Can a pensioner open an individual entrepreneur - age limits

The possibility of carrying out entrepreneurial activities is regulated by civil law. In accordance with Art. 21 of the Civil Code of the Russian Federation, any person who has full legal capacity acquired after reaching 18 years of age has the right to conduct entrepreneurial activity. This provision means that the pensioner has the right to engage in entrepreneurial activities.

Please note that the age limit after which a pensioner is prohibited from opening an individual entrepreneur is not established by law, since such an establishment would contradict the requirements of the Constitution of the Russian Federation.

Registration of individual entrepreneurs is carried out on the basis of Federal Law No. 129 of 08.08.2001 “On state registration of legal entities and individual entrepreneurs”. This regulatory act also does not provide for any restrictions regarding obtaining the status of an entrepreneur by a person receiving a pension.

Registration of individual entrepreneurship by a pensioner

The procedure for registering an individual entrepreneur as a pensioner is quite complicated and requires collecting a package of documents. If you fill out the forms yourself, inaccuracies may occur, which will result in the return of documents.

You can avoid mistakes if you contact a consulting firm whose specialists have the necessary experience and information about currently accepted state standards. They guarantee that the paperwork will take place without unnecessary hassle and will not cause additional complications associated with financial expenses.

Here's what you need to do if you decide to register yourself:

- look at the OKVED directory;

- select the type of activity;

- correctly plan your activities, determine its direction in order to avoid unnecessary expenses when changing this plan in the future;

- fill out application form No. P21001, which you can;

- start collecting a package of documents (TIN, copies of passport, receipt of payment of state duty).

After you collect all the documents and deliver them to the tax office, the documentation package will be reviewed within five days. The registration procedure is standard, but from 2021 there are changes for entrepreneurs who have not registered. They will be able to legalize their paid activities and take advantage of “tax holidays”. These conditions are available only to individual entrepreneurs working under the simplified tax system and PSN.

Choosing a tax system

A pensioner should open an individual entrepreneur after he has decided on the choice of taxation system, since the law does not exempt such a person from paying tax on his activities.

The following taxation systems for individual entrepreneurs are distinguished:

- USN. There are two types:

- 6% of income (suitable for those whose business does not require large expenses);

- 15% of the difference in income reduced by expenses (chosen by those who, in the course of commercial activity, buy a lot of things or spend on servicing the business);

- OSN - chosen by those who sell certain types of goods (alcohol, tobacco products, gasoline, and so on);

- Patent simplified tax system. To establish such a system, it is necessary to obtain a patent for a certain type of activity;

- UTII. In this mode, real income is not taken into account. The calculation will be based on the potential amount of profit.

The application for choosing a system is submitted together with other documents during registration.

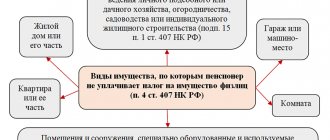

What taxes do you need to pay?

After successful state registration with the Federal Tax Service inspection as an individual entrepreneur, the pensioner needs to choose a suitable tax regime for himself and submit a corresponding application to the Federal Tax Service. It could be:

- General tax system (OSNO). After the transition to OSNO, individual entrepreneurs will have no restrictions on the volume of revenue and types of activities of the individual entrepreneur. However, with OSNO you will have to pay personal income tax and VAT, as well as maintain cumbersome accounting and tax records. Personal income tax rate = 13% on income received. The VAT rate ranges from 0 to 20% (depending on the type of product or service).

- Simplified taxation system (STS). Under the simplified tax system, the object of taxation can only be “income” (tax rate - 6%), or “income - expenses” (tax rate - 15%). Moreover, the tax rate for the simplified tax system can vary from 1 to 15% depending on the annual income of the individual entrepreneur and the object of taxation.

- Patent system, PSN (registration of a patent for a period of 1 to 12 months) - no need to file a tax return. The tax rate on PSN is 6%. However, on a PSN, the income of an individual entrepreneur can be no higher than 60 million per year, and the staff can be 15 people. at most.

- Unified agricultural tax is suitable only for those pensioners-individual entrepreneurs who decide to engage in agricultural activities. The tax rate for the unified agricultural tax is 6% of income (Article 346.8 of the Tax Code of the Russian Federation). Moreover, on the Unified Agricultural Tax you must now also pay VAT (Article 346.1 of the Tax Code of the Russian Federation). In addition, you can switch to the unified agricultural tax only if 70% of the income from business activities comes from the sale of agricultural goods.

And also, a pensioner has the right to become self-employed. In this case, he will have to pay an income tax tax of 4% (if the counterparties are individuals) or 6% (when the clients of the individual entrepreneur are legal entities, organizations, individual entrepreneurs). Moreover, it is not necessary to pay insurance premiums here, and upon payment of tax a tax deduction in the amount of 10,000 rubles is provided.

There is no need to keep any reports for self-employment. All tax calculation operations are carried out through the “My Tax” mobile application.

However, it is not possible to become self-employed in all types of activities (all exceptions and types of activities are given in Articles 4, 6 of Law of the Russian Federation No. 422-FZ). In addition, the revenue of an individual entrepreneur cannot exceed 2.4 million rubles. in year. And also, an individual entrepreneur cannot hire at least 1 employee.

In addition to self-employment, for all other specialties. tax regimes, individual entrepreneurs are required to pay the appropriate insurance premiums:

- For yourself - 32,448 rubles. for pension insurance (in the Pension Fund) and 8,426 rubles. for honey insurance (in FFOMS). If a pensioner’s income exceeds 300,000 rubles, then another 1% of the amount greater than 300,000 rubles will have to be paid for pension insurance.

- For your employees (if there is at least one employee on staff).

In 2021, insurance premiums for their employees are equal (Article 425 of the Tax Code of the Russian Federation):

- for pension insurance (in the Pension Fund of the Russian Federation) - within the limit on payments to employees of 1,465,000 rubles. – 22% (above the limit – 10%);

- on social media insurance (in the Social Insurance Fund) - within the limit on payments to employees of 966,000 rubles. – 2.9%. Amounts above are not subject to contributions;

- for honey insurance (in FFOMS) - 5.1%. There is no limit here;

- on social media insurance from prof. diseases and accidents at work (RF Law No. 179-FZ) - from 0.2 to 8.5%, depending on the class of occupational risk.

Moreover, a pensioner individual entrepreneur can also take advantage of reduced insurance premiums (with the exception of the gambling business and other cases given in paragraph 3 of Article 14 of Law of the Russian Federation No. 209-FZ). So: starting from 2021, the following reduced contribution rates apply (clause 2.1 of Article 427 of the Tax Code of the Russian Federation):

- for pension insurance - 10%;

- for honey insurance - 5%.

However, reduced tariffs apply only to amounts exceeding the minimum wage (as of January 1, 2021, minimum wage = 12,792 rubles).

Articles:

Taxation for individual entrepreneurs in cargo transportation: which system to choose

How can an individual entrepreneur close a patent before its expiration date?

Registration procedure

The registration procedure is carried out on the basis of the norms of Federal Law No. 129.

To register, a pensioner must personally contact the tax authority at his place of residence and submit a certain package of documents.

Documents must be reviewed, and the person must be registered as an individual entrepreneur within a period that cannot be more than 5 days from the date of acceptance of all documents.

Submission of information by mail is allowed. In this case, a registered letter must be sent with a list of all the documents included in the envelope.

Submission of information is permitted with the help of a representative who has a power of attorney certified by a notary.

You can apply to register your status at the MFC.

Individual entrepreneur registration procedure

The procedure for elderly people is as follows:

- The pensioner determines the field of activity and selects the OKVED code based on this.

- A tax payment system is selected.

- Payment of state duty.

- Collecting the required papers and drawing up an optimal development plan.

- Submitting an application to the tax office. The verification takes 5 days. If everything is in order, the individual entrepreneur is registered and an individual code is given.

- Registration is completed at the Pension Fund, where applications are also made in person.

After receiving the appropriate certificate, the entrepreneur can optionally open a bank account with a financial institution. The same applies to printing.

Package of documents

In order for a certificate of registration as an individual entrepreneur to be issued, the pensioner must submit the following documents:

- Statements. For registration, form No. 21001 is established. This form requires you to provide the following information in block letters:

- FULL NAME;

- Date and place of birth;

- Citizenship;

- Information about place of residence;

- Passport registration details;

- Information about types of activities;

- Telephone for communication;

- Applicant's signature.

- Identity document, as well as a copy of its pages;

- TIN;

- Document confirming payment of the state fee.

Step-by-step instructions for opening an individual entrepreneur for a pensioner

If you have thought through everything well and decided to implement your business, we will consider how to properly open an individual entrepreneur for a pensioner. This process is no different from the standard opening of an individual entrepreneur.

Opening procedure:

Step 1. Selecting a field of activity and determining OKVED.

It is necessary to take into account that you must clearly understand what type of business activity you will be engaged in. Each type has its own number, or as it is commonly called, the OKVED code. If you want to choose two directions, then indicate two codes.

The law does not prohibit choosing several types of activities; you can use at least 10 areas. But you shouldn’t prescribe it for the future, in the hope that you might do it. You can always submit an application and add or remove an activity.

Step 2. Selecting a tax system.

Many entrepreneurs make a big mistake and choose a system without studying in detail all the advantages and disadvantages of each. You should not put this issue off until later, in the hope that at the end of the year everything can change.

You must clearly think about the amount of mandatory tax deductions you will pay. You just need to take a calculator and calculate all the possible options. Only after simple mathematical calculations will you understand which system to choose.

Step 3. Payment of state duty.

The fee is 800 rubles. You can get a receipt form from the tax service, or remotely on the website of the Federal Tax Service of the Russian Federation. On the tax service website you can print a receipt and make payment at any bank.

If documents are submitted via electronic means of communication - the tax website or a government services portal, then you do not have to pay the state fee. This exemption was introduced by Federal Law No. 234-FZ of July 29, 2018.

Step 4. Preparation and submission of documents.

The first thing you need to do is prepare a complete package of documents. If you don’t have a TIN or for some reason it’s lost, it’s okay, because it can be restored. All you need to do is submit documents to the INFS and wait a few days.

As soon as the complete package of documents is in hand, it should be submitted to the tax service.

After submitting the documents, you should have:

- Receipt for receipt of a complete package of documents;

- Application for choosing a taxation system.

Of course, in order to save personal time, you can send documents by mail, by registered mail.

Step 5. Receiving documents.

If all the documentation is drawn up correctly and meets all the requirements, then after 5 days you will be able to receive a certificate of registration of individual entrepreneurs.

Please note that if you need a document confirming that you can make transfers using the simplified system, you must write an application and request it.

Step 6. Registration with the Pension Fund and the Federal Compulsory Medical Insurance Fund.

The tax office, after registering an individual entrepreneur, sends documents to the pension fund and compulsory health insurance fund. A few days later you should receive a notification by mail about registration with the Pension Fund and the Federal Compulsory Medical Insurance Fund.

If this does not happen, you can personally contact these institutions, having with you your TIN, SNILS and individual entrepreneur registration certificate.

Step 7. Purchase of equipment.

If your field of activity is related to sales, then be prepared to purchase a cash register. There are, of course, exceptions when a cash register is not required and payment can be accepted by checks or strict reporting forms.

A cash register is not required if:

- You will sell newspapers and magazines at a kiosk or on the street;

- The company is engaged in the sale of securities;

- The company supplies educational institutions with food products;

- The field of activity is related to remote trade, where it is not possible to install a cash register.

Step 8. Opening a bank account.

It is worth noting that entrepreneurs decide for themselves whether to open a current account or not. An account may be required if you plan to carry out non-cash transactions.

To open an account you will need:

- Select a bank;

- Provide the financial company specialist with a completed application form for opening an account, passport, Taxpayer Identification Number, entrepreneur register and registration number (OGRN).

Step 9. Preparing the print.

According to the law, an individual entrepreneur is not required to have a seal. But it is still advisable to do it. The print is made very quickly and simply. You need to select a sample and provide the details of the individual entrepreneur.

Taxes and benefits for individual entrepreneurs pensioners

Since the registration and implementation of commercial activities by pensioners is no different from other persons, it is necessary to remember that benefits for pensioners when opening an individual entrepreneur are not provided for by law.

The only positive thing can be called the making of mandatory payments, which have an impact on increasing the person’s pension provision.

However, there is an exception here: when a pensioner opens an individual entrepreneur, the pension increases only if it is minimal at the time of registration.

On a general basis, benefits are provided in the case where a person has chosen a simplified taxation system and commercial activity is carried out in the field of production:

- Food products and non-alcoholic drinks;

- Items made of leather or plastic, iron or wood;

- Children's goods;

- Motor transport;

- Communication services.

When a disabled person who has reached retirement age conducts commercial activities, he does not make payments to the Pension Fund and the Social and Insurance Fund as a benefit.

Does this category have any benefits?

Self-employment - pros and cons of this status

There are no special benefits for pensioners for individual entrepreneurs. Older people pay taxes and contributions at regular rates. They should be paid even if the individual entrepreneur does not work and does not generate income. No benefits are provided for persons of retirement age in this matter.

True, an older entrepreneur, just like his young colleagues, has the right to apply preferential taxation systems provided for by the Tax Code of the Russian Federation. You can also take advantage of regional benefits and other legally established preferences.

A pensioner can apply for registration of an individual entrepreneur in several ways:

- In electronic form using the State Services website.

- At the nearest MFC.

- In the territorial department of the Federal Tax Service of Russia at the place of residence.

The procedure in all cases of submitting documents is no different; in order to register an individual entrepreneur, you should:

- Fill out the application in the established form 21001. Its form can be printed from the Federal Tax Service website, and can also be obtained directly from the tax office or the MFC.

- Pay the fee. The payment receipt is included in the list of required documents.

- Present a passport of a citizen of the Russian Federation, a copy of it and a TIN certificate. If the last document is not available, then you can find out the TIN from the Federal Tax Service, as well as obtain a new or duplicate certificate in case of loss of the original.

- The application processing period takes no more than five working days.

- Open a bank account and prepare a seal.

To register as an individual entrepreneur, you will need two documents: a passport and an INN

OKVED codes cause particular difficulty for older people. These are digital designations of the types of activities that future businessmen plan to engage in. You can find OKVED in a special directory. There are usually several of them indicated in the application, but one must be the main one. The MFC helps to sort out this issue, so in order not to make mistakes and not rewrite the application several times, the board will contact this government agency.

After the allotted time for consideration of the application, the tax service is obliged to provide a package of documents on registration of individual entrepreneurs, or a document with a reasoned refusal.

Important! Individual entrepreneur registration certificates are no longer issued. Now a newly minted entrepreneur can only receive an extract from the unified state register of individual entrepreneurs.

For the state, it makes no difference at what age an adult entrepreneur registers. Even if a pensioner opens an individual entrepreneur, the pros and cons will be about the same as those of young competitors.

Tariffs for benefits

In order to apply a preferential tariff, a merchant, as already mentioned, must be engaged in a certain type of activity, income for the year must be at least 70% of all income, the total amount of income received cannot be more than 79,000,000 rubles.

The following tariffs are established:

- Individual entrepreneurs engaged in certain types of licensed activities - 20% on pension contributions;

- Individual entrepreneurs providing services in the field of education, science, healthcare, art - 20% on contributions to the Pension Fund.

VAT and benefits

Entrepreneurs who do not use the simplified tax system are almost all VAT payers.

Tax legislation allows the possibility of not depositing funds for this type of taxation.

To receive such a benefit, two grounds can be used:

- For the three months preceding the person’s application, his income was less than 2 million rubles;

- If an entrepreneur carries out certain types of activities that are licensed. In this case, it is enough for the entrepreneur to provide a license and documents on the implementation of this activity.

Please note that it is recommended to plan for a change of activity in advance, since its registration must be carried out anew.

Grants and subsidies when possible

A beginning businessman may be provided with a subsidy or subsidy based on programs that are developed at the federal or local level.

The following types of assistance are distinguished:

- Grants that are issued on a competitive basis;

- Financial assistance aimed at purchasing fixed assets and concluding employment agreements;

- Subsidies provided to persons who are registered as unemployed;

- Compensation for previously taken loan funds aimed at developing entrepreneurship.

To get help you should:

- Prepare a business plan;

- Prepare cost estimates;

- Have a certificate of registration as an individual entrepreneur;

- Contact the authority that provides subsidies.

Required documents and design features

Despite the fact that the registration of an individual entrepreneur occurs very quickly, and you can become an entrepreneur from scratch in just one or two weeks, the procedure itself has a number of important features. In order to decide on all the important points, you need to go through seven stages.

Necessary documents for registration of an individual entrepreneur

Search for a type of activity in the OKVED lists

In order for your company’s activities to receive approval, you need to find its type in the all-Russian classifier. This code must be selected for each type of activity that the entrepreneur will engage in. The main code will describe the functionality of the IP as a whole, and additional code will clarify the information.

Starting from 2021, a new edition of the directory, OKVED-2, is in effect. To register, you must use it, otherwise the code may be incorrect or invalid.

How to choose the right tax system

Read interesting information about what a 55-year-old woman should do in retirement to earn real money in our new article.

Choosing a tax system

A key step, a detailed explanation of all the features and pitfalls of which will require a separate article. There are five taxation schemes in the Russian Federation, each of which has its own advantages and disadvantages. Let us briefly describe the main tax schemes.

| Parameter | BASIC | USNO | UTII | PSN |

| The tax base | Income - Expenses | Income Income - Expenses | Imputed income | Imputed income |

| Business tax rate | 13% | 6% 5 — 15% | 15% | 6% |

| Payment of property tax | Yes | Only tax paid on the cadastral value of real estate | ||

| Payment of VAT | Yes | No | ||

| Limitations on the number of employees | No | Up to 100 people | Up to 100 people | Up to 15 people |

| Property restrictions | No | Up to 100 million rubles | No | No |

| Restrictions on type of activity | No | Article 346, paragraph 12 of the Tax Code of the Russian Federation | Article 346, paragraph 26 of the Tax Code of the Russian Federation | Article 346, paragraph 43 of the Tax Code of the Russian Federation |

| Other taxes paid | Excise taxes, state duties, customs duties, land tax, water tax, mineral extraction tax and some fees | |||

simplified tax system 6%. Under this scheme, the individual entrepreneur pays six percent of all money received that passed through his company, plus additional contributions to the pension fund and social insurance fund.

simplified tax system 15%. This type of taxation requires paying a percentage not of income, but of profit. The tax is calculated quite simply: subtract expenses from annual income, and then multiply the resulting amount by 0.15.

Which of these two “simplified” options is more profitable? For young companies, the first scheme will often be more profitable due to the relatively high percentage of income and low turnover. For individual entrepreneurs with a large annual turnover and small profits, you should think about the second one.

Tax regime

BASIC. The standard tax system is characterized by increased taxes and complex accounting. This scheme is selected by default for all individual entrepreneurs and companies that did not decide on the system during registration, as well as those for whom the use of simplified modes is prohibited.

OSNO is beneficial if the majority of individual entrepreneurs’ clients work according to this scheme, when importing goods into the country to obtain a tax deduction and in wholesale trade. For most individual entrepreneurs organized by retirees, this type will interfere with running a business, taking up resources and time.

PSN. The patent system makes it possible to buy an annual patent for a number of professions. In this case, 6% tax is taken not from the individual entrepreneur’s income, but from a special register. For example, if the amount of annual income for your profession according to the register is 700 thousand rubles per year, but in practice you receive one and a half million rubles, then the tax savings compared to the simplified tax system of 6% will be double. Annual contributions to the Pension Fund and the Federal Migration Service will become fixed in the amount of about 20 thousand rubles.

Advantages of the patent system

The cost of a patent and the list of available activities may vary in regions. For clarification, contact your local federal service.

UTII. The “imputation” system is very similar to the previous one, but the potential income of an individual entrepreneur is calculated by the tax authorities, and the entrepreneur pays 15% of the estimated income. Such a system can be either very profitable at the initial stage of explosive growth, or it can bury the business if income is noticeably lower than expected.

The choice of each option depends on the decision of the pensioner himself. The only advice that can be given without knowing the type of activity and registration conditions is to not take risks in the first year until the prospects for the business become clear.

Payment of state duty

You can get a receipt for payment both on the official website of the Federal Tax Service and at any branch of the service. You can pay the fee free of charge at any branch of Sberbank; other banks may additionally charge money for the transfer. The payment amount will be 800 rubles.

Receipt for payment of state duty

There is one important nuance when printing a receipt from the website: for 2019, there are two options indicated there, for the Federal Tax Service and the MFC.

- when registering with the MFC, you need to select the item “State registration as an individual entrepreneur”;

- To register with the Federal Tax Service, you must print out the document “State fee for registration as an individual entrepreneur.”

After payment, you must save the receipt itself - you will need it when submitting documents. If you make a mistake when downloading, paying for the wrong receipt, then in the best case you will have to submit the documents again, and in the worst case you will be rejected during the verification process.

Finding the right branch

According to the registration procedure described in Law No. 129-FZ, you must register as an individual entrepreneur at the tax office located in your area of registration. You can find out about the Federal Tax Service branches in your city on the Federal Tax Service website or by calling the all-Russian hotline 8-800-2222222.

You must register as an individual entrepreneur at the tax office

The law directly states that registration can only be done in the city where the citizen is currently registered. There is no need to go to another city right away: a visit to the nearest tax office will help you find out if you have problems with your documents and if everything is in order with paying the duty. Documents can also be sent by registered mail.

Registration of documents

Standard application form.

Application for state registration of an individual as an individual entrepreneur

The list of documents required for registration for citizens and guests of Russia may differ markedly. In our case, we are considering registration of an individual entrepreneur for a pensioner who is a full-fledged citizen of the Russian Federation.

You can fill out the form P21001 application for state registration of an individual as an individual entrepreneur here, fill out and then print it out, as well as a sample of filling out the application can be found here.

To register an individual entrepreneur, you will need the following documents:

- Passport or equivalent identification card, plus a copy of all its pages.

- Application made in standard form P21001.

- A copy of the certificate with the TIN registration code.

- Receipt for payment of the state fee.

- Application for application of the selected form of taxation (for the simplified taxation system you can download form No. 26.2-1 here).

Important! When executed by power of attorney, the signature on the application must be notarized. If documents are submitted in person, this is not necessary.

List of documents required for registration of individual entrepreneurs for pensioners

Transfer of the finished package of documents to the tax service

The collected documents are transferred to the tax office. After delivery, the service employee is required to provide a receipt of receipt and an application for application of the simplified tax system. Be sure to save the first document, and check the second document for the date, signature and stamp of the organization.

Please note that any delays or problems with the preparation of the tax scheme will automatically transfer you to OSNO. Here it is better to clarify the question several times than to remain silent and suffer with an inconvenient system for a whole year.

Video - When to register an individual entrepreneur

Obtaining registration

If there are no errors in the documents, the Federal Tax Service will issue documents confirming the status of an individual entrepreneur three working days after submitting the application. The inspection provides:

- tax registration certificate;

- confirmation of registration in the Unified State Register of Individual Entrepreneurs.

Important! Starting from April 2021, the inspectorate provides registration documents electronically. Don't forget to indicate your email when filling out the application!

Until 2021, a certificate with the OGRNIP identifier was issued. Today this practice has been abolished.

Certificate of registration of an individual as an individual entrepreneur

No documents confirming the choice of taxation scheme will be issued. The countdown begins from the date of registration; in order to clarify the details in the future, you can order an information statement.

Registration with the Social Insurance Fund and Pension Fund

The Federal Tax Service sends registration information to both funds automatically. Within one to two months you should receive a notification by mail that the individual entrepreneur has been added to the organization database. Save this document, it may come in handy.

Registration Notice

If the notice has not arrived, then you must personally submit the documents to the Pension Fund in two copies (original and copy):

- USRIP sheet;

- TIN;

- SNILS.

After registration, a notice of registration will be issued in person.

Mandatory taxes for individual entrepreneur pensioners

There is the following group of taxes that are paid by any entrepreneur, regardless of his age:

- Insurance tax transferred to the tax service, which is paid for oneself, as well as if the individual entrepreneur has employees hired on the basis of an employment agreement or civil contract. The amount of this payment is approximately 23,000 rubles. If the income received exceeds 300,000 rubles, the amount increases. If there are employees, 13% of their earnings are transferred;

- Contribution to the Compulsory Medical Insurance Fund. Approximately 4,000 rubles;

- VAT in the amount of 18% of the amount (paid when renting premises, purchasing goods or equipment for commercial activities).

Amount of taxes for individual entrepreneurs on the simplified tax system

The simplified tax system is a regime where an individual entrepreneur can keep his records as simply as possible, receive a low tax rate, and also reduce the tax amount due to insurance contributions. When choosing a simplified system, an entrepreneur can adhere to two options:

- Income at a rate of 6%.

- Income reduced by expenses at a rate of 15%.

To carry out reporting under this scheme, the profit from the enterprise should not exceed 150,000,000 rubles. This indicator is fixed until 2021 (see The main thing about income tax: calculation, rate, payment terms, preparation of the declaration).

Features of taxation of individual entrepreneurs with employees

If there is at least one employee subordinate to the entrepreneur, then all information about payments and salaries will need to be sent to the Federal Tax Service. You will also need to provide reports 2-NDFL and 6-NDFL.

Single tax on imputed income for individual entrepreneurs

The imputed income tax is a voluntary tax adopted in 2013. The government proposed limiting UTII until January 1, 2021, but this period was extended to 2021. From July 1 of this year, all individual entrepreneurs are required to purchase an online cash register for use. The requirements also apply to businessmen with a patent.

Fictitious registration of individual entrepreneur of a pensioner - responsibility

As a rule, fictitious registration of a business for this category of persons is the registration of one person as an entrepreneur, while another person is engaged in commercial activities.

The law provides for only one type of liability for a pensioner-entrepreneur: in case of failure to fulfill the obligation to pay taxes.

This crime is punishable in accordance with Art. 199 of the Criminal Code of the Russian Federation.

Please also note that the pensioner is liable for obligations with all his property.

Opening procedure in stages

There are several stages:

- The citizen chooses the type of activity in which he will engage. It will be necessary to pay attention to the fact that the person must decide for himself what he will do. Each type has specific meanings; they are referred to as OKVED. If a person wants to engage in 2 types, then they need to enter a pair of codes. The law does not prohibit the use of a larger number of directions. However, you need to choose only what the individual entrepreneur does; you can always make adjustments.

- Choosing a tax system . You should first study all the positive and negative aspects of each option. Please understand that you will not be able to make changes until the end of the annual period. The person also takes into account that fiscal payments are constantly being made.

- Payment of state duty . Its value is 800 rubles. You can obtain a form for entering information from fiscal service employees. It is also possible to print a receipt located on the official website of the Federal Tax Service. Payment is made when contacting a banking organization.

- Preparation of a documentation package. If a person does not have a TIN or it has been lost, then they need to visit the fiscal service and get a duplicate. The process takes several days. As reports are submitted, the employee issues confirmation in writing. You can use the sending option when using the postal service.

- Receiving ready documentation . This will take five days, provided that the citizen has collected the entire package of documents and has not made any mistakes. A certificate confirming registration is issued.

- Registration with the Compulsory Medical Insurance Fund and the pension authority . Documentation is transferred there by employees of the fiscal authority. The citizen is provided with notification regarding registration. The person can also do this themselves. You need to have SNILS, INN and a certificate indicating registration of individual entrepreneur with you.

- Purchase of equipment. This applies to the area related to the sale of goods. A cash register will be required. Sometimes it is permissible to carry out this process using checks and a strict reporting form. There is no need to buy a device if a person sells magazines and newspapers, does it on the street or at a kiosk, sells securities, or provides products to educational institutions.

- An account is opened in a banking organization . However, the person makes this decision independently. This suggests that the entrepreneur may not have a current account.

At the last stage, the IP seal is prepared.