land for construction purposes, subsidiary farming, etc.

Note that the cadastral value may differ from the market value upward, since it is not an absolutely accurate indicator. Since it consists of an average assessment of the object for the cadastral region, taking into account the date of commissioning and some features of the structure. The legislation establishes that once every five years the cadastral value must be clarified and recalculated based on data from independent appraisers.

Real estate tax for pensioners from 2021, who have been assigned a pension according to the legislation of the Russian Federation, are exempt from paying tax on only one unit of each type of property. A pensioner can choose a preferential facility himself. The rest are taxed at the established rate. In other words, only one apartment and car owned by a pensioner is exempt from property tax.

- disabled people of groups 1 and 2, as well as disabled people from childhood and children;

- recipients of old-age pensions;

- WWII veterans;

- persons holding the title of Hero of the Soviet Union and the Russian Federation;

- holders of the Order of Glory of three degrees;

- liquidators of emergencies that occurred at radioactive sites: the Chernobyl nuclear power plant, Mayak PA, tests at the test site in Semipalatinsk;

- other categories of military personnel, as well as their families.

As is known, penalties are calculated on the day of actual repayment of the arrears. At the same time, it is not uncommon for the amount of penalties in the demand to be much less than what will be on the date of actual repayment of the tax debt, and the taxpayer transfers to the budget only the amounts specified in the request. In such a situation, the inspectorate may send a demand for the “stuck” amount of penalties (from the date of the demand to the day of actual payment of the tax). The Tax Code of the Russian Federation did not contain a separate deadline for submitting a request for payment of arrears of penalties when the tax arrears have already been paid and it was often necessary to be guided by the general provisions of paragraph 5 of Art. 75 of the Tax Code of the Russian Federation, clarifications of the Plenum of the Supreme Arbitration Court of the Russian Federation dated July 30, 2013 No. 57 (clause 51), letter of the Federal Tax Service dated August 22, 2014 No. SA-4-7/16692, taking into account which the demand must be sent no later than 3 months from the date of payment of the entire amount arrears (in case of repayment of arrears in parts - from the moment of payment of the last part), if its size is less than 500 rubles, and taking into account the newer edition of clause 1 of Art. 70 of the Tax Code of the Russian Federation - less than 3,000 rubles.

Requirements for individuals . As before, in general cases, the demand for payment of tax must be sent to the taxpayer no later than 3 months from the date of discovery of the arrears. The innovation is that, regardless of the individual’s individual entrepreneur status, a demand is sent if the amount of arrears reaches RUB 3,000. Previously, a lower level was set for “ordinary” individuals - if the arrears, penalties and fines for it exceeded 500 rubles.

I would like to note that the updated version of clause 3 of Art. 29 of the Tax Code of the Russian Federation pleased not only individuals, but also organizations, since it does not contain novelties that relate specifically to companies, and they were actively discussed by legislators. It was supposed to introduce mandatory notarization of a power of attorney issued by a legal entity, i.e. The seal of the organization and the signature of its leader would not be enough. So, companies can breathe a sigh of relief and issue paper powers of attorney as usual, without involving a notary.

Deadline for submitting a request for payment of arrears of penalties . A new paragraph has appeared in Art. 70 of the Tax Code of the Russian Federation, which states that a request for payment of debt on penalties accrued on arrears after the day the demand for payment of such arrears was formed is sent to the taxpayer no later than 1 year from the date of payment of such arrears or from the day when the amount of these penalties exceeded 3,000 rubles .

The taxpayer - a controlling person confirms the amount of profit (loss) of the foreign company (CFC) he controls by submitting to the tax authority the CFC's annual financial statements and an audit report (mandatory or voluntary audit of financial statements). Moreover, these documents are submitted by organizations along with the income tax return, and by individuals - along with a notice of CFC.

The procedure for calculating transport tax in the event of destruction of a vehicle as a result of a fire, accident, natural disaster, etc. has changed. Tax calculation will stop on the 1st day of the month in which the vehicle was destroyed. Previously, car owners were forced to pay tax before the date of deregistration of the vehicle.

We recommend reading: What is an encumbrance on an apartment?

Previously, if the tax authorities made a mistake when calculating transport tax, they would issue additional payments for the uncollected amounts. Moreover, the recalculation could be carried out for three previous tax periods. Now there will be a ban on recalculating transport tax, which will worsen the situation of the taxpayer.

Taxation of interest on deposits is regulated by Art. 214.2 Tax Code of the Russian Federation. The repealed version of the article provided that interest on deposits (account balances) in rubles was subject to personal income tax at a rate of 35% when the rate under the agreement exceeded the key rate of the Bank of Russia (as of January 1, 2021, the rate of the Central Bank of the Russian Federation was 6.25%) by 5 percentage points (i.e. if the interest rate exceeded 11.25%), and interest on deposits in foreign currency was taxed at a rate of 35% if the contractual rate exceeded 9%. At that time, banks did not set rates in such amounts, which led to the absence of taxation of interest income.

To avoid negative consequences, taxpayers are recommended to independently control the receipt of notifications from the tax authority and the calculation of personal income tax on interest on deposits and account balances, as well as pay a single tax payment in advance on the basis of clause 1 of Art. 45.1 of the Tax Code of the Russian Federation, if there are reasonable doubts about the timeliness of receipt of a tax notice.

As indicated by the Ministry of Finance 3, the specifics of determining the tax base when receiving income in the form of interest on deposits (account balances) in banks in the Russian Federation, established by Art. 214.2 of the Tax Code of the Russian Federation, apply to income received starting from January 1, 2021. Income in the form of interest on deposits (account balances) is taken into account when determining the tax base for personal income tax for the tax period in which this income was received.