Preferential retirement in the Russian Federation - latest news

Are beneficiaries affected by the innovations? In 2021, changes took place in Russia aimed at reforming the system of social and pension security for the population. Some of them involve increasing the age when the right to a pension arises.

They were perceived ambiguously by society, since the insurance pension is a kind of compensation for lost ability to work. Increasing the retirement age significantly delays the right to receive these payments.

Reference! The new pension reform will affect not only citizens who have the right to count on a regular insurance pension, but also beneficiaries, except for employees of hazardous industries. However, the changes will affect them to a lesser extent.

For employees who have the right to receive an insurance pension based on length of service (medics and teachers), a gradual deferment in the right to dispose of the accrued pension is provided. So, those of them who received payments in 2021 will be able to receive them only in 2020. The deferment period will change every year.

For workers in the north, the retirement age will increase. At the end of the reform, it will be 55 years and 60 years, depending on gender. In 2021, “northerners” have the right to retire at 50.5 years and 55.5 years, respectively.

In 2021, there were no significant changes that would fundamentally change the procedure for establishing preferential pension provision. However, one cannot fail to note the Government’s decision to expand the list of periods included in the length of service.

So, now teachers, doctors, rescuers and other beneficiaries have the right to take into account the time of professional training and advanced training for the purpose of assigning a pension. This decision allows you to expand the circle of recipients of material support on a preferential basis.

Who has the right to retire on preferential terms?

List of professions and activities that give the right to receive a preferential pension:

- work in hot shops;

- in hazardous production, with negative factors;

- underground and mining works;

- work in difficult physical conditions;

- expeditionary work;

- forestry activities;

- locomotive crews;

- temporarily or permanently working in the Far North;

- liquidators of the consequences of a radiation disaster;

- civil aviation pilots;

- miners and mines;

- metallurgists;

- members of the crew on ships;

- drivers of city vehicles;

- female machinists;

- employees of the Ministry of Emergency Situations;

- military personnel;

- teachers;

- medical workers;

- employees of institutions executing criminal penalties in the form of imprisonment.

People eligible for early exit based on social indicators:

- women raising 5 or more children, the youngest of whom should be no more than eight years old at the time of the mother’s retirement;

- one of the parents raising a disabled child;

- a person who has received a disability due to the performance of official duties.

The increasing coefficient, as well as the number of years for preferential length of service, differs for different types of professional activity. In addition to early retirement, beneficiaries are entitled to additional social benefits.

Exit conditions

As a general rule, in 2021, citizens can submit documents for accrual of an insurance pension upon reaching a strictly defined age. So, women have the right to count on it from 56.5 years old, and men from 61.5 years old. It should also be noted that there are additional criteria for receiving pension payments. They relate to the number of years of insurance experience (12 years) and the required minimum IPC value (21).

However, a number of citizens have the right to submit documents to receive financial support before the deadline. Their list is limited and determined by current legislation.

Thus, in order to receive a preferential pension (that is, to qualify for payments from an earlier age), a citizen must belong to one of the categories of workers who, due to special working conditions, have the corresponding right.

In general, preferential pensions are provided to citizens under the following conditions:

- labor activity in climatically unfavorable areas;

- labor activity associated with hazardous working conditions;

- the special nature of the work associated with the specifics of individual types of activity.

Important! In addition, in accordance with current legislation, pension provision under special conditions for its assignment is provided for military and law enforcement officers.

Who is entitled to

Employees working in unfavorable conditions can take advantage of the opportunity to receive an early pension. The list of professions and specialties involving increased complexity was determined back in Soviet times, when two categories (lists) of the most dangerous activities were identified. The legislative act regulating this issue, adopted by the Supreme Soviet of the USSR, is still in force today.

List No. 1

List No. 1 contains a list of types of professional activities that are the most dangerous and undermine health due to extremely unfavorable working conditions. Here we assume specialists working in mining industries, foundries, involved in working with toxic chemicals and explosives.

The right to a preferential pension for male workers in this group arises after 10 years of work in hazardous conditions, which is guaranteed by law. At the same time, the age for retirement is reduced by the same period. In total, you need to work for two decades.

Women are entitled to benefits only if they have completed 7.5 years of “harmful” work experience; the age is reduced by 10 years. Total experience of 15 years.

List No. 2

List No. 2 contains a list of types of professional activities that involve difficult working conditions, the nature of which leads to early loss of ability to work.

These, among other things, should include specialists working in the railways, construction industry, communications, etc.

The age for workers in these groups is reduced by 5 years. Moreover, the conditions under which they have the right to count on benefits are much more complex. In other words, you need to have more work experience both in general and in hazardous production in particular.

For employees whose professional activities involve harmful and difficult working conditions, additional insurance premiums must be paid:

- from the first list – 9%;

- from the second list – 6%.

Attention! If the organization has carried out special events related to the certification of workplaces, then based on the results of a special assessment of working conditions, a differentiated approach can be applied to calculate the amounts of additional insurance contributions.

Doctors

The work of doctors is also associated with working conditions that pose a certain risk and tension, therefore, a preferential retirement procedure has been developed and applied for them, but subject to a number of conditions, including those related to the place of work and position held. Thus, the right to a benefit is given by working in the following healthcare institutions:

- hospitals;

- clinics;

- dispensaries;

- antenatal clinics;

- maternity hospital;

- MSCh;

- FAPs;

- SMP;

- blood transfusion stations;

- military hospitals and infirmaries.

Employees of the above-mentioned institutions must work in positions included in one of the following groups:

- doctors;

- nursing staff (nurses, midwives, paramedics, laboratory assistants, etc.).

Specialist doctors who hold administrative positions and do not actually carry out medical activities also have the right to count on benefits.

To have a legal right and be able to receive a pension, they must have at least thirty years of experience in medicine if they are in the city, and at least 25 years if working in the countryside.

Teachers

Pedagogical activity involves increased psycho-emotional stress, which also leads to early loss of ability to work. In this regard, the law provides for early retirement for this category of workers. Like doctors, this opportunity depends on length of service, which is at least 25 years of work in the following institutions:

- schools (general education, correctional, gymnasiums, lyceums);

- institutions of further education;

- orphanages;

- Secondary educational institutions and vocational schools;

- kindergartens and nurseries.

Teacher positions that give the right to early retirement are strictly defined by law. Among them, the following should be highlighted:

- teachers (including primary school);

- directors, head teachers;

- educators;

- speech therapists.

Working in the north

Labor activities carried out in difficult and sometimes extreme conditions of the Far North also involve the accrual of an early pension.

The requirements for “northerners” are such that they must have 15 years of work experience in the Arctic and tundra zones (Far North), and 20 years in areas with similar conditions. The requirements for “northerners” are such that they must have 15 years of work experience in the Arctic and tundra zones (Far North), and 20 years in areas with similar conditions. At the same time, we should not forget about the mandatory minimum work experience in general.

The concept of preferential length of service

The pension amount for health workers is calculated based on length of service.

For personnel working in rural areas, the minimum period of work in healthcare is 25 years. For those living in the city - 30 years. Early pension is granted to persons regardless of their age.

Calculation of experience

It is accepted that a working year is counted as 1 year of experience. The exceptions are:

- Working in rural areas. Their calendar year is 15 months.

- Surgeons, resuscitators, forensic experts, anesthesiologists. For them, a year of work counts as one and a half years of experience. If they work in rural areas, then the annual length of service increases to 1.9 months.

Moreover, they can calculate a preferential pension for a health worker only for the time that he worked at full time.

Countable periods

To calculate pension payments, not only the actual periods of work are taken, but also:

- days on which the employee was temporarily unable to work;

- vacation for which payment was accrued;

- travel for work matters;

- time spent on professional development.

Also, the time that is counted includes maternity leave, but does not include leave to care for children under 3 years of age.

Rules for calculating preferential length of service

For persons who, due to the specifics of their activities, have the right to early retirement, in addition to the insurance period, the so-called preferential period is of significant importance.

Preferential length of service should be understood as periods during which a citizen carried out labor activities that provided for the possibility of early retirement.

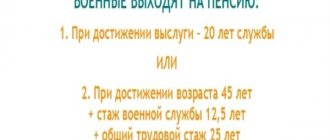

For military personnel and employees of structures equivalent to the army, the insurance period does not apply, since they receive state pension provision, the principles of calculation and formation of which differ from those for the insurance type of pension. In this regard, the so-called “length of service” is of fundamental importance for them, that is, the period of stay in military or equivalent service.

Thus, if there is a sufficient amount of preferential service, a citizen has the right to early retirement, that is, to submit an appropriate application several years earlier than the generally established age (how much depends on the category of the recipient).

The concept of “mixed service” has been introduced for military and law enforcement officers. It should be understood as the totality of years of service and performance of work in a “civilian” specialty.

What is preferential service?

Pension standards are defined in the following regulatory documents:

- Federal Law No. 173 “On labor pensions in the Russian Federation” dated December 17, 2001.

- PPRF N 516 “Rules for calculating periods of work giving the right to early assignment of an old-age labor pension...” dated 06/11/2002.

- Federal Law No. 400 “On Insurance Pensions” dated December 28, 2013.

This term refers to the worked period of work that allows one to retire before the maximum retirement age. In individual types of activities, a multiplying factor is used in the calculation. Thus, after working for a calendar year, a specialist receives additional days of service and retires before reaching the general age limit.

Preferential conditions may be provided for several reasons:

- For harmful or difficult working conditions (according to the list of dangerous and harmful professions). The basis is the characteristics of the work.

- For social characteristics (for example, due to health or family circumstances). The basis will be the characteristics of the employee.

The lists of preferential professions were approved back in 1991 and include all types of employment under special working conditions. They are divided into:

- a list of professions with particularly difficult and particularly harmful conditions;

- list of professions with difficult and harmful conditions.

IMPORTANT! A separate list contains categories of citizens working and living in the territories of the Far North.

How is a preferential pension calculated?

The principle of calculating the insurance pension for preferential categories of citizens (with the exception of military personnel and law enforcement officers) does not differ from that used to determine the amount of pension payments in general. In other words, the same familiar formula is used, which takes into account the number of pension points and the cost of each of them:

SP = IPC*SPK+(FV*KvFV), where:

- SP – the amount of the insurance pension.

- IPC – number of pension points.

- SPB – the cost of one pension point.

- FV – fixed payment.

The cost of pension points and the size of the fixed payment is indexed every year. In 2021, one point costs 98 rubles 83 kopecks, the payment amount is 6044.48 rubles, and for some preferential categories it is even higher.

As mentioned earlier, in order to count on pension payments as usual, you must have at least 12 years of service in the current year.

Upon completion of the pension reform, the length of service requirements will be significantly increased. So, in order to qualify for financial support, a citizen will need at least 15 years of insurance experience.

As for the preferential pension, in order to assign it, you also need, in addition to insurance, appropriate length of service. It should be noted here that it is calculated differently for different categories of beneficiaries.

By harmfulness

In accordance with the law, there are lists of professions and positions in which a certain health risk is acceptable in terms of the occurrence of so-called occupational diseases. In this regard, the working capacity of persons employed in hazardous work decreases much earlier, so the retirement age for them is seriously reduced.

All such professions and positions are included in “List No. 1” and “List No. 2”:

- “List No. 1” indicates the most harmful and dangerous professions associated with chemical production, mining, metallurgy, and so on. In accordance with the law, for a preferential pension, citizens of such professions must work in hazardous work for at least 10 (men) or 7.5 (women) years with a total period of labor activity of at least 20 (men) or 15 (women) years.

- “List No. 2” contains a list of professions that significantly affect the preservation of working capacity, but to a lesser extent than the professions from the first list. These include workers in pharmaceutical production, aviation, maritime transport, and so on.

Thus, men can apply for early payments if they have 12.5 years of specialized experience and 25 years of general experience. Women - 10 and 20 years old, respectively.

From teachers

Teachers are also among the persons whose professional activities lead to early loss of ability to work. In accordance with the law, in order to receive early financial support, they must work for at least 25 years in their specialty. It should be understood that only periods of full-time work are taken into account.

For health workers

Healthcare workers have the right to apply for an early retirement if they have worked in relevant institutions for at least 25 years (when carrying out medical activities in rural areas) or at least 30 years (when working in urban areas).

For law enforcement officers

Employees of the Ministry of Internal Affairs and other law enforcement agencies have the opportunity to retire based on length of service. Today it is 20 years , but a gradual increase from 20 to 25 years is expected. According to mixed length of service, police officers retire after 12.5 years of service and 25 years of total service.

For workers and residents of the Far North

Citizens working in areas unfavorable in terms of climatic conditions and transport accessibility have the right to early provision.

At the same time, depending on the severity of the conditions, regions of the Far North and equivalent areas are distinguished. In the regions of the Far North, men go on vacation if they have worked there for at least 15 years with a total experience of 25 years. Women - 12.5 and 20 years old, respectively.

In areas equivalent to KS, men are required to have at least 20 years of “northern” experience, and women – 15 years. At the same time, the requirements for general length of service are the same as for retirement in the Far North.

For the military

Military pensions depend on length of service. In 2021, it is 20 years. In some cases, length of service can be calculated taking into account an increasing coefficient. For example, periods of participation in hostilities are counted in a special way. Thus, by the time of retirement, the actual length of service (without taking into account increasing factors) may be a shorter period.

Who is entitled to a preferential pension?

Early termination of employment with payment of maintenance is available to citizens in two main categories - social and professional affiliation.

A preferential social pension is provided only to those who have fulfilled certain conditions. For example, this category may include mothers of many children with at least 15 years of work experience. If you give birth to three children and raise the youngest of them until the age of 8, retirement is possible from the age of 56. If the same conditions are met by a mother of three children, retirement begins at age 55.

There are 2 lists of preferential categories:

List 1

It includes 24 professions that are directly related to high hazards and difficult conditions: mineral processing, mining, chemical production, metalworking, etc.

List 2

It includes 34 types of activities associated with difficult and harmful conditions. These include the production of building materials, food and light industries, and activities at power plants.

But that is not all. To qualify for a preferential pension, you must earn length of service, which is documented.

| Profession | Floor | Age limit | Special experience | Total experience |

| Public transport driver | M F | 55 50 | 20 15 | 55 50 |

| Worker in high intensity textile industry | AND | 50 | 20 | not taken into account |

| Teacher | Any gender | not considered | 25 | not taken into account |

| Civil Aviation Flight Control | M F | 55 50 | 12,5 10 | 25 20 |

| Work related to underground work, hazardous working conditions, including hot shop | M F | 50 45 | 10 7,5 | 20 15 |

Decor

Registration of a preferential pension, in essence, the procedure itself is no different from registration of a regular one. However, if there is a benefit, in addition to the standard package of documents, papers confirming the right to early retirement are also submitted. As a rule, the relevant information is contained in the work book, but additional certificates, orders, etc. may be required, which confirms the fact of work in a specific position in a certain area and period.

For these purposes, the assignment of a preferential pension to the employee should submit an application to the Pension Fund of the Russian Federation, having in hand the following documents:

- passport;

- SNILS;

- employment history;

- income certificate;

- a certificate from the employer about the preferential nature of the work (not in all cases, but only those expressly provided for by law);

The period for consideration of the application is 10 days, but if there are controversial issues, it can be extended. If the application is not satisfied, it is possible to ensure your legitimate interests by filing a claim with the judicial authorities.

The application is submitted in writing to the Pension Fund branch at the place of residence. It, among other things, indicates the grounds for granting an early pension. In general, it does not differ in shape from the usual one. In addition, documents can be submitted to the MFC or electronically.

Military personnel and law enforcement officers submit documents to the relevant departments within their departments without contacting the Pension Fund.

How to apply for a preferential pension

To receive a preferential pension, a citizen must contact the nearest branch of the Pension Fund of the Russian Federation at his place of residence. An important issue is the availability of supporting documents or entries in the work book proving the legality of providing an early pension.

Step 1. You need to fill out an application. It must indicate your full name and information from your passport, as well as SNILS, as well as the reason for granting an early pension.

Step 2. To make pension transfers, you need to take the following documents with you:

- SNILS;

- passport;

- a copy of the work book;

- documents indicating work in harmful or difficult conditions;

- average earnings from last place of work;

- military ID;

- a document confirming the change of surname (relevant for women);

- certificates for all children.

Step 3. The inspector accepts all documentation, checks the compliance of the originals and the provided copies, and provides a receipt for the papers received from the citizen.

You should contact the branch of the Pension Fund of the Russian Federation one month before the deadline for granting the right to preferential retirement.