- home

- Reference

- Maternal capital

If a citizen has received the right to a maternity capital certificate and the payment itself, it is necessary to familiarize yourself in advance with the situations when a return of this amount, even partial, is acceptable. The rules often apply to funds already invested in the mortgage.

If the agreement between the parties is terminated, the money is returned, because the main goals were not achieved. The procedure differs in some nuances, which cannot be avoided without studying.

Is it possible to return maternity capital back to the Pension Fund and how to do it

Law No. 256 Federal Law does not specify the exact conditions under which funds must be returned. But maternity capital is considered a targeted government support program. And the owner of such assistance is obliged to pay the state if for some reason he was unable to use it in one of the areas that is also established by current legislation.

Most often, the return procedure is associated with the following circumstances:

- Housing purchased with a loan and repaid with maternity capital is sold.

- The inability to pay off debts, which is why property is seized.

- The contract is terminated, or the homeowner simply leaves the housing cooperative.

- It was decided to use the money for other purposes.

If the main goal is still achieved, then it is no longer possible to return the money.

Compensation is also transferred to the Pension Fund if the main housing transaction is declared invalid. Each party is obliged to reimburse the other for all expenses that were associated with certain actions. Maternity capital is paid from the federal budget, which is why it is so important to repay it on time.

It is also useful to read: Sample application for disposal of maternity capital funds

State measures if maternity capital is not returned

The Pension Fund (or the prosecutor's office at its request) has the right to file a claim through the court for the return of the amount of targeted assistance. If such a situation occurs, the holder of the state certificate must provide evidence of the legality of the amount spent.

In the case where the defendant bought another premises to replace the one he had, and it is suitable for living, improves the original living conditions of the children, the court may side with him. If the building is in disrepair, the previously available area was larger for each family member, or an unreasonable choice of the location of the facility (for example, a remote village, far from schools, preschools and hospitals) - the court’s decision will be strictly negative. The requirements are reasonable, and even a kindergarten nearby will make a difference.

As sanctions, the law provides for the collection of amounts by force. Defendants who are unable to return (this fact is also determined by the court) the wrongfully spent funds may ask for a deferment of execution.

Consequences of refusal to return maternity capital

Theoretically, the family can keep the returned capital and use it for its intended purpose, in accordance with the purposes required by law. At the same time, you should collect all documents confirming legal actions, since you will have to answer to the guardianship authorities and the Pension Fund. The practice of applying the rules shows the widespread judicial procedure for repeated petitions.

The return of maternity capital to the pension fund is the main requirement if for some reason the main essence of its intended use is lost.

Those who received the MSC and used it illegally (in circumvention of the purposes stated by the norm) face administrative liability. In addition, as part of civil law requirements, state certificate holders are subject to a fine in the amount of the MSK spent in this way. Further provision of financial assistance is canceled and is not subject to revision. It will no longer be possible to restore rights. Having stumbled once, a citizen loses the opportunity to participate in the targeted support program.

The obligation to return maternity capital is unshakable if the applicant applies for a second application to the Pension Fund.

What difficulties may arise when returning

The process is quite complex, and serious obstacles arise during its implementation. When purchasing a residential property, each family member becomes a shared owner. Therefore, the sale of property, if necessary, becomes more difficult.

It is necessary to obtain permission from the creditor bank if there is a need to sell an object for which the debts have not yet been partially repaid. Therefore, agreements often include provisions related to early termination of contracts.

The legislation does everything possible to protect against the misuse of maternity capital funds. Therefore, it is prohibited to receive money in the form of cash, regardless of the chosen method.

It is especially difficult when the sale is related to divorce. It is necessary to obtain consent not only from the financial organization, but also from social authorities that control relationships between citizens. A new transaction is concluded with the terms of the Agreement that was in force earlier. After this, the maternity capital is returned back to the Fund.

The same conditions are observed when an exchange is organized.

What is the penalty for cashing out maternity capital?

Specific punishment for cashing out maternity capital is provided for by the sanctions of Art. 159.2 of the Criminal Code of the Russian Federation, which is devoted to fraud in receiving payments.

If a person has provided knowingly false and (or) unreliable information to receive maternity capital funds, then he faces liability under Part 1 of Art. 159.2 of the Criminal Code of the Russian Federation with the appointment of one of the following penalties:

- fine up to 120 thousand rubles. or in the amount of salary for up to 1 year

- compulsory work for up to 360 hours

- corrective labor for up to 1 year

- restriction of freedom up to 2 years

- forced labor for up to 2 years

- arrest up to 4 months

If the criminal actions in question are committed by a group of persons, the qualification of the actions will be carried out under Part 2 of Art. 159.2 of the Criminal Code of the Russian Federation with the appointment of one of the following penalties:

- fine up to 300 thousand rubles. or in the amount of salary for up to 2 years

- compulsory work up to 480 hours

- correctional labor for up to 2 years

- forced labor for up to 5 years with or without restriction of freedom for up to 1 year

- imprisonment for up to 4 years with or without restriction of freedom for up to 1 year

If the acts under Part 1 and Part 2 of the above article are committed on a large scale, i.e. the size exceeds 250 thousand rubles. (maternal capital is obtained, as a rule, in an amount greater than the specified amount), then the person may be sentenced to:

- fine from 100 thousand rubles. up to 500 thousand rubles or in the amount of salary for a period of 1 to 3 years

- forced labor for up to 5 years with or without restriction of freedom for up to 2 years

- imprisonment for up to 6 years with a fine of up to 80 thousand rubles. or in the amount of salary for up to 6 months or without it and restriction of freedom for up to 1.5 years or without it

If the act in question is committed by an organized group or on a particularly large scale, i.e. in the amount of 1 million rubles, persons face punishment in the form of imprisonment for up to 10 years with a fine of up to 1 million rubles. or in the amount of salary for a period of up to 3 years or without it, with or without restriction of freedom for up to 2 years.

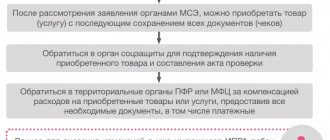

All possible return methods

The choice of the appropriate method for a particular situation depends on whether the money was transferred to the account or not.

- If the funds have not yet been received , the certificate owner personally submits an application to the Pension Fund employees with a request to terminate the current agreement. This must be done no later than 10 days after the relevant decision is made. If the funds are used to create a pension, the woman can refuse compensation at any time before the payments are scheduled.

- Another thing is when the money is transferred to the account, but the transaction does not take place. In this case, return to the Pension Fund is required. In most cases, after termination of the transaction, the money is returned to the certificate owner. The citizen is obliged to return an amount equal to what was spent. If necessary, a clause related to the transfer of money on behalf of the seller or developer is included in the termination agreement.

Sometimes it is possible not to return maternity capital to the Pension Fund, but simply use the available finances for their intended purpose. The main thing is not to forget to inform employees about the decision made. Otherwise, there is a high probability that they will sue. Separately, they ensure the preservation of written evidence in favor of completing a new transaction.

The difference between the total amount and the services actually provided is returned to the child if the following circumstances exist:

- A minor citizen dies.

- Termination of the hostel rental agreement.

- Deduction.

You must submit an application to refuse assistance so that the money is no longer transferred to the educational institution.

Methods for returning mat. capital in the Pension Fund

As mentioned above, the return of maternity capital is not provided for by law. However, a refund can be made if:

- The money from the Pension Fund has not yet been transferred.

- An application was submitted to transfer funds to the mother's pension account. A return, or rather a refusal of your decision, can be submitted the day before the pension is assigned.

In the case where tuition is paid, the remainder of the maternity capital is burned. It's strange, but it's true. If 200 thousand of the required 300 were spent on study, 100,000 rubles are not refundable and simply disappear.

Parents can terminate the contract with the developer and receive the invested money, taking into account the certificate. The amount received in cash should soon be invested in real estate or a mortgage. Otherwise, the Pension Fund will sue and win the case.

There is also a second option. The developer, at the request of the buyers, returns the money to the Pension Fund. The Pension Fund cannot re-issue maternity capital to the family.

IMPORTANT! When carrying out repair work related to expanding the area and improving living conditions, you should keep all receipts confirming expenses. Documents will allow you to preserve your reputation and prove that the money was invested for its intended purpose.

Will it be possible to receive it again after returning it?

The answer to this question will be yes. To resolve the issue, simply write a statement about the reuse of funds. If the application is approved, the funds will be directed only to solving issues specified in the Legislation. Often there are no legal proceedings; citizens have no other way to return the money in question.

If finances are returned back to the fund, the state places them under special control. Such situations are associated with circumstances that are beyond the control of either party. For example, when sellers or real estate developers turn out to be unscrupulous. And the facts of fraud are revealed after the initial agreements are signed. Voluntary return under such circumstances should only be encouraged.

The ban on re-use of assistance applies in the following situations:

- The documents indicated one university, but in fact the training takes place in another.

- Funds are allocated for the child’s education, but the child himself is expelled for one reason or another.

- The transaction was considered fictitious due to the fact that it was concluded between close relatives who paid additional compensation.

Part of the living space must be registered for children. If this is not done, the regulatory authorities will issue a warning in which they will ask to eliminate existing violations. Then comes a resolution with the punishment itself, if no action was taken from the other party.

What happens if the funds are not returned?

If the Pension Fund does not receive the required amount, its representatives have the right to file a claim with a corresponding demand for return. The regional prosecutor's office may also become a participant in the proceedings.

According to established judicial practice, the situation can develop in one of three directions:

- Recognition by the court of evidence that the funds were used for the intended purpose. The main thing is that the other party provides as many documents as possible in support of its position. The judge has the right to check the condition of the housing and whether there are improvements to the current living conditions. Location also plays a role. Regulatory authorities separately study the level of infrastructure development.

- Collection of the amount of maternity capital with a compulsory procedure. This happens if it is proven that the funds were not used for the specified purposes. The payer can only ask for a delay in the execution of this penalty.

- Return of funds on a voluntary basis. In this case, the defendant can expect to reuse the amount when the need arises. It is enough to agree with the requirements of the regulatory authority. Criminal liability threatens those who choose fictitious methods to cash out government assistance.

It is imperative to keep all receipts and payment documents in the case of repair work aimed at expanding the living space and improving current conditions. Then it will be easier to maintain your reputation and obtain additional evidence.

The recipient of the grant always bears the greatest responsibility. Even if he suffered from fraudsters, then only the citizen himself will be responsible to the regulatory authorities. The imperfection of the legal system in this direction is the most common problem encountered in practice.

It is also useful to read: Maternity capital for the purchase of secondary housing